Editor’s Note: This white paper is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between the Economic Studies Program at Brookings and the USC Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. We gratefully acknowledge financial support from Arnold Ventures.

Introduction

Since enactment of the Prescription Drug User Fee Act (PDUFA) in 1992, the Food and Drug Administration’s (FDA) approval of new prescription drugs has been increasingly funded with user fees assessed on the pharmaceutical industry. The FDA’s authority to collect these fees is due to expire with the current federal fiscal year on September 30, 2022, and Congress is expected to consider legislation reauthorizing PDUFA later this year. These provisions encompass branded small molecule drugs, biologics, generic drugs, and devices.

Past PDUFA reauthorizations have been a vehicle to make changes to the FDA’s authorities beyond the narrow scope of user fees. This year’s reauthorization comes at a time where there is widespread interest in promoting competition, with President Biden and bipartisan efforts in both the House and Senate seeking to bolster generic competition. The Reauthorization of the FDA’s User Fee programs offers an opportunity to make modest changes in FDA authorities in the service of promoting generic entry and price competition.

In what follows, we focus on three areas of FDA authority that could be refined to better promote generic competition: the Citizen Petition mechanism; the approval of so-called complex generic drugs; and the phenomenon known as “parking” under the Hatch-Waxman Act.

Citizen Petitions

Citizen petitions are one mechanism that can delay market competition from generic drugs. The Food, Drug, & Cosmetic Act allows interested parties to petition the FDA regarding pending abbreviated new drug applications (ANDAs) for generics, biosimilars, or new drugs that rely on research from an existing reference drug (505(b)(2) NDAs). Petitioners can ask the FDA to either reject or delay for further investigation those applications on grounds that such review is “necessary to protect the public health.” Between 2011 and 2019, the FDA received an average of 23 citizen petitions asking the agency to reject a pending application or impose restrictions for any upcoming applications referencing an existing drug. The FDA typically must take action on these petitions within 150 days of their submission.

Citizen petition filings can serve a valuable public purpose if they alert the agency to valid safety concerns that would not have otherwise been raised. A manufacturer might argue that the FDA should require additional bioequivalence testing beyond its standard requirements, including particular pharmacokinetic parameters, to make sure dosing remains equivalent across products. If the FDA reviews the petition and determines that “a delay is necessary to protect the public health,” the agency may then move to delay approval of a pending generic application.

But evidence suggests that interested parties (who are largely, though not exclusively, branded pharmaceutical firms facing the loss of market exclusivity) are often filing citizen petitions that have the effect of delaying generic or biosimilar entry to defer competition and maintain their existing market position.

Citizen Petition Filing Conduct

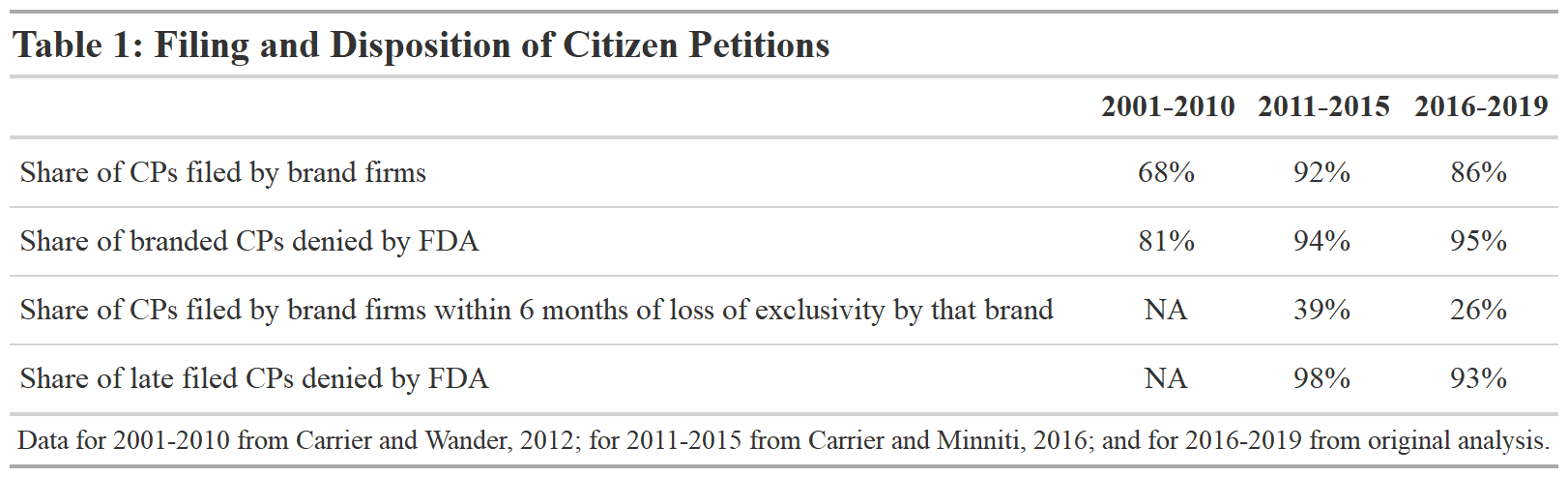

Table 1 summarizes the recent filings of Citizen Petitions according to their source, timing, and disposition. Most citizen petitions are filed by firms that make brand name drugs. Existing scholarship has concluded that most petitions were filed by brand firms, and a large majority of the petitions targeted generics. Yet ultimately, the FDA determines that few of these petitions have merit. Table 1 highlights a very high denial rate from 2001 through 2019. The Table also shows that a significant portion of petitions have been filed relatively close to the date that the branded product in question would have experienced a loss of exclusivity.[1] The vast majority of these petitions were also denied.

Impacts of Filing Conduct

These filings have the effect of delaying generic entry in at least some cases, though the frequency of these delays and their financial impact are not fully known. The FDA itself does report that occasionally ANDAs or 505(b)(2) applications are delayed due to citizen petition filings. However, the FDA’s processes make it difficult to ascertain the true scope of the problem. The FDA’s definition of when a delay has occurred is unclear. Their position is that if a generic application would be ready for approval “but for the resolution of” the issues raised in a particular citizen petition, the agency will then determine whether “a delay of approval is necessary to protect the public health” on the basis of a preliminary evaluation of the petition itself. But it is not clear whether the preliminary evaluation of the petition itself would be enough to slow the generic approval, and whether that is part of the agency’s evaluation of whether a delay has occurred, particularly when petitions are filed within a few months of a brand’s loss of exclusivity. These issues also cannot be analyzed externally, because in reporting on citizen petition filings, the FDA states whether an application has been delayed but not which products are affected. Further, the FDA’s practice of acknowledging the dismissal of a petition roughly contemporaneously with its approval of the generic makes it difficult to assess which petitions have caused delays and which were unlikely to have done so.

As a result, scholars believe that the frequency of delays may be higher than reported by the agency. From 2011 to 2015, 6 ANDAs were approved on the same day that the FDA resolved a relevant citizen petition and 17 were approved within one month of resolution of a relevant citizen petition. In all these cases, the citizen petition was denied. Between 2016 and 2019, there were 15 cases where the FDA resolved a citizen petition and on that same day approved a relevant ANDA or 505(b)(2) NDA. In 14 out of 15 of these cases where a citizen petition decision and relevant drug approval were issued on the same day, the petition was denied. More broadly, in 20% of the cases where citizen petitions targeted a real or potential ANDA or 505(b)(2) NDA and for which an FDA decision was given, the FDA approved a relevant drug on the same day as it issued a decision. From 2016 to 2019, among cases of same day approvals, it took an average of 161 days from petition filing for the FDA to give a decision.

Potential for adverse market impact is greater when petitions are particularly complicated or when companies file multiple petitions. In one particularly noteworthy case, Shire ViroPharma filed 24 citizen petitions and made many other submissions, including three lawsuits, to delay the approval of generics for an antibiotic it marketed. Teva filed eight citizen petitions, all of which were denied, in response to forthcoming generic competition for its multiple sclerosis drug, Copaxone. Yet longer or more complex petitions are not more likely to be granted. Between 2011 and 2015, 97% of petitions over the mean length were denied. More recently, between 2016 and 2019, 100% of petitions over the mean length were denied.

Delays in generic approvals due to citizen petitions have meaningful economic consequences. One study examining four products with petitions “that were highly likely to have been the final obstacle to a generic drug entering the market” found that the total cost to society from those petition-induced delays was $1.9 billion, with $782 million coming as costs to government insurance programs. Another study found that citizen petitions were successful in delaying generic entry for a depression drug by 133 days, during which the branded product’s manufacturer reaped $600 million in sales, and in delaying generic entry for an insomnia drug for 1,225 days, during which the branded product’s manufacturer earned $3.1 billion in sales.

Policy Directions: Reforming Citizen Petition Process

A range of policies might strengthen the FDA’s authority to respond to citizen petitions or deter companies from filing them in the first instance. Here, we focus on potential reforms to the FDA’s own authority, rather than those that would strengthen the Federal Trade Commission’s authorities to promote generic competition (such as the Stop STALLING Act).

It is important to note that Congress has already strengthened the FDA’s authority in this area in previous rounds of PDUFA, most notably in the Food and Drug Administration Amendments Act of 2007. For instance, the agency was given the authority to summarily dismiss a petition if it determines that it was “submitted with the primary purpose of delaying” a generic approval. In explicating the factors it will use to determine whether a petition has been so submitted, now the FDA includes factors such as the timing of the petition – if the filer “has taken an unreasonable length of time” to file the petition, if the filer was “raising issues that reasonably could have been known” earlier, or if the filing was particularly “close in time” to generic approval.

But agency officials have said that they do not believe these new authorities are sufficient to dissuade the filing of non-meritorious petitions. In one example, Neurelis, a company recently targeted by a citizen petition, urged the FDA to summarily deny the petition as an “ill-disguised attempt to delay approval of a competing product.” However, the FDA’s decision noted that even though there were indicators that the relevant petition may have been filed for the purpose of delaying competition, it was not possible to summarily deny the petition because the FDA could not conclude that the petition did not raise valid scientific or regulatory concerns without evaluating its merits. The petition was later denied, and Neurelis’ application was approved on the same day.

We make two recommendations to better address and assess citizen petitions.

1. Strengthen the FDA’s authority to dismiss petitions and penalize non-meritorious filers by instituting time limits and associated penalties

One set of reforms would further strengthen the FDA’s authority to dismiss petitions and penalize non-meritorious filers. Congress has been considering the STOP GAMES Act, which seeks to codify expanded authority to dismiss and penalize non-meritorious claims and to set deadlines for petition submission, requiring petitioners to attest that the information on which their petition is based became known to them no more than 60 days prior – and making this attestation a formal certification under the Federal Food, Drug, and Cosmetic Act (FDCA).

Making the attestation a formal certification could provide the FDA with the authority to impose financial or other penalties for the filing of citizen petitions outside this window. However, existing financial penalties under the FDCA are likely too small to discourage the filing of many petitions in the first place. To supplement existing authority, Congress might also consider giving the FDA the authority to impose different financial or other penalties (beyond the existing scope of the FDCA) for the filing of citizen petitions intended to delay generic entry.

2. Improve the transparency of the FDA’s review of citizen petitions by requiring the agency to report more details about delays and the agency’s review process

The FDA is already required to report to Congress a range of factors regarding delays in approvals that result from petitions; as noted above, those existing requirements may not be specific enough to enable observers to understand whether delays are occurring and, if so, which products are likely to be affected.

Congress could direct the FDA to develop reporting mechanisms for gathering and disseminating information into a format that can be used by others. In light of recent case law involving the Federal Trade Commission, such reporting would likely include actions brought against firms in collaboration with state attorneys general and private actors. For instance, at present the FDA is only required to report numbers of citizen petition filings, delays in approvals, and the lengths of those delays. Requiring the FDA to report on which generic applications are delayed may enable enforcement against the companies filing citizen petitions.

Complex Generics

Complex generics are small molecule nonbiological drugs for which it is difficult to establish bioequivalence. As more complex small molecule drugs lose exclusivity, complex generic approval delays lead to missed opportunities for increased competition and lower drug prices. In this section, we discuss the importance of complex generics to competition, regulatory barriers that lead to delays, and recommendations to overcome these barriers. We pay particular attention to drug-device combination products (including injectables) because of the importance to competition of such products and the relative ease of overcoming existing regulatory barriers to competition.

Competitive Role of Complex Generics

Complex generics are a heterogeneous set of products. In some cases, the complexity for regulators stems from the nature of the Active Pharmaceutical Ingredient (e.g., peptides). In other cases, complexity involves the product formulation (e.g., liposomes), and in still others it is the route of delivery (e.g., locally acting drugs like ophthalmic products) or the involvement of a device in the administration of the drug (e.g., metered dose inhalers and auto-injectors).

Because of the challenges in establishing bioequivalence, a significant number of complex nonbiological products with long-expired exclusivity face little or no competition from generics. We examined a set of complex products identified in a 2017 Government Accountability Office (GAO) study. The GAO’s list was established through a review of the literature that identified nonbiological complex products and through a consultation process with NIH scientists. We find that 24 complex nonbiological drugs they studied had no remaining exclusivity, but generic entry had occurred for only about half of those that were not discontinued. Where entry occurred, it took, on average, 15 years post-loss of exclusivity (LOE) for the first generic to enter.

Among complex nonbiologic drugs, drug-device combinations make up a growing subset, with a significant impact on public and private payer budgets. One recent study found that of the 20 drugs with the largest sales in the US, seven were drug-device combination products (four were biological products). The annual spending on those seven drugs in 2019 was over $50 billion. Another study comparing Canada, EU, and US approvals of complex generics found that three of seven studied products with no generic competition in the US but approved elsewhere were drug-device combinations involving injectables, with potential losses due to delays of between $600 million and $1.7 billion per year. And the use of such combinations is increasing: the number of listings of drug-device combinations in the FDA’s Orange Book more than doubled between 2005 and 2016.

Regulatory Barriers to Complex Generic Approvals

In recent years, the FDA has taken some steps aimed at lowering the regulatory barriers to bringing a complex generic to market. The FDA has committed under the Generic Drug User commitment because the complexity of these products requires separate guidances for each. In subsequent years, the FDA further prioritized reducing the frictions for generic competition in complex products. This largely took the form of additional product-specific guidance and meetings for developers with FDA officials to clarify requirements for approval early in the development of an ANDA.

Nonetheless, challenges remain, and evidence from Canada and the European Union raise the possibility that FDA guidance may be more restrictive than those jurisdictions. Here, we focus on issues related to sameness requirements for injectables and FDA guidance on drug-device combinations.

Sameness requirements for injectables

Even where product-specific guidance exists, establishing “sameness” continues to be highly uncertain for generic developers of sterile injectables. This is because product-specific guidances for sterile injectable products cover some but not all the requirements for the generic applicants. In particular, the guidance does not list the specific amounts of the ingredients otherwise listed in the label. The FDA does not share the specific formulation details, on the grounds that they are a “trade secret.” This presents an obvious conundrum in establishing sameness for both the FDA and applicants.

There are two pathways for dealing with this conundrum: controlled correspondence and 505 (b)(2), each with significant shortcomings.

Controlled correspondence allows applicants to propose formulations (combinations of ingredients, including excipients), without knowing the actual formulation of the reference listed drug. The FDA’s Office of Generic Drugs (OGD) has 120 days to respond to such correspondence. However, OGD limits the proposed formulations to three per correspondence. The resulting OGD rejection letter, should there be one, does not provide specific guidance on what the developer needs to fix in the application, and therefore the developer must respond by making an educated guess, again limited to three formulations. The limit on number of formulations that can be offered for review was probably designed to create an incentive for generic manufacturers to rigorously analyze their formulation relative to the reference product prior to submission of materials to the FDA. This process continues to generate multiple iterations, as generic firms look for acceptable product design and formulations, each one involving roughly four months of review by the OGD.

An alternative pathway is to seek approval through the FDA Office of New Drugs (OND) under Section 505(b)(2). This pathway allows the applicant to establish efficacy and safety of a new product by using existing data—in this case data on the originator product in its application for marketing approval. Because the approved “follow-on” product is a new NDA, there is no automatic 30-month stay that would preclude approval (as is the case when one seeks approval through the ANDA pathway). And because review is done by OND, it follows the PDUFA timelines in processes, skirting the controlled correspondence problem, but it does come with a higher application fee ($2.4 million for the 505(b)(2) pathway versus $170,000 for an ANDA).

However, the 505(b)(2) pathway has an important limitation — an approval under that pathway does not come with a so-called therapeutic equivalence AB rating, which is necessary to allow the follow-on product to be substituted for the originator at the point of sale. That, in turn, constrains the intensity of price competition associated with “generic” entry. To obtain an AB rating, a manufacturer of a “follow-on” product must file a Citizen Petition requesting an evaluation for that designation, but that likely reverts the application towards the FDA requiring the “sameness” standards that the applicant was trying to avoid. Furthermore, unlike other types of Citizen Petitions (discussed earlier), the FDA is not required to act on them within any specified period.

The evidence on timing shows that on average it takes the FDA about 3.5 years to act on Citizen Petitions filings for 505(b)(2) requesting AB rating.[2] The firms that make these requests are most commonly seeking to obtain AB rating for combination products that use an injection device. A recent review of the FDA’s poor track record in addressing these Citizen Petitions: of 26 petitions requesting AB rating since 2015, only two were granted, while five were withdrawn and 17 went unanswered.

The FDA carries a heavy workload and faces no deadline for processing these Citizen Petitions, but the FDA’s response may also be influenced by the financial incentives contained in the design of user fees. That is, when a drug receives an AB rating, its manufacturer is absolved of responsibility for paying the program fee for an approved NDA (which, in 2019/2020, carried program fees over $300,000).

FDA guidance on drug-device combinations

At roughly the same time that OGD was attempting to lower regulatory barriers through product-specific guidance, the FDA went in the opposite direction when it issued a guidance on evidentiary requirements for complex generics in the form of drug-device combinations. These new requirements make it more difficult in practice to establish “sameness” in products like EpiPen auto-injectors or Flovent HFA metered dose inhalers. Specifically, the 2017 FDA guidance states the following:

“Drug development should take into account the user interface and factors that can reduce the risk for medication errors, i.e., features to enhance patient safety. Such features include product appearance, identification markings (such as imprint codes on solid oral dosage forms), container closure, packaging configurations, labeling (including labels on containers and cartons), and nomenclature.”

This standard effectively impedes generic competition for drug-device combinations because the sameness features specified by the FDA are often patented. The FDA allows for minor differences in design, but what it considers minor versus major is not clear. When the FDA determines the differences are major, the applicant must conduct human factor studies to determine that medication error rates are not different than those of the reference product.

The FDA guidance further specifies that users of the generic drug-device product should be able to use it without any additional training from their provider. The FDA put this expectation forward despite evidence that in most cases, a modest amount of training through demonstration by a clinician in the context of a normal visit would ensure the same amount of the active pharmaceutical ingredient (API) would enter the body as the branded reference product. As such, the FDA approach conflicts with a more flexible approach in use in Europe.

With these regulatory expectations, it is not surprising that the FDA has rejected nearly every Citizen Petition seeking AB rating for a drug-device combination approved under 505(b)(2).

Policy Directions: Actions to Promote Complex Generics Competition

We propose several changes to FDA processes and policies. The suggestions that follow apply specifically to complex generic drugs that involve drug-device combinations where the device is used to inject APIs.

1. For drug-device combinations, relax the sameness standard from substantial equivalence to functional equivalence, even if that necessitates some modest training by healthcare providers

The 2017 guidance on drug-device sameness was meant to advance development of lower cost alternatives in light of the public backlash over Epi-Pen prices. But in pursuit of “sameness” in labeling, the FDA ended up setting a high bar for generic drug-device products because device features can be frequently updated and many of those are protected by patents. ANDA applicants try to work around those patents, but the FDA rejects most proposals from generic drug-device manufacturers, even though those proposals deliver the identical amount of an API to the body.

To address these barriers, Congress can take several steps. First, Congress should ask the FDA to further clarify what constitutes a major design difference. Second, Congress should expand the existing labeling exceptions for ANDAs to encompass situations where a patient’s switch to the generic can be facilitated with minimal training from a health care provider, whether that be a pharmacist or one of a patients’ clinicians. It is the pharmacists who typically carry out the switch to generic product, which then creates a clear opportunity within a pharmacist’s standard engagement with the patient to ask whether they have used the product before and, if not, explain how it is used.

If the training requirements turn out to be more than minimal, the FDA could use patient safety tools currently at its disposal. One option is to use REMS Medication Guides or Communication Plans to pharmacists to guide proper use of the device. The FDA could also work towards industry standards on such devices to streamline some of the features listed in the guidance.

2. Streamline review of ingredient sameness for injectable complex generics

Manufacturers consider ingredients for sterile injectables proprietary, other than the API, yet the FDA requires that the generic have identical ingredients in identical quantities. To avoid disclosing what is considered trade secrets by industry, the FDA engages generic drug applicants in an inefficient guessing game during the review process.

To address the lack of transparency, “The Increasing Transparency in Generic Drug Applications Act” (HR 7032) calls for the FDA to provide specific guidance when an application for marketing approval of a generic drug is rejected. In particular, the FDA would be required to provide detailed guidance to the applicant regarding the reasons why the application was rejected. We believe that this can be accomplished through either greater specificity in the controlled correspondence or through meeting between the manufacturer and the FDA staff.

An alternative approach is for the FDA to allow a larger number of potential formulations listed in the initial application than the current limit of three. We expect that the effect of adopting this additional step would allow generic drug makers to more rapidly arrive at a product design that meets the FDA’s sameness standards, and therefore make fewer claims on FDA resources.

3. Establish a defined period for review of Citizen Petitions requesting therapeutic equivalence under the 505(b)(2) pathway

An alternative way for manufacturers to get around current “sameness” requirements is the 505(b)(2) pathway. But the applicant must additionally file a Citizen Petition to obtain an AB rating, a request that the FDA routinely rejects or leaves unanswered. We address one such reason in Proposal 1.

However, even if Proposal 1 succeeds in establishing more appropriate sameness standards for devices, applicants must contend with lack of timeliness in review of Citizen Petitions to determine therapeutic equivalence under the 505(b)(2) pathway.

We propose that a fixed period of 180 days be established for the review of Citizen Petitions requesting an AB rating for a 505(b)(2) application. Congress should also establish performance metrics for the FDA’s review times for Citizen Petitions requesting a determination of therapeutic equivalence in the 505(b)(2) pathway.

Parking and the 180-day exclusivity provision of Hatch-Waxman

When a firm applies to market a generic drug, its application must either assert that the patents protecting the branded drug have expired (or will expire by the time of entry) or, alternatively, include a so-called Paragraph IV certification asserting that the patents protecting the drug are invalid. The first generic firm to file a successful Paragraph IV challenge with respect to a particular drug receives a 180-day market exclusivity period, which creates a powerful incentive for prospective generic entrants to pursue such challenges. Over time, applications with Paragraph IV certifications have become common. As of 2017-19, 81% of new molecular entities facing initial generic entry had patent(s) challenged under Paragraph IV, with an even higher share (93%) of drugs with annual sales greater than $250 million (in 2008 dollars) experiencing at least one Paragraph IV challenge.

However, the clock on the first filer’s exclusivity does not start until the filer markets the product, and any delay between FDA approval and the start of marketing can be costly from the social perspective. Some reasons for “parking” the product can be justified. For example, a company may not have its manufacturing facility ready in time. Here we discuss two potential reasons for delay that we argue should be ameliorated through policy change: pay-for-delay and aversion to at-risk entry.

“Pay-for-delay” is an implicit or explicit arrangement between the first filer and the branded company to delay generic entry. Such agreements are beneficial to both the brand and the generic firm, but substantially harms consumers who continue to pay higher prices for the drug. Recently, court rulings have greatly tamped down on the ability to pursue these so-called “pay-for-delay” deals, though some opportunities likely remain if the payment from brand to generic firm is obscured. For instance, brand firms may be able to include “most-favored entry” (MFE) clauses (e.g., this could specify if another generic obtains an earlier entry date, the settling generic can advance its entry to that date) or allow the generic drug to enter international markets before local patents expire.

The risk of having to pay damages to the brand firm if courts subsequently rule against the first filer’s Paragraph IV challenge is another reason why firms may choose to park an approved application while court challenges are resolved. So-called “at-risk entry” for a generic product creates large gains for consumers in the form of lower prices (and in turn, taxpayers). And it does so without reducing the value of valid patents to brand firms because the generic firm would owe economic damages to the brand firm if the court rules that patent infringement occurred (or triple damages if the court determines it was “willful or wanton infringement”). But at-risk entry will occur less frequently than is socially optimal because the generic drug manufacturer does not internalize the benefit to consumers and taxpayers from that entry.

The current exclusivity reward for the first generic filer (when there’s a single first-filer) also does little to encourage at-risk entry because the length of marketing exclusivity is generally unaffected by waiting to enter until patent litigation plays out.

Policy Directions: Actions to Reduce Anti-competitive Parking

We recommend two reforms to encourage more timely generic entry:

1. Amend the provisions governing the 180-day exclusivity reward for patent challenges to specify a presumption that any patent litigation settlement between generic and brand firms that does not allow for immediate generic entry be viewed as grounds for forfeiture of the generic’s 180-day exclusivity period. Such authority should discourage more obscured forms of remuneration from brand to generic firm (including MFEs and allowances to sell in foreign markets) and encourage first-filing generic firms to enter because delaying entry will risk losing the benefit of exclusivity if the FDA approves competitive products.

2. Create additional financial incentives to encourage at-risk launching by the first generic filer, in order to more closely align the generic firm’s financial incentives with social welfare gains from earlier generic entry. The Government Accountability Office (GAO) should examine options such as granting additional exclusivity to generic drugs that launch at-risk under certain conditions and their potential effects.

Concluding Observations

In this paper, we outline three classes of modifications to the FDA’s processes and authorities that would promote greater and more timely generic entry into pharmaceutical markets. The modifications are by and large modest and are grounded in the assessment of existing practices and the barriers to competition they create. The types of policy changes proposed here would be expected to yield significant cost savings from enhanced competition.

[1] A loss of exclusivity is defined as the nearest patent, final patent, nearest exclusivity, or final exclusivity end date.

[2] Darrow JJ,M He, K Stefanini, The 505(b)(2) Approval Pathway, Food and Drug Law Review 74:402-439, 2019; see Figure 7.

Acknowledgements: We acknowledge expert research and publishing support from Karina Aguilar, Kate Hannick, Conrad Milhaupt, and Caitlin Rowley. We are grateful to Matthew Fiedler for many constructive suggestions on an earlier draft of this paper.

Disclosures: The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.