Student debt cancellation should consider wealth, not income

As enrollment numbers and tuition at higher education institutions grow, the rise in student debt is outpacing both. According to the Pew Research Center, from 1993 to 2012, the share of students taking out loans to finance their degrees rose from roughly half (49%) to over two-thirds (69%), with no indication of slowing. Over the same period, the average loan amount grew from $12,434 to $26,885, and surpassed $30,000 in 2020—a nearly three-fold increase in the last three decades.

If wages and wealth were growing at similar rates, this rise in the cost of education might not be a problem. But the rise in the cost of tuition has outpaced the rise in wages and overall inflation. As more students take out more loans at higher amounts, the issue of student debt—and proposals to mitigate it—has taken greater prominence in national policy debates. The problem is especially pertinent for Black households, for whom a lack of generational wealth risks making student debt a long-term financial burden.

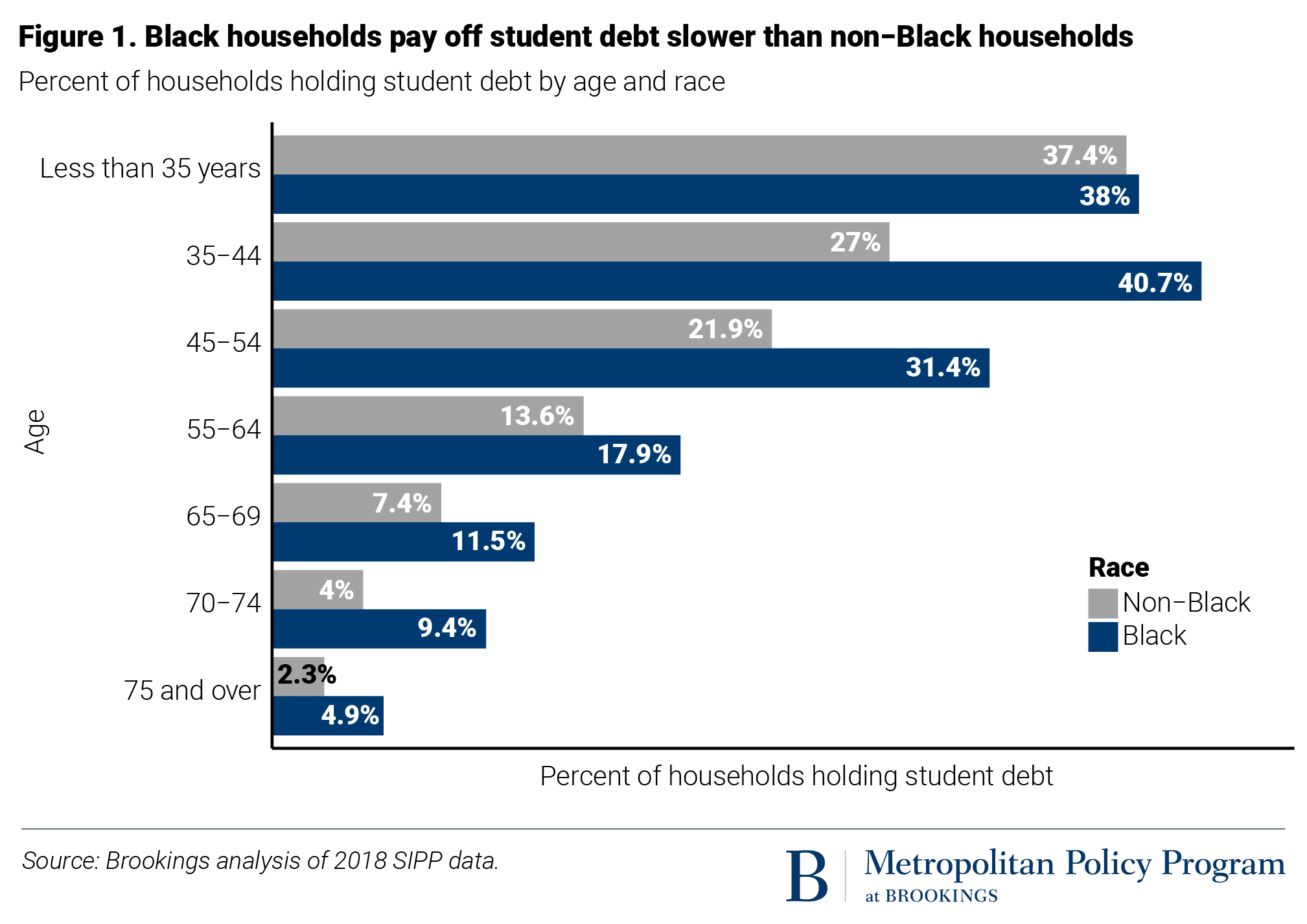

After graduation, loans quickly balloon, delaying or even preventing Black Americans from building wealth. According to our analysis of the Census Bureau’s 2018 Survey of Income and Program Participation (SIPP), there is a significant wealth disparity between Black and non-Black people at every age group, and Black people are not building wealth at the same pace as their non-Black peers, particularly in their prime working ages. Black households’ economic position is often precarious, and defaulting can actively jeopardize their financial health. Yet when we talk about student debt cancellation, rarely is that conversation centered on the experiences of Black Americans—missing a significant part of the problem.

Based on an analysis of the 2018 SIPP, we argue that because student debt disproportionately harms the wealth-poor—and the Black wealth-poor in particular—student debt cancellation could be a powerful tool in dismantling institutional discrimination and shrinking racial wealth disparities if implemented correctly.

We compare the effects of cancelling debt against the status quo, and at three different levels of intervention: 1) $10,000 cancelled for all (as President Joe Biden has proposed); 2) up to $50,000 cancelled based on means-testing for households earning under $100,000 and a sliding scale cancellation for households earning up to $250,000 (as Sen. Elizabeth Warren [D-Mass.] has proposed); and 3) total debt cancellation (as Sen. Bernie Sanders [I-Vt.] has proposed). As might be expected, we find that the more student debt that is cancelled, the greater the effect increasing Black wealth, particularly for households below the wealth median.

In this paper, we center the Black experience in our consideration of student loan debt and draw from our own analysis to argue for debt cancellation that is not means-tested (predicated upon household income) as an important mechanism for closing the racial wealth gap.

The rise in student debt is not hitting American families equally

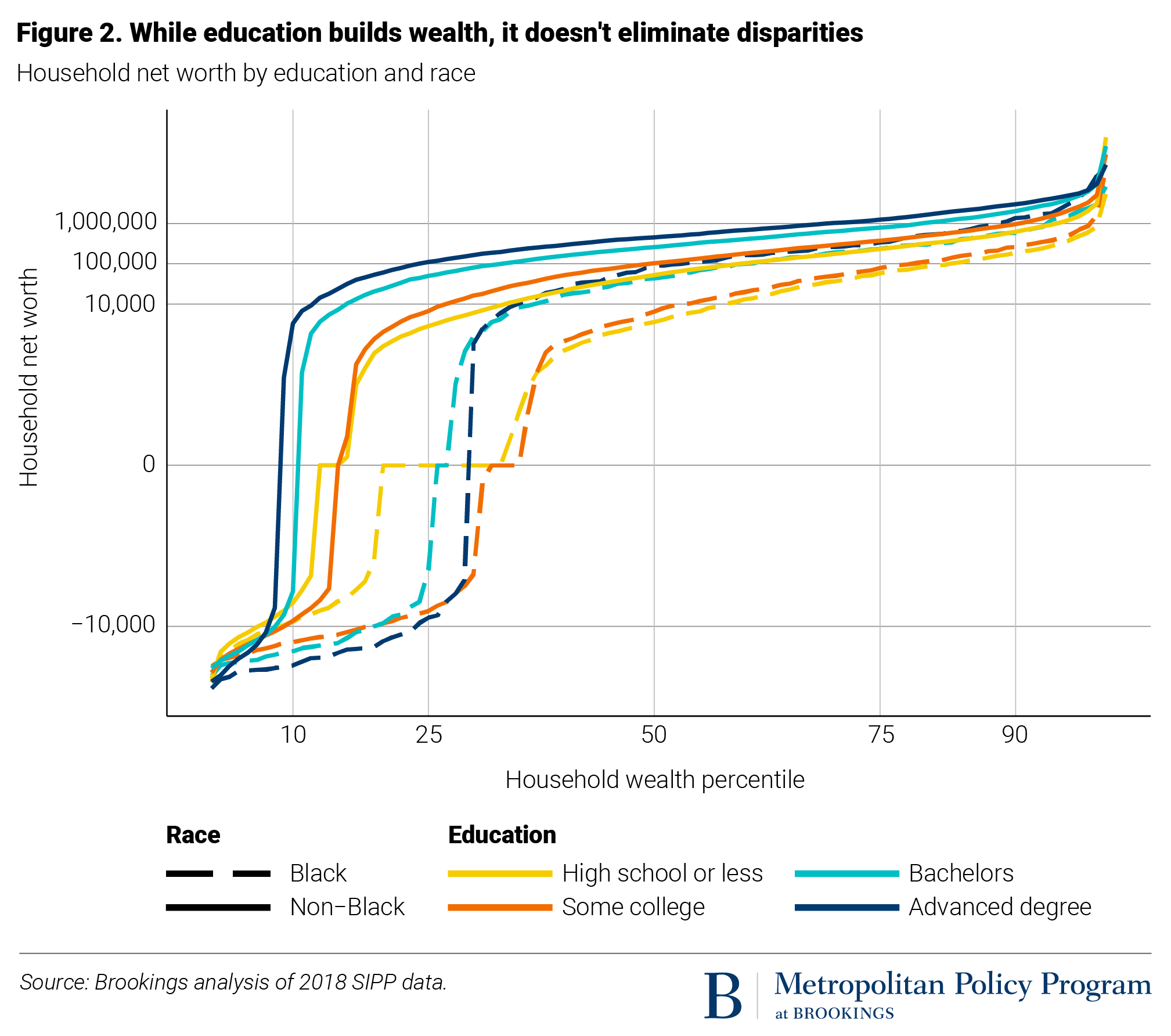

Education has long been heralded as the solution to the racial wealth gap. But as our colleague Darrick Hamilton notes, “Higher education is associated with greater wealth within race groups, but more education will not solve the problem of racial wealth disparity.”

That may be because of student debt, which exacerbates the racial wealth gap born from systemic racism leveled against Black families. A 2019 study from The Journal of Consumer Affairs found that, as of 2016, student debt accounted for between 3% and 7% of the racial wealth gap, and that student debt was growing.

Critics of student debt cancellation often focus on the higher income earnings of professionals. Our Brookings colleagues, for instance, argue that debt cancellation is a regressive policy that unfairly and disproportionately aids already affluent individuals at taxpayers’ expense.

But these broadside critiques often miss three key details in the labor market. First, an American Economic Association study showed that while individuals with student loans do have higher incomes, they do not have statistically significant higher hourly wages, suggesting that student debt is forcing loan holders to work longer hours. Second, student debt pushes graduates to choose work they are less passionate about and away from public interest careers that offer lower salaries relative to corporate work. Third, a study in the Economics of Education Review shows that recent graduates with student debt take jobs that have higher initial salaries but lower potential wage growth.

Critics of student debt cancellation also misrepresent who borrows and who holds federal student debt. According to our Brookings colleagues, Black borrowers typically owe 50% more in student debt upon graduation than their white peers. Four years after graduation, this gap increases to 100%. While poor and Black households’ student debt increases, nonbank marketplace lenders like Splash Financial and SoFi offer lower refinance rates to low-credit-risk households. By targeting the student debts of the highest-income and highest-net-worth households, private companies have forced the federal government to hold the highest-risk loans (those held by lower-income and low-wealth households), according to the Congressional Budget Office. So, by cancelling federal student debt, lawmakers are ipso facto aiding low-wealth households.

Race and class dynamics place the heaviest loan burden upon low-wealth families, particularly low-wealth families of color. A JPMorgan Chase study found that 13% of Black borrowers are projected to never pay off their loans because the compounding interest outpaces their ability to pay down the principal. As the Education Trust reports, “a Black bachelor’s degree recipient is more likely to default than a White college dropout, and Black borrowers from families in the highest income quintile have higher default rates than White borrowers in the lowest income quintile.”

According to our Brookings colleagues, 37.5% of Black borrowers will default at some point, compared to 12.4% of white borrowers. Additionally, majority-Black ZIP codes tend to have higher student loan borrowing rates and larger balances compared to majority-white ZIP codes, which means that the aggregate impact of loans depresses whole communities—not just individuals.

As the nation recovers from the COVID-19-induced economic recession in the coming years, it will be helpful to look back at what helped and hindered the last recovery. A study from the Federal Reserve Bank of St. Louis showed that student debt harmed the recovery from the Great Recession. One reason is that households build wealth during and after recoveries through home equity—the largest driver of net worth for the typical family. But a study from the Federal Reserve Board found that an increase in student debt is inversely correlated with home ownership rates. And a working paper from Washington University in St. Louis’ Center for Social Development found that households with student debt had a projected $54,334 less in home equity than households without student debt, even after accounting for differences in age, income, occupation, marriage, race, and health status.

Key distinctions in different student debt cancellation proposals

In recognition of the vast sums of student debt and their economically restrictive and socially inequitable effects, numerous policy recommendations from major political contenders have surfaced over recent years. Sen. Sanders, Sen. Warren, and Vice President Kamala Harris each rolled out proposals during the Democratic presidential primaries, and now the Biden administration is prepared to push for action as well.

- Sen. Sanders’s plan was the most expansive, proposing to cancel all $1.7 trillion of the nation’s student debt in a one-time action.

- Sen. Warren’s plan was more targeted, offering a tiered approach based on income. Borrowers earning less than $100,000 per year would be eligible for a maximum of $50,000 in relief, with a gradually decreasing benefit for those with incomes between $100,000 and $250,000. No relief would be offered to those earning over $250,000 annually.

- Vice President Harris’ plan offered up to $20,000 in relief to entrepreneurs in disadvantaged neighborhoods who were Pell Grant recipients. Practically speaking, the Harris plan was a community development proposal that used debt cancellation as a tool to support small businesses, but was not a student debt relief plan in its own right.

Are any of these proposals possible? With a majority in the Senate, Democrats could pass a measure on student debt through the once-yearly process of budget reconciliation, or President Biden could use the power of the executive to waive debt held by the federal government. However, Democrats are currently not treating the issue as a top priority for the budget reconciliation process (which is a limited tool), and Biden himself has expressed skepticism that his executive power should be used in this way.

Instead, Biden has called on Congress to cancel $10,000 in debt for borrowers, which would be wide in scope but a thin amount compared to the average debt held by most students, particularly Black students. The Biden plan would have significant impact for many families (according to a study done by the Obama White House, two-thirds of defaults occurred in households with less than $10,000 in student debt), but it would not have the ameliorative racial wealth effects that larger cancellation policies would have. Because the effects of student debt disproportionately lie along lines of race and wealth, any debt cancellation effort would do well to consider the effect of intergenerational wealth on student debt. If implemented correctly, student debt cancellation could be a powerful tool in dismantling institutional discrimination by shrinking racial wealth disparities.

Cancelling student debt has the greatest effect for low-wealth households

Our examination of wealth data shows the effect of debt cancellation on the overall net worth of Black households across different metrics. In order to calculate differences in household wealth, we use the standard procedure for transforming wealth data—making possible comparisons between positive and negative values. The downside in using this standard transformation is that it overstates differences between positive and negative net worth households. Using this method, we follow the study by the Jain Family Institute showing the effects of student debt cancellation across net worth percentiles. By showing the effects across net worth percentiles, we can show the distributional effects of student debt cancellation for all households, not just the median.

Because we use the 2018 SIPP, our estimates of total debt are slightly different than the often-cited estimates from the Federal Reserve Board’s monthly report on consumer credit. Our data underestimates the total amount of student debt held. This happens for two reasons. First, this occurs because much of the nation’s total student debt is held by individuals not considered to be part of “households”—for example, because of how “households” are defined in surveys like the SIPP and the Survey of Consumer Finances, independent young adults are weighted for the entire young adult population and young adults who live with their parents are discounted. Second, many households that hold student debt are young and of color—groups that are harder for surveyors to get accurate measures for.

We find that households held just over $1 trillion in student debt in 2018. According to the Federal Reserve Board’s monthly report on consumer credit, in the third quarter of 2020 (the most recent data available), there are $1.7 trillion in student loans owed and securitized. Despite our lower estimate, we still find that student debt is a larger source of household indebtedness than credit card and vehicle debt.

Taking out student loans is an attractive offer for many people because households with a college-educated head of household tend to have a higher net worth. If heads of households with a bachelor’s degree have positive net worth (indicating lower debts and higher asset ownership), they have significantly higher wealth than their counterparts without a college degree. In our analysis of households with a bachelor’s degree at every wealth percentile, non-Black households below the 11th percentile and Black households below the 28th percentile have zero or negative net worth. And for these wealth-negative households, those with a non-college-educated head of household actually have more wealth than those with a college-educated head of household, due to a lower debt burden (see Figure 2).

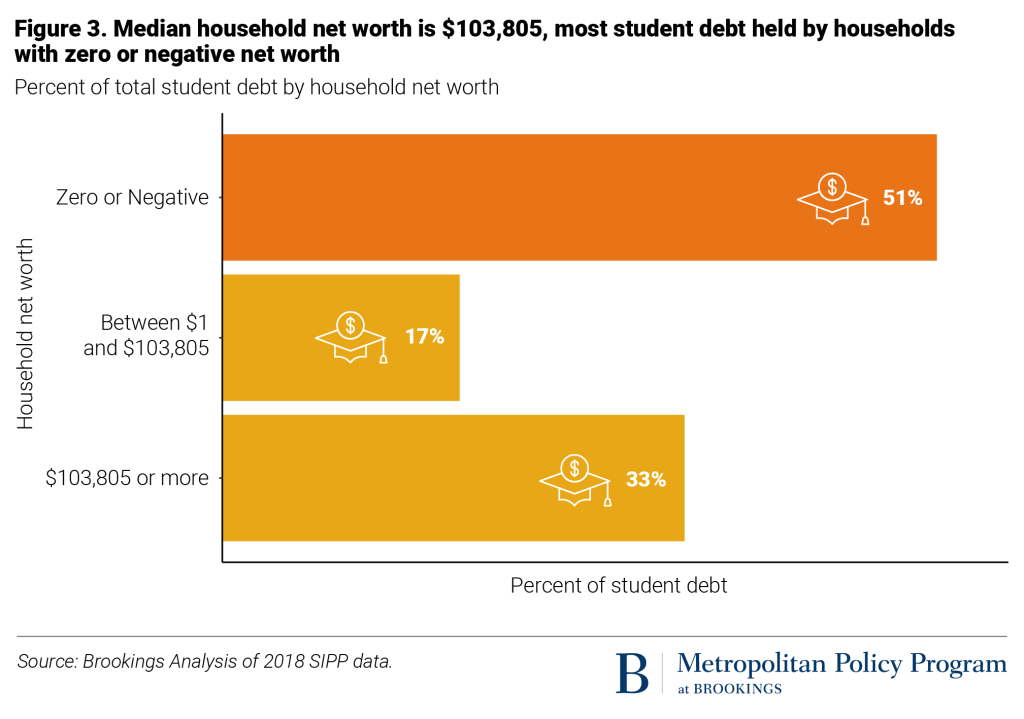

Two key data findings bolster our claim that student debt disproportionately harms wealth-poor households and, in particular, wealth-poor Black households. First, we find that more than half of all student loan debt is held by households that have a zero or negative net worth (see Figure 3).

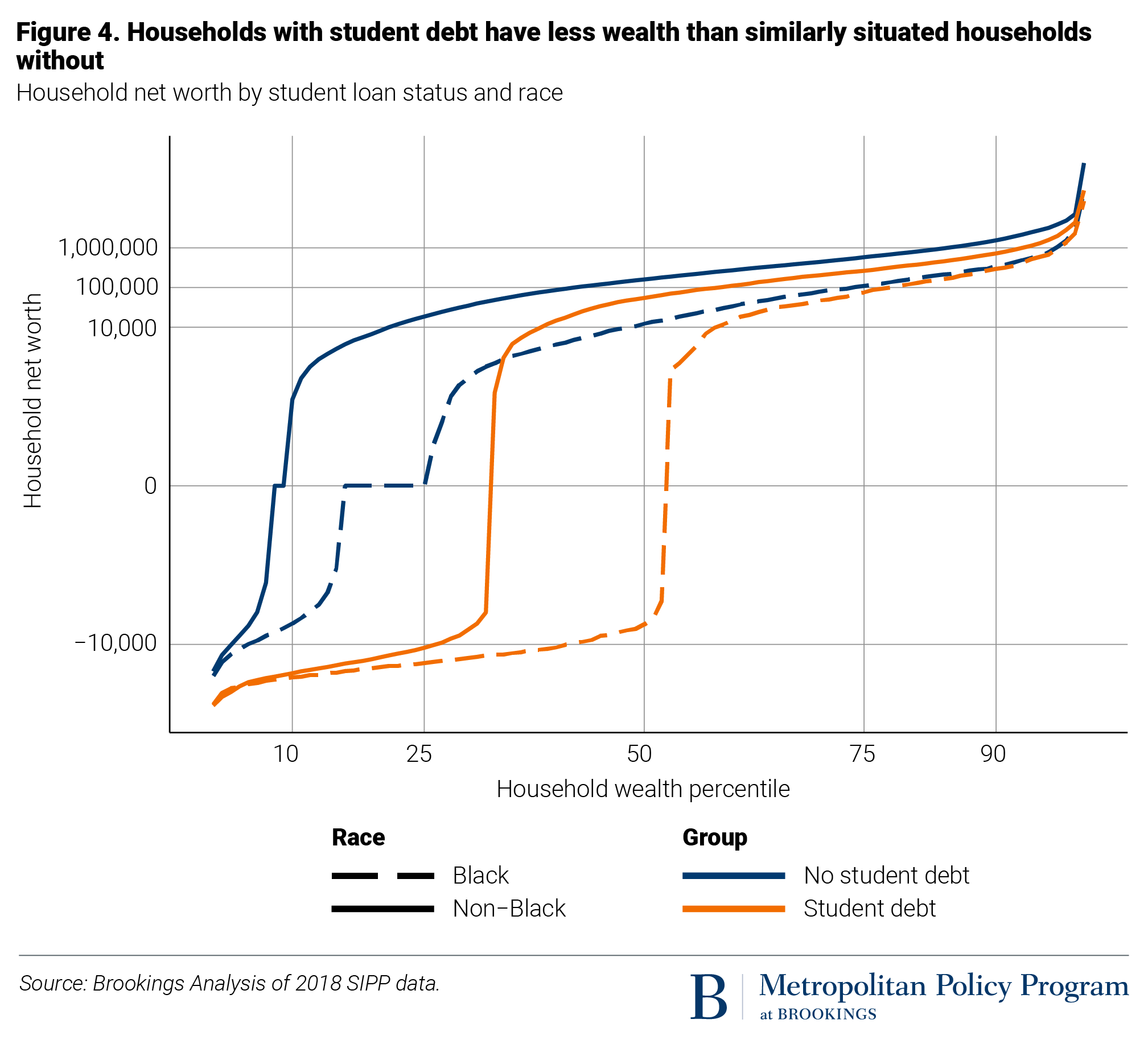

Second, we find that of households with student debt, 52% of Black households and 32% of non-Black households have zero or negative net worth. Of households without student debt, 25% of Black households and 9% of non-Black households have zero or negative net worth. Households with student debt have lower net worth than households without student debt at every percentile.

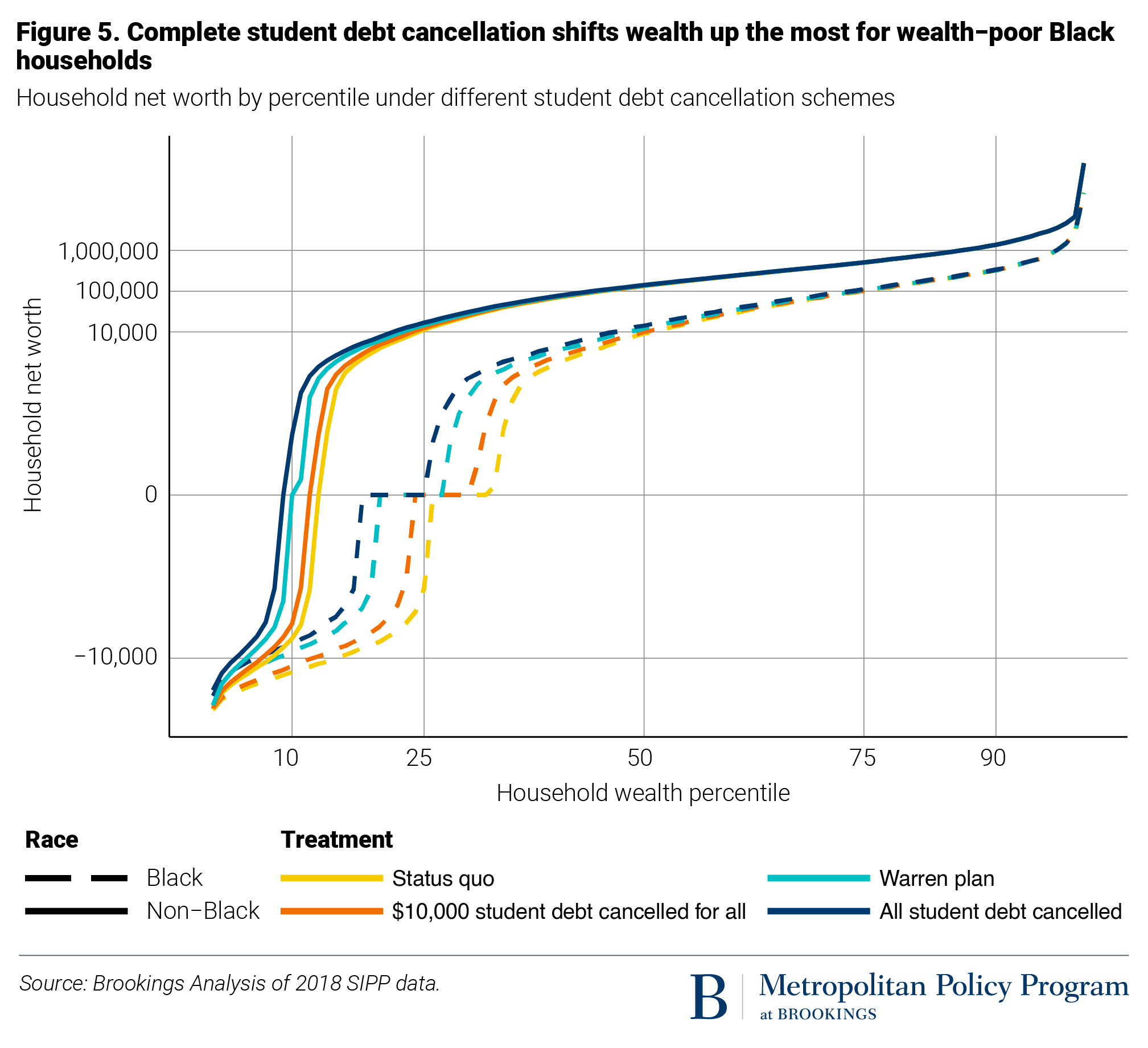

To examine the effects of different debt cancellation policies, we plotted Black and non-Black households’ net worth and wealth percentile. By examining household net worth at every wealth percentile, we show that cancelling debt shifts wealth up across the distribution. This shift disproportionately helps wealth-poor Black households (see Figure 5 below).

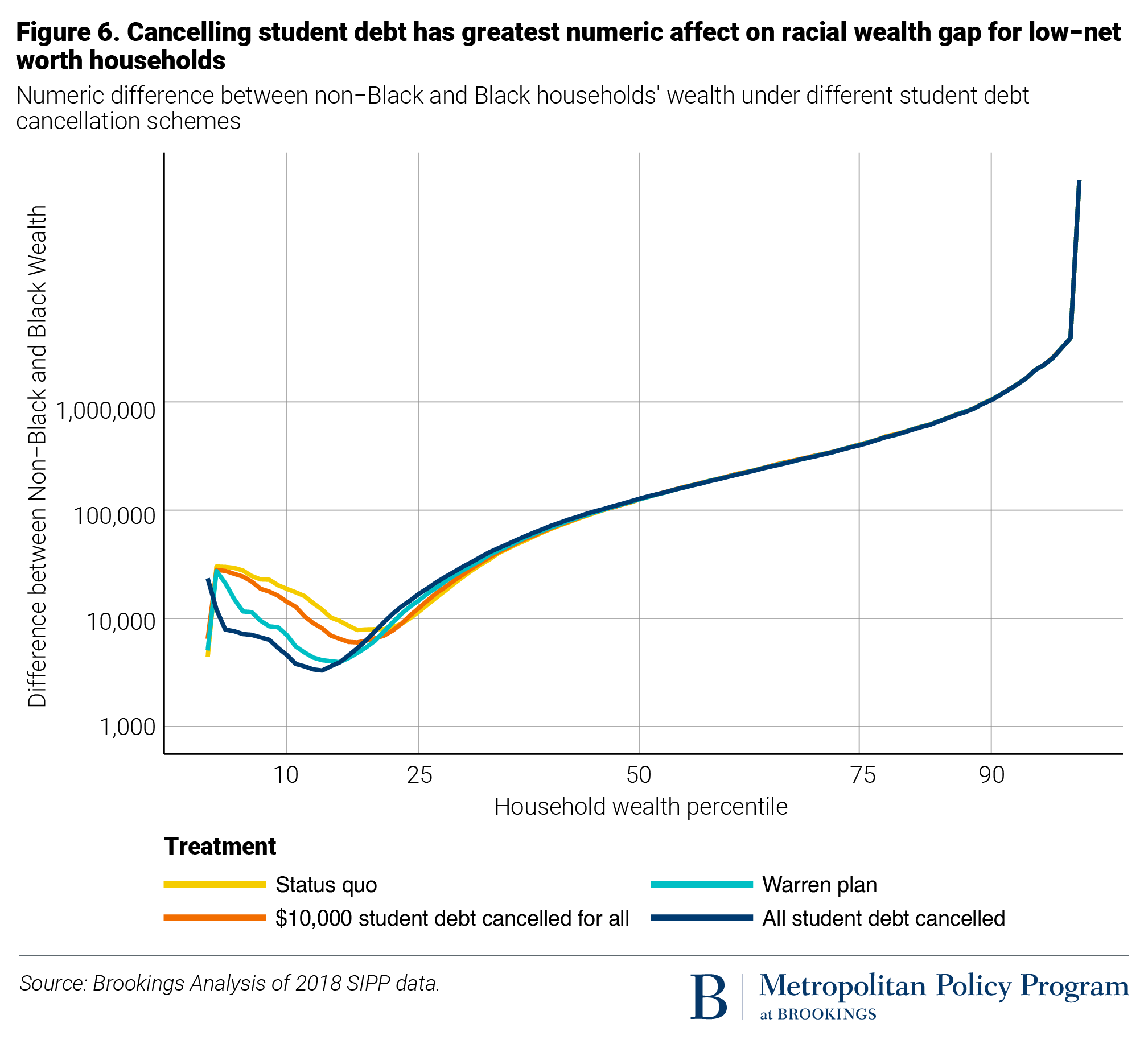

We also plotted the numerical difference between Black and non-Black household net worth, meaning non-Black household net worth minus Black household net worth at every wealth percentile. We find that when all student debt is cancelled, the numerical difference between the wealth of non-Black and Black households shrinks for households between the second and 20th percentiles. But for households at the first percentile and between the 21st and 54th percentiles, cancelling all student debt increases the numerical difference between Black and non-Black wealth. For households above the 50th percentile, the numerical difference is negligible (see Figure 6 below).

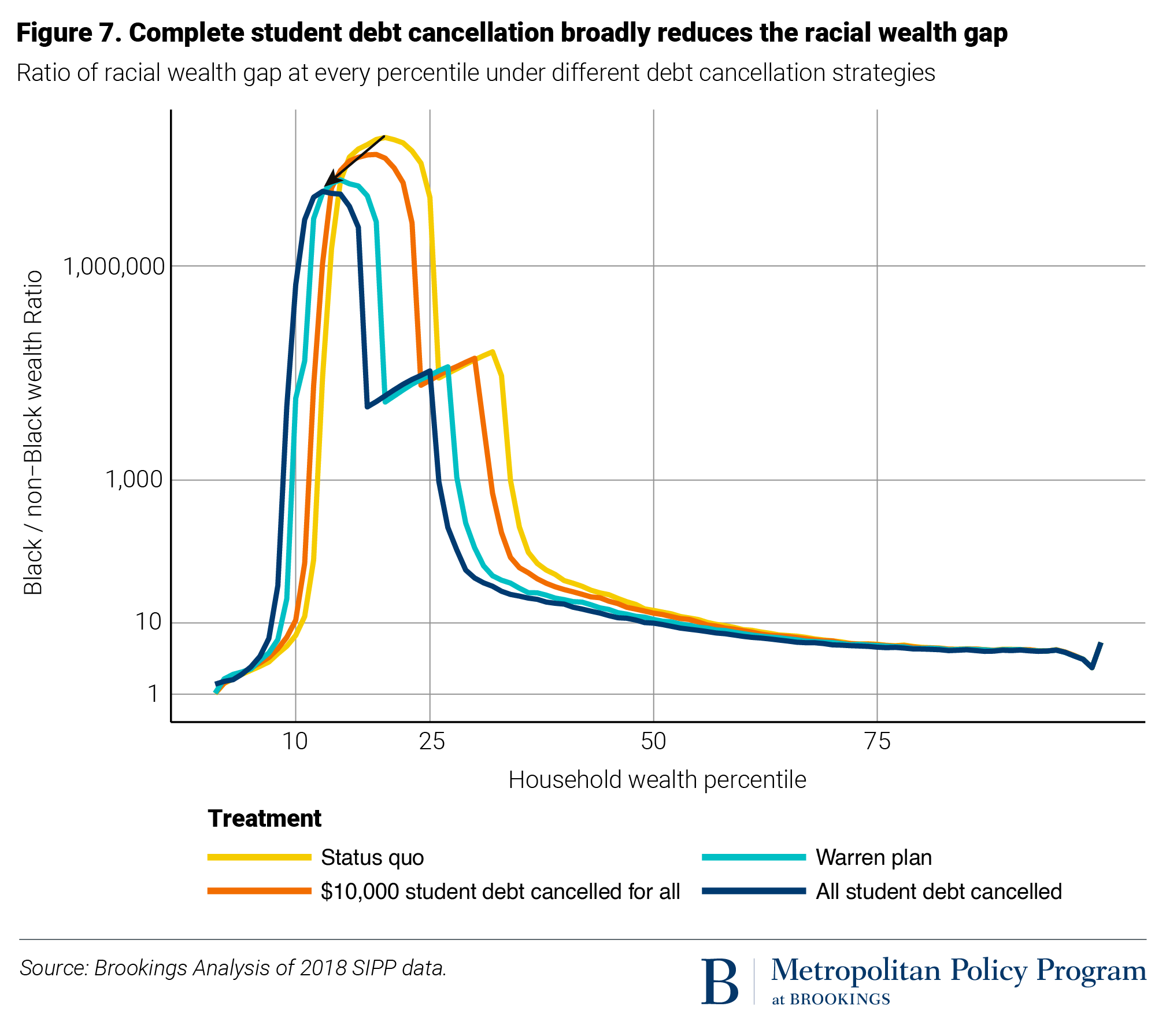

While the numerical difference does increase for some households, this does not imply that cancelling all student debt would increase the relative difference between Black and non-Black households. In most conversations about the racial wealth gap, the relevant metric is the wealth ratio—e.g., when our colleagues wrote that “The median white household has a net worth 10 times that of the median Black household.”

We plotted the ratio of the racial wealth gap at every wealth percentile to examine the relative effects of debt cancellation. As previously discussed, the transformation used on the wealth data overstates differences when comparing between positive and negative values. Due to the transformation, the ratio of non-Black wealth to Black wealth spikes above 1 million where Black households have zero or negative wealth and non-Black households have positive wealth. Under the different cancellation plans, this spike shifts to the left and narrows due to more Black households becoming wealth-positive under the debt cancellation plans. In contrast with the finding that the numerical difference between Black and non-Black households only decreases for some, we note that that debt cancellation has the broad effect of reducing the wealth gap ratio at different wealth percentiles. Further, we find that the more debt is cancelled, the greater the racial wealth gap is reduced (see Figure 7 below).

Conclusion

Americans like to think that if individuals are educated in great schools, they can pull themselves up by their proverbial bootstraps and bring their families with them. From childhood, we’re told that we can achieve middle-class status if we work hard in school and get good grades, no matter if obstacles such as bad policing, weak labor markets, and discriminatory housing policies litter our path. We believe that a good education can propel us past those barriers, and we can surpass our parents’ social standing.

But many Black college graduates are not surpassing their parents in wealth and improving their chances of achieving the American Dream. The reality is that wealth, not education, is what makes the difference. Wealth-poor Americans are disproportionately straddled with student debt, as people without means attempt to use education to increase their economic mobility but go into debt in the process.

Many continue to argue that student debt isn’t a problem for high-income earners and only those with low incomes should receive debt cancellation. And certainly, people with a college degree have higher incomes than those without one. But non-Black households with some college but no degree have a higher median net worth than Black households with advanced degrees. Black households’ ability to achieve that American dream via education and higher incomes is throttled by high debt and the lack of intergenerational wealth. Consequently, income doesn’t necessarily reveal the extent of the student debt crisis for Black Americans.

Many of our public programs are income-based means-tested, affecting households differently dependent on their incomes. For Black households, these tests unfairly ignore the intergenerational wealth accumulation that they have been denied. As President Biden considers debt cancellation policies, he should consider the wealth disparities created by anti-Black policies of the past.

As we highlight the problems with using income-based means tests and the importance instead of considering wealth, we should note that this does not suggest that wealth-based means tests are the solution. It would be incredibly difficult and inefficient to build a wealth-based means test—but we ought to design our public programs with their effects on wealth in mind. Federal student debt cancellation and free universal public college—so Black students are not straddled with debt in their attempts to achieve the American dream—are examples of programs that, if adopted, would not need to have means tests in order to have ameliorative effects on the racial wealth gap.