Editor’s Note: This paper is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between the Economic Studies Program at Brookings and the USC Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. This work was supported by a grant from the Robert Wood Johnson Foundation.

At present, 11 states have declined to expand Medicaid to all people with incomes below 138% of the federal poverty level (FPL), as permitted under the Affordable Care Act (ACA). In these states, adults with incomes below 100% of the FPL typically lack access to subsidized health insurance coverage.[1] Adults with incomes between 100 and 138% of the FPL are eligible for subsidized coverage through the ACA Marketplaces, but face higher cost-sharing and, prior to recent legislation, higher premiums than they would in Medicaid. These states’ decisions are estimated to have reduced coverage by 3.7 million people, while worsening financial security, access to health care, and health outcomes, including mortality.

In 2021 and 2022, Congress considered two ways of addressing these gaps in coverage but did not enact either. The first was for the Centers for Medicaid Services (CMS) to operate a “federal Medicaid program” in the non-expansion states that would, in effect, directly substitute for the missing state Medicaid expansion. The second, which was passed by the House of Representatives, was to extend eligibility for subsidized Marketplace coverage to people below the poverty line, while modifying how Marketplace coverage functions for people below 138% of the FPL to make it more “Medicaid-like.”

The analysis considers the relative merits of these two approaches, with the goal of helping policymakers choose between them if the Medicaid coverage gap returns to Congress’ agenda in the future. I compare the approaches along four dimensions that would be central to policymakers’ decisions: (1) number of people covered; (2) quality of coverage; (3) per enrollee fiscal cost; and (4) ease of implementation.

My overarching conclusion is that these two approaches are similar. Both would ensure that people with incomes below 138% of the FPL are eligible for zero- (or near-zero) premium coverage that covers a broad set of services with minimal cost-sharing; as such, either would largely or entirely fill the gaps left by state decisions not to expand Medicaid.[2] However, there are also differences worth considering along each of the four dimensions listed above. The nature of those differences would depend on the details of each legislative proposal and CMS’ implementation decisions, and it appears unlikely that either approach would outperform the other on all four dimensions. In brief:

- Number of people covered: Without changes to the Marketplace enrollment process, enrolling in coverage would likely be harder under a Marketplace-based approach due to the need to select a plan and, in some cases, pay a premium. The House-passed Marketplace-based approach also lacked the “retroactive” coverage for care received before enrollment that would be available under a federal Medicaid program. These downsides of a Marketplace-based approach could, in principle, be mitigated with small changes to the House-passed bill and thoughtful implementation decisions.

On the other hand, relying on a federal Medicaid program would require enrollees to transition between coverage programs when their income crossed 138% of the FPL. This eligibility “seam” could cause coverage disruptions that would not occur under a Marketplace-based approach. These disruptions would likely be hard to fully avoid under a federal Medicaid program.

- Quality of coverage: If a federal Medicaid program emulated state Medicaid programs, then it might offer somewhat narrower provider networks and more restrictive drug coverage than a Marketplace-based approach. However, CMS could also implement a federal Medicaid program in ways that would make it much more generous than a Marketplace-based approach along these dimensions, as well as opt to cover additional services that Marketplace plans do not typically cover. Another consideration is that a Marketplace-based approach would likely offer enrollees more plan options and, thus, allow some enrollees to select plans that better matched their needs; however, this would come at the cost of placing enrollees in a more complex choice environment that could lead other enrollees to choose plans that poorly matched their needs.

- Per enrollee fiscal cost: A federal Medicaid program would pay health care providers and drug manufacturers lower prices than Marketplace plans, as it would have many tools to limit prices that Marketplace plans lack. A reasonable estimate (derived below) is that these price differences would reduce the per enrollee fiscal cost of a federal Medicaid program by one-quarter to one-third relative to a Marketplace-based approach, depending on how CMS implemented a federal Medicaid program. If they wished, legislators could “claw back” some of the higher prices paid to providers and manufacturers under a Marketplace-based approach, such as by reducing payments to hospitals intended to cover uncompensated care costs or extending Medicaid-like drug rebates to Marketplace enrollees who would be eligible for Medicaid under expansion.

Utilization could also differ between a federal Medicaid program and a Marketplace-based approach. However, the direction of those differences would likely depend on decisions CMS made about provider networks and utilization controls under a federal Medicaid program.

- Ease of implementation: A Marketplace-based approach would be easier to implement than a federal Medicaid program because it could rely heavily on existing infrastructure, whereas a federal Medicaid program would need to create new systems to perform many core functions, such as regulating and contracting with managed care plans. As a result, a Marketplace-based approach could likely be at least partially implemented in a matter of months, whereas it might take years for a federal Medicaid program to begin offering coverage.

The discussion above implies that policymakers’ choices between the two approaches would depend on how much weight they assigned to each of these four dimensions, as well as the details of each legislative proposal and CMS’ implementation decisions. For example, a policymaker who prioritized maximizing the number of people covered might prefer a federal Medicaid program if CMS maintained current Marketplace enrollment process. But the same policymaker might prefer a Marketplace-based approach if the House bill was amended to add retroactive coverage and CMS improved the Marketplace enrollment process since a Marketplace-based approach could be implemented faster and would avoid an eligibility “seam” at 138% of the FPL. Similarly, a policymaker who prioritized maximizing the quality of the coverage enrollees received might prefer a Marketplace-based approach if CMS implemented a federal Medicaid program in ways that emulated state Medicaid programs, but hold the opposite view if CMS made implementation decisions that caused a federal Medicaid program to provide more generous coverage.

Closely related, this discussion shows that lawmakers, CMS, or both would have important choices to make if either approach returned to the forefront. Notably, legislative changes to the House-passed bill, including the addition of retroactive coverage or provisions to “claw back” revenue from providers or manufacturers, could improve its performance along some of the dimensions examined here. For its part, CMS would face consequential implementation decisions, particularly regarding the enrollment process under a Marketplace-based approach and coverage quality under a federal Medicaid program.

The remainder of this analysis presents an overview of the two approaches to addressing the coverage gap and then a detailed analysis of how they compare along the dimensions enumerated above.

Overview of the Two Approaches

To set the stage for the rest of the analysis, I begin with a brief overview of the two approaches.

The first approach, which was proposed by the House Committee on Energy and Commerce in draft reconciliation legislation, is to create a “federal Medicaid program.” Under this approach, the federal government would operate a coverage program that would largely replicate state Medicaid expansion coverage, including with respect to eligibility, covered services, and (a lack of) premium and cost-sharing obligations. The draft envisions that coverage would be delivered through Medicaid managed care plans or third-party administrators under contract with the federal government, similar to how most state Medicaid expansion coverage is delivered.[3] Eligibility determinations under this approach would likely rely heavily on the HealthCare.gov infrastructure used for Marketplace enrollment.[4]

The second approach, which was included in the House-passed Build Back Better Act, would use the ACA Marketplaces to fill the coverage gap. This approach would extend eligibility for the premium tax credit to people below the poverty line to allow this group to obtain subsidized Marketplace coverage. It would also change how Marketplace coverage works for all people with incomes below 138% of the FPL to make that coverage more “Medicaid-like.” These changes include:

- making these enrollees eligible for a more generous tier of cost-sharing reduction that would raise the actuarial value of silver plans to 99% (and adding coverage without cost-sharing for some services that are covered in Medicaid but may not be covered in Marketplace plans, including non-emergency medical transportation and certain family planning services); and

- exempting people in this income group from the employer-sponsored insurance “firewall,” which makes most people offered coverage by an employer ineligible for Marketplace subsidies.

In the rest of the analysis, I treat the Energy and Commerce draft as the archetype of the federal Medicaid program approach and the House-passed bill as the archetype of the Marketplace-based approach. Thus, unless otherwise specified, I assume that each approach would mirror the relevant legislative proposal.[5]

Before proceeding, I note that both the Energy and Commerce draft and the House-passed bill included maintenance of effort provisions intended to ensure that current Medicaid expansion states continued their expansions rather than relying on the federal government to cover people with incomes below 138% of the FPL. The House-passed bill would also have increased the federal share of Medicaid expansion costs from 90% to 93%. I assume that either approach would be adequate to preserve all existing expansions (and also that no new states would expand under either approach). In any case, the question of how to preserve existing Medicaid expansions is largely separable from the question of what type of coverage policymakers should offer to people in the coverage gap, so I do not consider this issue further.[6]

Number of People Covered

I now examine how many people would be covered under the two approaches. At a high level, the two approaches would likely be very similar. Each would make the same group of people eligible for zero-premium (or near-zero-premium) coverage with minimal cost-sharing. And both approaches would use the HealthCare.gov infrastructure to determine eligibility and process enrollments. Nevertheless, as discussed in detail below, there are some differences that could matter at the margins.

Plan selection frictions

At present, people enrolling in Marketplace coverage must affirmatively choose a plan before their coverage begins. By contrast, a federal Medicaid program would presumably automatically assign people who do not affirmatively choose a plan to one of the available managed care plans, mirroring the process that is required for state Medicaid programs. Research in the context of Massachusetts’ pre-ACA health insurance exchange suggests that this additional step could reduce enrollment under a Marketplace-based approach relative to under a federal Medicaid program.

In practice, CMS could likely largely mitigate this source of enrollment friction through its implementation decisions. Because these enrollees would almost always have access to at least two silver plans with zero (or near-zero) premiums, CMS could automatically enroll people who applied for coverage and were determined to be eligible for zero-premium coverage into one of these plans. Indeed, CMS may wish to consider adopting this approach even outside of the coverage gap context.

Premium payment frictions

Another potential difference relates to premium payments. The people targeted by a Marketplace-based approach would typically have access to zero-premium silver plans. However, in some cases, peculiarities in how the premium tax credit applies to plans that include benefits that are not considered “essential health benefits” under the ACA could cause all silver plans to carry small positive premiums for these enrollees. In other instances, enrollees might simply choose plans with positive premiums even though zero-premium plans are available—or end up in these plans unintentionally since a plan that had a zero premium at enrollment might nevertheless have a positive premium in a future year.

A range of evidence suggests that being required to pay even a small premium can meaningfully reduce enrollment, likely largely because of the hassle and cognitive costs involved in paying. This disenrollment risk would not arise under a federal Medicaid program since it would never charge premiums.

Once again, CMS could likely largely mitigate reduction in enrollment due to premium frictions through its implementation decisions. CMS could prevent insurers from disenrolling people with only small unpaid premiums, and it could set up policies to automatically transition people who stopped paying premiums into an available zero-premium plan. As above, these are steps that CMS might wish to consider implementing even outside of the context of a coverage gap program.

Income transitions across 138% of the FPL

The two approaches would also function differently when enrollees’ income transitioned from below 138% of the FPL to above 138% of the FPL or vice versa. Crossing this income threshold would involve some changes for enrollees under either approach. In particular, enrollees whose incomes rose above 138% of the FPL would face higher cost-sharing and become subject to the premium tax credit employer coverage “firewall,” which would likely necessitate some form of eligibility redetermination. Once income rose above 150% of FPL, these enrollees would also face higher premiums.

However, these income transitions could be more disruptive under a federal Medicaid program because the menu of plan options would change at 138% of the FPL, so enrollees would need to choose a new plan.[7] For downward income transitions, CMS could automatically assign enrollees to a plan, which could help ensure continued enrollment. However, it would not always be possible to use automatic enrollment to smooth upward income transitions since, if enrollees’ incomes rose enough to place them above 150% of the FPL, they would typically lack access to a zero-premium silver plan. Moreover, even in cases where transitions across 138% of the FPL did not disrupt enrollment, they could still disrupt access to care since a change of plan would frequently involve changes in provider network or other plan features.

Retroactive coverage

Another potential difference relates to the “retroactive” coverage typically available in Medicaid. Like state Medicaid programs, a federal Medicaid program would be required to provide retroactive coverage for services delivered in the three months before a person enrolled. Thus, people eligible for a federal Medicaid program would have substantial financial protection against an unexpected health shock (e.g., an injury that resulted in an emergency room visit) even if they had not enrolled before it occurred. By contrast, Marketplace plans only cover services received after the coverage becomes effective.

In principle, Medicaid-like retroactive coverage could be grafted onto a Marketplace-based approach. In particular, the federal government could directly pay claims for services delivered prior to enrollment or pay insurers to pay these claims. For either approach to perform well, the federal government would likely need to specify the prices paid for these services (e.g., some multiple of Medicare’s prices) and protect enrollees from balance billing by requiring providers to accept these amounts as payment in full. Draft legislative text published by the Senate Committee on Health, Education, Labor and Pensions after House passage of the Build Back Better Act envisioned an approach in this vein, although it had some limitations.[8]

Tax credit reconciliation

Another difference between the two approaches is that Marketplace enrollees can be required to pay back part of any advance payments of the premium tax credit they receive during the year if their actual income for the year ends up being higher than they expected when they enrolled (so that they are eligible for a smaller tax credit). No similar repayment obligation would exist under a federal Medicaid program.

Repayment obligations under a Marketplace-based approach would likely be relatively uncommon and, in typical cases, modest in size. The value of the premium tax credit does not begin to decline until an enrollee’s income rises above 150% of the FPL, so most enrollees with incomes below 138% of the FPL would need to experience a large positive income shock before a repayment obligation could arise. Moreover, the House bill would tightly limit repayment obligations for all enrollees whose annual income ends up below 200% of the FPL: $150 per year for a single person and $300 for a family.

Nevertheless, if these repayment obligations were salient to enrollees at the time of enrollment, they could slightly reduce enrollment. (While even small premiums can cause substantial reductions in enrollment, as noted above, the likely reason for that is that remitting a small premium requires enrollees to take action to continue their coverage. That would not be the case with the implicit premiums created by the possibility of repayment.) The repayment obligation would also, of course, impose a modest additional financial burden that would not exist under a federal Medicaid program, albeit one that would entirely affect enrollees who experienced a large positive income shock.

Congress could, if it wished, mitigate these concerns under a Marketplace-based approach by specifying more stringent limits on repayments than in the House-passed bill. This would have some cost, likely primarily by reducing recoveries from people whose annual income ends up being higher than the income they projected at the time of enrollment. In principle, it could also increase incentives for enrollees to understate their income at the time of enrollment, although reconciliation obligations may not be sufficiently salient for this type of strategic income misreporting to become widespread.

Account transfers from state Medicaid programs

A final possible difference between the two approaches could concern people who lose eligibility for their state’s Medicaid program (e.g., very low-income parents who experience an increase in income or children who turn age 19) or who apply to their state’s Medicaid program and are determined ineligible. Under a Marketplace-based approach, states would be required to redirect people in these situations to the Marketplace in accordance with the account transfer procedures mandated by the ACA. However, these procedures might not automatically apply to the federal Medicaid program envisioned in the Energy and Commerce draft. In principle, Congress could easily apply these procedures to a federal Medicaid program, although states might resist complying with something they perceived as a new requirement.

Quality of Coverage

I now consider how these two approaches would compare with respect to the quality of the coverage enrollees received. Once again, there would be important similarities between the two approaches. Both approaches would offer coverage for a broad set of health care services, including the services considered essential health benefits under the ACA and certain other services typically covered in Medicaid. Similarly, there would be only small differences in cost-sharing, with the federal Medicaid program offering coverage with an actuarial value of 100% versus 99% under the Marketplace-based approach. There could, however, be larger differences in plan characteristics other than cost-sharing.

Provider networks

One such dimension is provider networks. At least on average, Marketplace plan networks appear to be comparable to or modestly broader than Medicaid managed care plan networks (although both are much narrower than the networks typically offered by employer plans). Thus, if the networks available under a federal Medicaid program resembled those offered by existing Medicaid managed care plans, then a Marketplace-based approach to addressing the coverage gap would likely offer enrollees somewhat broader provider networks than a federal Medicaid program.

However, CMS could likely implement a federal Medicaid program so that it offered much broader networks than existing Medicaid managed care plans. The legislation grants CMS broad authority to regulate provider payment rates and establish network adequacy standards for its contracted managed care plans. Thus, CMS could, for example, require all plans to pay providers Medicare rates and subject plans to stringent network adequacy standards. The very high level of provider participation observed in traditional Medicare suggests that providers are typically willing to accept Medicare rates when there is no scope to negotiate higher rates by holding out for a better deal, implying that plans would likely be able to assemble broad networks at these prices. (Offering broader networks than existing managed care plans would, of course, come with a fiscal cost, an issue I return to in the next section.)

Broader networks have benefits for enrollees. They make it easier for enrollees to find a suitable provider when they need care and could allow enrollees to find more convenient or higher-quality providers. Broader networks also reduce the likelihood that enrollees will face out-of-pocket costs if they inadvertently receive out-of-network care, although the No Surprises Act would protect enrollees from these costs under a Marketplace-based approach (in the most common scenarios where enrollees inadvertently receive out-of-network care) and Medicaid’s balance billing protections would protect enrollees under a federal Medicaid program (at least if the provider opted to bill the program).

Prescription drug formularies and utilization management

The two approaches could also differ in their use of prescription drug formularies and other utilization management tools. Marketplace plans may establish formularies that exclude some drugs, subject to some regulatory requirements, including a requirement to cover at least one drug in each of an exhaustive set of therapeutic classes. Marketplace plans may also implement various restrictions on use of the drugs they do cover, including prior authorization and step therapy requirements.

By contrast, a federal Medicaid program, like state Medicaid programs, would generally be required to cover all drugs approved by the Food and Drug Administration (FDA). However, also like state Medicaid programs, a federal Medicaid program could place other limits on enrollees’ access to those drugs, including prior authorization requirements and quantity limits. Thus, how a federal Medicaid program compared to a Marketplace-based approach with respect to prescription drug coverage would depend on how often a federal Medicaid program’s contracted plans applied these types of limitations.

If a federal Medicaid program behaved like state Medicaid programs, then it might offer more restrictive coverage than a Marketplace-based approach, on balance. Research by the Medicaid and CHIP Payment and Access Commission has found that while state Medicaid programs cover more drugs than commercial insurance plans (consistent with the statutory requirement to cover all FDA-approved drugs), state Medicaid programs often use other types of coverage restrictions more intensively, with the result that commercial enrollees sometimes have unrestricted access to more drugs. (A caveat is that Marketplace plans appear to offer more restrictive drug coverage than employer plans, so existing Medicaid coverage might compare more favorably to Marketplace plans than to commercial plans writ large.)

On the other hand, CMS could likely also implement a federal Medicaid program in ways that would ensure it offered much more generous drug coverage than state Medicaid programs. In particular, it could restrict the ability of managed care plans to apply the types of coverage restrictions that are common in state programs or prefer bidders that made less use of these tools. Under this scenario, a federal Medicaid program might offer less restrictive coverage than a Marketplace-based approach.

Covered services

Another possible difference between the two approaches is the set of covered services. Under either approach, enrollees would have coverage for the same minimum set of benefits. The federal Medicaid program would be required to cover (at a minimum) the same set of services that states are required to cover for the Medicaid expansion population, which generally consists of the set of essential health benefits defined in the ACA plus a few additional services, notably non-emergency medical transportation and certain family planning services. A Marketplace-based approach would cover the same minimum set of services through the existing requirements on individual market plans to cover essential health benefits and the additional wrap-around coverage that would be funded by the House-passed bill.

However, CMS could choose to go beyond the statutory minimum under a federal Medicaid program. For example, CMS could choose to cover adult dental services or certain home and community-based services. By contrast, Marketplace plans would be unlikely to go beyond the statutory minimum, at least without charging an additional premium. Congress could, of course, arrange for coverage of additional services under a Marketplace-based approach in the same way that the House-passed bill arranges for coverage of services not typically covered in Marketplace plans, but this could not be done administratively.

Plan variety

A final difference is that a Marketplace-based approach would likely give enrollees a greater variety of plans to choose from. To start, enrollees would likely have more insurers to choose from under a Marketplace-based approach. For 2023, Marketplace enrollees in the states using the HealthCare.gov enrollment platform can choose from plans offered by more than 6 insurers, on average. By contrast, CMS could choose to offer only one plan in a geographic area under a federal Medicaid program. While CMS might go beyond this minimum, a reasonable guess is that a federal Medicaid program would still offer fewer options than are available on the Marketplace given CMS’ interest in limiting how many contracts it needed to oversee. A Marketplace-based approach would also offer greater variety of plan types within a single insurer, as insurers must offer both silver and gold plans and typically offer bronze plans too.

Greater variety could either benefit or harm enrollees. On the positive side, access to plans from more insurers could help enrollees find plans that better match their needs, especially plans that include particular providers. (A caveat is that only the two lowest-cost silver plans would typically have a zero premium, so taking advantage of this greater plan variety would often require enrollees to pay a premium, which could limit how valuable this greater plan variety was in practice. By contrast, if plans from multiple insurers were available under a federal Medicaid program, all would have zero premium.)

On the other hand, the greater plan variety with a Marketplace-based approach would also give enrollees more opportunities to make mistakes. A particular concern is that some enrollees would opt for non-silver plans, especially bronze plans, over silver plans. For these enrollees, silver plans would have an actuarial value of 99% due to the generous cost-sharing reductions available on those plans, versus 60% for a bronze plan and 80% for a gold plan, so they would face far higher cost-sharing when in enrolled in non-silver plans. But they would not receive commensurate premium savings, both because gross premiums differ across metal tiers by less than the expected difference in cost-sharing and because net premiums cannot fall below zero (which compresses premium differences between bronze and silver plans).[9]

These types of mistakes are not just a hypothetical concern. During 2022 open enrollment, 16% of Marketplace enrollees with incomes below 150% of the FPL in states served by the HealthCare.gov enrollment platform opted for non-silver plans, almost exclusively bronze plans.[10],[11] It would, in principle, be possible to prevent a similar outcome under a Marketplace-based coverage gap program by requiring these enrollees to choose silver plans, but the House-passed bill did not take this approach.

Per Enrollee Fiscal Cost

Another consideration is how much these approaches would cost the federal government per person enrolled. Under either approach, federal costs would approximately equal the amount spent on medical care for these enrollees plus the administrative costs and profit margins of the insurers that delivered the coverage.[12] In practice, differences in medical spending would be the largest driver of any cost differences since administrative costs and profits are small relative to medical spending and since both approaches would deliver coverage through private insurers. Thus, this section examines how the two approaches would compare with respect to the two determinants of medical spending: (1) the unit prices paid to health care providers and drug manufacturers; and (2) the amount of care used by enrollees.

Unit prices

A federal Medicaid program would have authority to regulate provider prices and would receive the same large statutory rebates on prescription drugs as state Medicaid programs, whereas Marketplace plans must negotiate prices with health care providers and drug manufacturers. As a result, a federal Medicaid program would likely pay providers and manufacturers less than Marketplace plans.

To gauge the size of the resulting differences in spending, I use Congressional Budget Office (CBO) projections of the prices paid by different payers in the coming years.[13] These projections, in turn reflect CBO’s synthesis of the literature on the prices currently paid by different payers.

A challenge in using these projections is that CBO only provides projections for private insurance plans overall, not Marketplace plans in particular. Private plans are overwhelmingly employer-sponsored plans, and it is generally believed that Marketplace plans pay lower prices than employer plans.[14] While direct estimates of the prices paid by Marketplace plans are not available, per enrollee claims spending in ACA-compliant individual market plans (a category that consists predominantly Marketplace plans) was estimated to be 29% lower than in large employer plans in 2017, after adjusting for health status differences.[15] The differential in per enrollee spending could overstate or understate the difference in average prices between Marketplace and employer plans since it could incorporate health status differences that cannot be adjusted for or utilization differences due to differences in provider networks, utilization controls, and other plan features. Lacking better data, I make the crude assumption that prices paid by Marketplace plans are exactly 29% lower than those in private plans overall.[16]

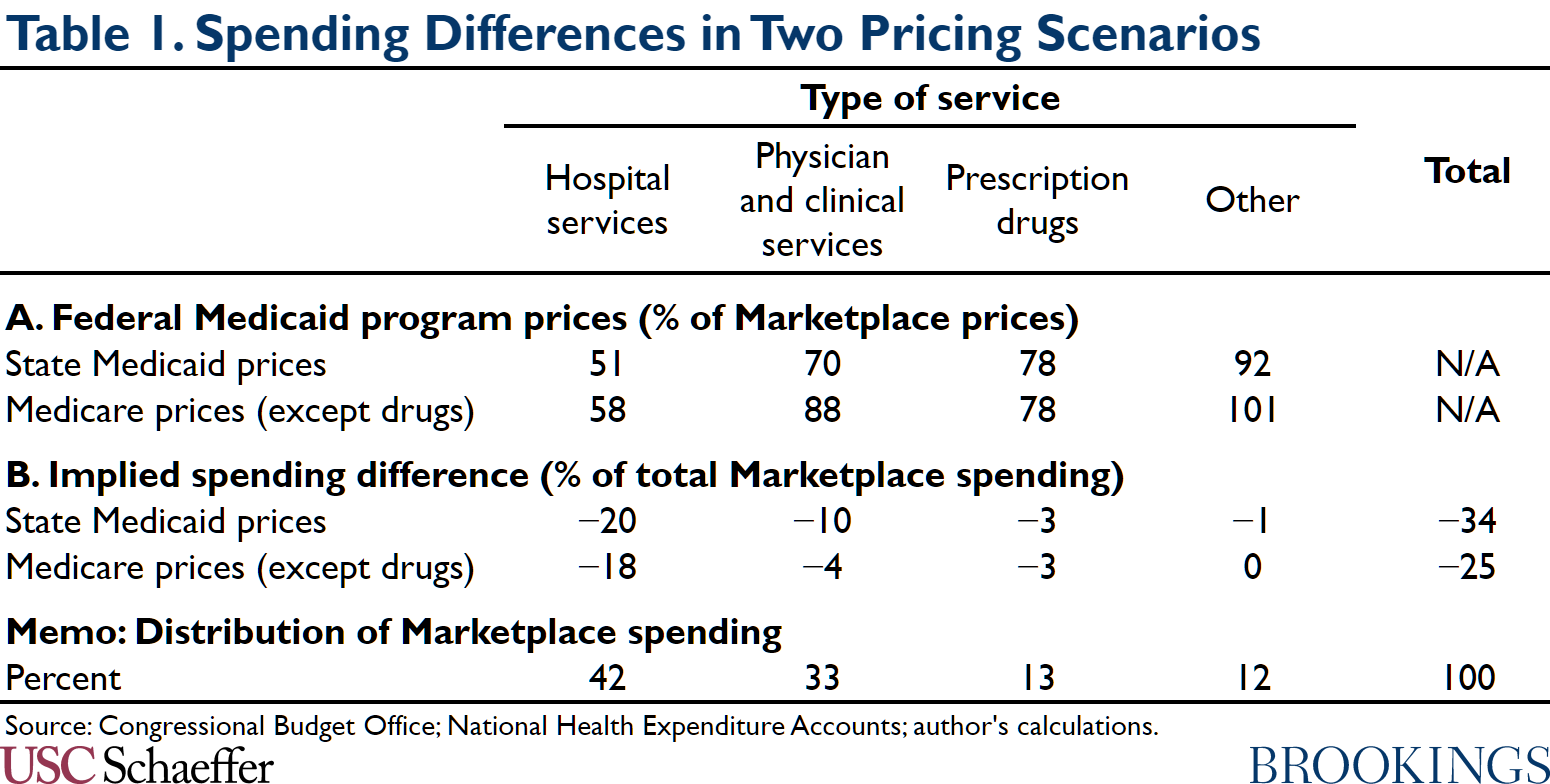

I now consider two scenarios for how a federal Medicaid program might be implemented. The first assumes that a federal Medicaid program would pay prices similar to state Medicaid programs. In this scenario, the federal Medicaid program would pay less than Marketplace plans across all service categories, as shown in Panel A of Table 1. To convert these price difference into spending differences, I use data from the National Health Expenditure Accounts on how personal health care spending in private insurance spending was distributed across service categories in 2019 to proxy for the distribution of Marketplace plans’ spending. As shown in Panel B, I estimate that price differences would reduce per enrollee spending under a federal Medicaid program by around one-third relative to a Marketplace-based approach, with most of the savings coming from lower payments for hospital services.

The second scenario assumes that a federal Medicaid program would pay more than state Medicaid programs in an effort to construct broader provider networks. As discussed above, setting prices at Medicare levels would likely be adequate to construct relatively broad networks, so I assume that CMS would take this approach (except for prescription drugs, where I assume it would pay Medicaid-like prices).[17] Even in this scenario, a federal Medicaid program would still pay meaningful less that Marketplace plans for most services, so lower prices would reduce spending by around one-quarter relative to a Marketplace-based approach, with lower payments for hospital services again playing the dominant role.

If policymakers wanted to use a Marketplace-based approach but avoid the higher payments to providers that come with it, they could include provisions that would “claw back” all or part of the higher payments to providers and manufacturers that would occur under a Marketplace-based approach. For example, the House-passed bill reduced certain Medicaid payments that are intended to offset hospitals’ uncompensated care costs (costs that would fall markedly under any coverage gap policy). Similarly, Congress could require drug manufacturers to pay Medicaid-like rebates to the federal government for drugs used by Marketplace enrollees with incomes below 138% of the FPL.[18] The desirability of approaches in this vein would depend on whether the higher prices paid under a Marketplace-based approach generated value for society, such as by allowing some providers to continue operating or by encouraging drug manufacturers to invest more in research and development.

Utilization

How a federal Medicaid program compared to a Marketplace-based approach with respect to utilization would depend on how CMS implemented a federal Medicaid program.

As discussed above, existing state Medicaid managed care plans likely have somewhat narrower networks and perhaps tighter prescription drug utilization controls than Marketplace plans, on average. While I am unaware of direct evidence on other forms of utilization controls, it is plausible that state Medicaid managed care plans are somewhat more restrictive on these dimensions too. The lower prices that state Medicaid programs pay providers may also reduce utilization relative to Marketplace plans by reducing providers’ willingness to treat patients with Medicaid coverage. Thus, if CMS implemented a federal Medicaid program so that its plans resembled existing state Medicaid managed care plans, utilization would likely be somewhat lower than under a Marketplace-based approach.

However, as noted above, CMS could implement a federal Medicaid program so that it offered broader networks, applied fewer utilization controls, and paid higher prices than state Medicaid programs. In that case, utilization might be the same or higher under a federal Medicaid program as it would be under a Marketplace-based approach. Utilization could also be higher if CMS opted to have a federal Medicaid program cover services that Marketplace plans typically do not.

It is difficult to estimate the magnitude of the potential differences in utilization under these various policy scenarios. However, one touchpoint is a recent paper that leveraged random assignment of enrollees to managed care plans within a state Medicaid program. This paper estimated that spending was 25% lower in the lowest-spending managed care plan than in the highest-spending managed care plan, almost entirely due to utilization differences. This finding illustrates that plan characteristics can have large effects on utilization and, thus, that utilization differences could either meaningfully reinforce or offset a federal Medicaid program’s pricing advantage, depending on CMS’ decisions.

Ease of Implementation

I close by considering the ease of implementing these two approaches. One major advantage of a Marketplace-based approach is that it could rely on existing systems to regulate and contract with insurers (albeit with some modifications, such as to implement the enhanced cost-sharing reductions included in the House-passed bill). By contrast, under a federal Medicaid program, CMS would need to build new systems to contract with managed care plans, and it would need to make many consequential regulatory decisions that do not arise in its current role overseeing state Medicaid programs.

A Marketplace-based approach would likely have smaller advantages over a federal Medicaid program with respect to establishing eligibility and enrollment systems since both approaches could rely heavily on the existing HealthCare.gov infrastructure. Nevertheless, a federal Medicaid program would require somewhat larger changes to this infrastructure. For example, CMS would need to develop systems to transition enrollees between the federal Medicaid program and the Marketplace when income crossed 138% of the FPL, and it would need to develop automatic enrollment procedures to address instances where enrollees failed to choose a plan (although, as discussed above, it might choose to develop similar automatic enrollment procedures under a Marketplace-based approach as well). In the near term, CMS would also need to develop procedures for transitioning current Marketplace enrollees with incomes between 100 and 138% of the FPL into the federal Medicaid program.

Because of the broad scope to rely on existing systems under a Marketplace-based approach, it could likely be at least partially implemented in a matter of months. By contrast, implementing a federal Medicaid program would likely take years. Similarly, a Marketplace-based approach would place fewer ongoing administrative burdens on CMS since CMS would have one fewer coverage programs to oversee.

[1] In almost all of these states, adults without children are ineligible for Medicaid no matter how low their incomes are, while income eligibility thresholds for parents are far below the FPL. One exception is Wisconsin, where adults with incomes below the FPL are eligible for Medicaid under a pre-ACA Medicaid waiver program. Medicaid (or Children’s Health Insurance Program) eligibility thresholds for children are above 138% of the FPL in all states.

[2] In some respects, either federal approach might actually outperform traditional Medicaid expansion, especially in states with particularly burdensome enrollment procedures or relatively stingy coverage. However, a full comparison of these approaches to traditional Medicaid expansion is beyond the scope of this analysis.

[3] For simplicity in what follows, I use the term “managed care plan” to encompass both true managed care plans, as defined in the legislation, and third-party administrators.

[4] The legislation only specified that the Secretary “may” use the HealthCare.gov infrastructure “to facilitate eligibility determinations and enrollments,” but it is likely that the Secretary would use the HealthCare.gov infrastructure in practice rather than construct an entirely new eligibility and enrollment system.

[5] An exception is that I analyze the Marketplace-based approach as if it were permanent even though the version included in the Build Back Better Act was temporary. For simplicity, I also focus on the program parameters that would apply when the Marketplace-based approach was fully phased in.

[6] A caveat is that states might need to be given somewhat larger incentives to preserve their existing expansions as a federal coverage gap program became more generous or paid providers more. But the basic policy tools that could be used to preserve existing expansions would remain the same under any of these approaches.

[7] A federal Medicaid program might still be better positioned to prevent coverage disruptions than a traditional Medicaid expansion since both the federal Medicaid program and the Marketplaces for the relevant states would be administered by CMS using the HealthCare.gov enrollment infrastructure. By contrast, under a traditional Medicaid expansion, enrollees would need to transition between a state-run program and HealthCare.gov.

[8] Notably, the draft would not encompass services delivered before the start of the plan year (even if delivered during the three months before enrollment) nor would it bar providers from balance billing enrollees. Additionally, it would determine the prices of out-of-network services using an arbitration process similar to the one under the No Surprises Act. Because the federal government would pay the full cost of these claims, insurers would have little incentive to pursue low prices in arbitration, which would likely result in unnecessarily high prices. Routine use of arbitration would also have high administrative costs.

[9] Gross premiums would differ by less than the expected difference in cost-sharing for a few reasons. First, the House-passed bill would directly fund part of the more generous cost-sharing reductions available to enrollees with incomes below 138% of the FPL, so silver plan premiums would no longer reflect the full value of the cost-sharing reductions that silver plan enrollees receive, unlike in the current pure “silver loading” environment. Second, even under pure silver loading, silver premiums reflect the average value of the cost-sharing reductions received by silver plan enrollees, but enrollees with incomes below 138% of the FPL are eligible for more generous cost-sharing reductions than other Marketplace enrollees. Third, with respect to gold plans specifically, gold premiums are anomalously high relative to the premiums of plans in other metal tiers, perhaps because enrollees in gold plans are adversely selected relative to enrollees in other metal tiers.

[10] This estimate was derived from the open enrollment public use file published by CMS.

[11] These enrollees do not lose quite as much from choosing non-silver plans as enrollees with incomes below 138% of the FPL would lose under a Marketplace-based coverage gap program. Nevertheless, these choices are still very likely to be mistakes—and for the same reason.

[12] This equality might not hold exactly under a Marketplace-based approach. The key question would be whether (after netting out the direct cost-sharing reduction payments that insurers would newly receive): (1) per enrollee claims costs differed between new and existing enrollees; or (2) the per enrollee claims costs of existing enrollees changed. If either of these things was true, then a portion of the new costs associated with enrollees below 138% of the FPL would be financed through changes in the overall level of individual market premiums rather than directly through the premium tax credit and cost-sharing reduction payments that the federal government made on behalf of these enrollees. Because the large majority of individual market enrollees now receive subsidies, most of the change in premium spending resulting from a change in premiums would still be borne by the federal government, but a small portion would be borne by unsubsidized enrollees.

[13] I use CBO’s projections for 2030 since that is the year for which CBO provides the needed detail by payer, but projections for other years in the relatively near future would likely be similar. The projections are extracted from the report’s Exhibit 4-1, which reports how prices under a single payer system would compare to the prices paid by various payers under current law. The relative prices paid by different payers can be derived by division.

[14] This may be because Marketplace plans serve more price-sensitive consumers and, related, offer narrower networks, factors that may increase insurers’ leverage in negotiations with providers.

[15] The authors’ headline estimate is that individual market spending is 27% lower than in the large employer market after adjusting for health status differences. The slightly larger estimate used here is derived from a sensitivity analysis reported in the authors’ Table 5 in which they adjust for differences in the geographic distribution of individual and employer market enrollees.

[16] One provision of the House-passed bill could increase the prices that Marketplace plans paid for certain services above current levels. In particular, as noted earlier, the House-passed bill would require Marketplace plans to provide coverage without cost-sharing for certain services that are covered in Medicaid but may not be covered in Marketplace plans to people with incomes below 138% of the FPL. The language would bar plans from limiting patients to in-network providers and would fully reimburse plans for the cost of delivering these services. Under these conditions, plans would have little incentive to obtain reasonable prices for these services. This problem could be avoided by directly specifying the prices that plans would pay for these services.

[17] Notably, a federal Medicaid program could not pay more than Medicare for many services since it would be subject to Medicaid rules that limit aggregate payments to institutional providers to the amount that would be paid under Medicare.

[18] This approach would be similar in spirit to proposals to apply Medicaid-like drug rebates to drugs used by Medicare Part D enrollees who would have been covered by Medicaid before creation of Medicare Part D.

Acknowledgements: I thank Richard Frank, Allison Orris, and Judy Solomon for helpful comments and conversations and Conrad Milhaupt for excellent research assistance. All errors are my own.

Disclosures: The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.