Earlier this week CMS released the long awaited Notice of Proposed Rulemaking (NPRM) for the Medicare Shared Savings Program (MSSP), which, when finalized, will impact new Accountable Care Organizations (ACOs) entering the program in January 2016, as well as those MSSP ACOs renewing their agreements for another three year performance period. We summarize these changes in an Executive Summary. While there are a number of smaller programmatic changes included in the NPRM, there are also some major changes proposed that could significantly impact the course of the MSSP into the future. Above all, CMS appears to recognize the significant challenges that many ACOs have faced in MSSP, as acknowledged in the link to the contributions of The Brookings Institution in the preamble to the NPRM. CMS is seeking comments on all of their proposals over the next 60 days, due February 6th, 2015. We can expect a number of changes and adjustments to be made to the regulation prior to finalization.

Proposed Changes to Financial Performance Models

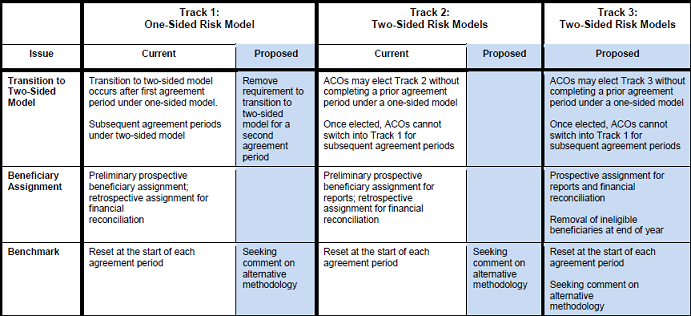

Among the most important course changes noted in the NPRM, CMS has proposed a number of changes to the financial performance tracks for ACOs participating in the MSSP Program (see Figure 1 below) CMS recognizes that many organizations are struggling to meet the requirements and competencies necessary to succeed as an ACO, particularly for moving to increasingly levels of risk. They have proposed to allow MSSP participants in Track 1, which involves only up-side risk or shared savings without shared losses, to remain in Track 1 for additional 3-year performance periods, while receiving a smaller proportion of savings. Currently, MSSP participants are required to transition into Track 2 in subsequent performance periods, where they are held to two-sided risk and would share in losses if their expenditures exceeded the designated minimum loss rate. Many smaller and less experienced ACOs, particularly those that are physician led, have continued to express concern about being required to assume two-sided risk and threatened to leave the program after their first performance period. We have previously highlighted some of the challenges for physician practices implementing accountable care, and steps that the practices are taking to address these challenges, in a toolkit produced through the ACO Learning Network.

Figure 1: Overview of Proposed Revisions to Shared Savings Financial Model: Track 1, 2 and 3

* This an abbreviated version of Figure 1. For the complete table click

here

.

These proposed changes to Track 1 may in fact help to retain some of these current participants and encourage new applicants to enter the program with the assurance that they can remain in a one-sided risk model for more than three years. The major trade-off for ACOs that opt to remain in Track 1 is that their maximum attainable level of shared savings would decline by 10 percent, from 50 percent to 40 percent. Nonetheless, this proposed change will allow many current ACOs to remain in Track One for an additional performance cycle in order to build their capacities and experience to better transition to two-sided financial risk.

At the same time that CMS has proposed ACOs be able to remain in Track 1, they also remain firm in their commitment to move more organizations over time into two-sided risk models. In order to spur this movement, they have proposed to create a new Track Three options for MSSP participants. Both current and new MSSP participants would be able enter Track Three. The Track 3 option increases both the risks and rewards for ACOs that are ready to make the transition to greater risk assumption. Unlike Track 1, where the maximum shared savings rate is 50 percent in the first performance year, and Track 2 where the maximum savings rate is 60 percent, those ACOs entering Track 3 would be eligible for up to a 75 percent shared savings rate. CMS has also proposed to set the MSR (minimum savings rate) and MLR (minimum loss rate) at a flat 2 percent, which would make it easier to attain both shared savings and shared losses. Track 1 will remain on a sliding scale for MLR and MSR rate that goes from 2 percent to 3.9 percent based on the number of attributed patients, and CMS has proposed that Track 2 move to the sliding scale calculation as well.

Another notable change in the proposed Track 3 is that beneficiaries would be assigned prospectively, rather than an initially prospective assignment approach followed by retrospective reconciliation for Tracks 1 and 2. CMS would remove any beneficiaries at the end of the year that became ineligible for attribution over the course of each performance year. Prospective attribution should give these ACOs a much better idea of what patients they are accountable at the beginning of each performance year, a point that many ACOs have made in the lead up to the proposed rule. Increased certainty about attributed patients may be one determining factor for ACOs deciding to between moving to two-sided risk in Track 2 versus Track 3.

CMS has also proposed to waive some existing program rules to make the transition to two sided risk easier and more appealing. Specifically, CMS proposes waiving requirements that a patient have a three-day hospital stay before received covered care at a skilled nursing facility (SNF), certain telemedicine payment restrictions, the homebound requirement under the home health benefit, and the prohibition on qualified providers referring patients to post-acute care providers with whom they have financial and clinical relationship. While CMS is proposing these waivers for Track 3, they remain open to consideration that Track 2 ACOs should be availed of these waiver opportunities as well. The Medicare SNF coverage requirement has already been waived for the Pioneer ACO Model and MA plans.

CMS has also acknowledged the significant issue of patient churn from year to year, which averages 24% across the ACO program under current attribution rules. In order to address this issue, CMS is seeking comment on whether a patient attestation process would be appropriate for ACOs that assume two-sided risk in MSSP. Again, the Pioneer ACO Program is currently conducting a test of beneficiary attestation for the 2015 performance year.

As these proposals indicate, a major issue to analyze during the comment period is the extent to which the proposed Track Three will induce more ACOs to transition to taking on two-sided financial risk, and what modifications to these or other MSSP proposals may help achieve this goal.

Setting, Updating, and Adjusting Financial Benchmarks

Another critical issue that CMS raises, but clearly does not have a definitive approach to address, at this point is the process for setting, updating, and adjusting financial benchmarks. ACOs and other stakeholders have expressed their concern that resetting ACO benchmarks at the start of each agreement period may disadvantage ACOs, particularly those that have generated shared savings. Furthermore, some have expressed concern that the existing benchmarking methodology does not sufficiently account for the influence of cost trends in the surrounding region or local market for a given ACO. CMS acknowledges these issues, but does not propose any specific changes to benchmark methodology. CMS is seeking comment on some proposals that may begin to address these issues: equally weighting the 3 performance years; accounting for shared savings payments in benchmark; using regional FFS expenditures (as opposed to national factors) to trend and update the benchmark; implementing an alternative that uses the initial historical benchmark in the beginning and then constant relative costs for region in subsequent years; and use just regional FFS costs over multiple periods. CMS seeks comment on which of these proposals are best and if a combination of them should be used going forward.

Given the time and effort CMS undertakes to articulate these challenges and potential paths in the proposed rule, it is evident that comments on the proposed rule can have a substantial impact on the ultimate benchmark methodology that will be used in the next phase of the MSSP program. Subject to public comment, CMS appears ready to move forward to at least some adjustments. Like some of the other critical issues raised in the proposed rule, the resolution of this issue will have an impact on whether ACOs enter the MSSP program or continue in it, and whether they transition to sharing in financial risk.

Finally, one issue that will directly impact the financial performance of ACOs, but is not included in the proposed rule, is their performance on quality measures. In November, CMS included some changes to the quality measures for MSSP in the Final Rule for the 2015 Physician Fee Schedule. Although the total number of quality measures remains at 33, CMS removed eight measures and added eight new measures, including additional ones on stewardship of patient resources, all-cause admissions for specific conditions, depression remission, and adjustments to the composite measures for diabetes. The performance of ACOs on these quality measures directly impacts the percent of shared savings that they are eligible to receive, so these organizations must ensure that they remain focused on both cost reduction and quality improvement. It is possible that CMS will continue to revise and refine the quality measures for ACOs in future physician payment regulations.

Next Steps

CMS has not been as aggressive on some issues as many ACOs had hoped they would, especially with regard to further refinements to the benchmark methodology and strategies to increase patient engagement, due to concerns about downsides of such proposals, such as higher costs to Medicare without driving reforms in care. Rather, the proposed rule lays out key issues and potential paths forward, opening the door to significant further revisions to the final rule based upon the public comments. Thus, the upcoming comment period is a critical period for shaping the future of the Medicare ACO programs.

Commentary

What the new Medicare Shared Savings Program Proposed Rule Means for ACOs

December 4, 2014