Thirty-nine percent of U.S. adults reported lacking sufficient liquidity to cover even a modest $400 emergency without borrowing or selling an asset, and 60 percent reported experiencing a financial shock (e.g., loss of income or car repair) in the prior year. While facing precarious financial situations may leave households unable to manage essential expenses and plan for the future, the research also suggests that U.S. households report feeling optimistic about their finances. These disparate findings suggest a complex interplay between a person’s objective financial circumstances (such as their savings) and their own perceptions of their financial situation.

To better understand how people think about and experience their financial circumstances, researchers have recently engaged in efforts to define and measure “financial well-being,” a term that encompasses a person’s holistic financial state. Existing research typically uses relatively objective measures (e.g., income, savings, debt) to measure household financial circumstances. However, relatively little research has operationalized financial well-being using subjective measures (e.g., perception of one’s financial circumstances, the sense of control over financial lives). This points to a potentially large gap in the research, as this subjective sense of well-being may capture a more complete picture of someone’s financial reality than objective measures. For example, someone with low levels of liquid assets and a low income may still be able to rely on friends and family or informal income streams to help buffer them against financial shocks. This dynamic may not be captured in many traditional financial measures, even though it is integral to the overall financial security and well-being of a person.

In 2015, the Consumer Financial Protection Bureau (CFPB) developed the new Financial Well-Being Scale to comprehensively measure the way households internalize major financial circumstances, such as financial shocks, hardships, and experiences. The scale is scored between 0 and 100. Building on this foundational work, we have applied this scale to better understand the state of self-assessed financial well-being of low- and moderate-income (LMI) households. The research relied on survey data obtained in 2017 through a continuing partnership between Washington University in St. Louis, Duke University, and Intuit, Inc. The survey was conducted immediately after tax filing and six months after that. (We administered the Household Financial Surveys to LMI households who consented to participate in the survey after filing their taxes in TurboTax Freedom Edition (TTFE), a free tax preparation and filing software program for qualified low-income users offered as part of the IRS Free File Alliance.)

How does financial well-being in LMI households compare to that of the general population?

We found that LMI households averaged 48 points for financial well-being while the average financial well-being score for the general U.S. population was 54. LMI households were more likely to report extremely low levels of financial well-being (scores between 19 and 44) while the general population was more likely to report moderately high financial well-being levels (scores between 55 and 74).

What household demographic and financial characteristics predict financial well-being?

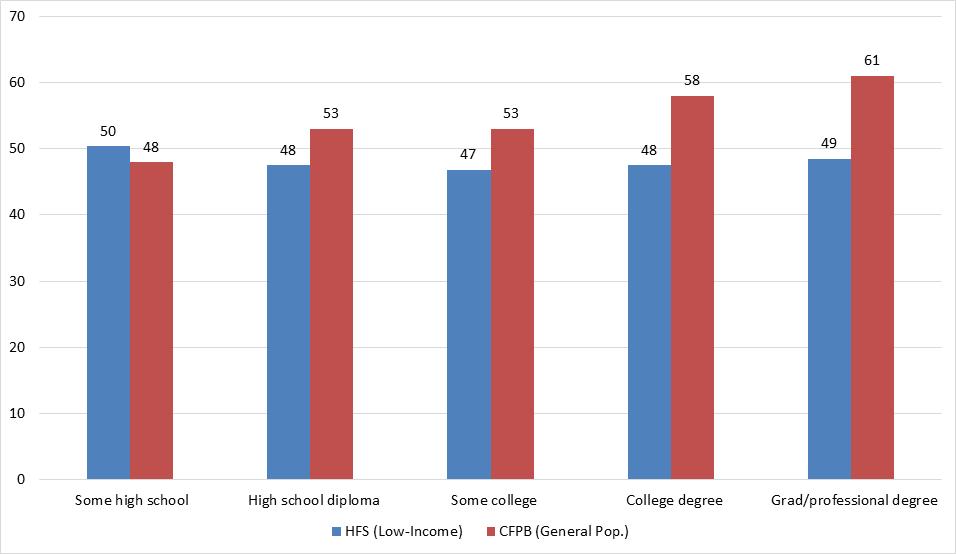

In the general population sample, an increase in education and age corresponded to an increase in financial well-being (Figures 1a and 1b). This trend was not observed for LMI households: Financial well-being was highest for those with the lowest educational attainment (Figure 1a) and followed a U-shaped trajectory for age (Figure 1b). These results speak to the different realities LMI households may face relative to higher-income households. Typically, more education implies higher incomes now and in the future, and getting older may mean increased financial security through increased income, assets, and homeownership. However, highly-educated LMI households may feel the gap between their educational attainment and their life circumstances more acutely than LMI households with less educational attainment. Likewise, older LMI households may exhibit declines in financial well-being as they approach retirement age and have relatively low savings to support them in retirement.

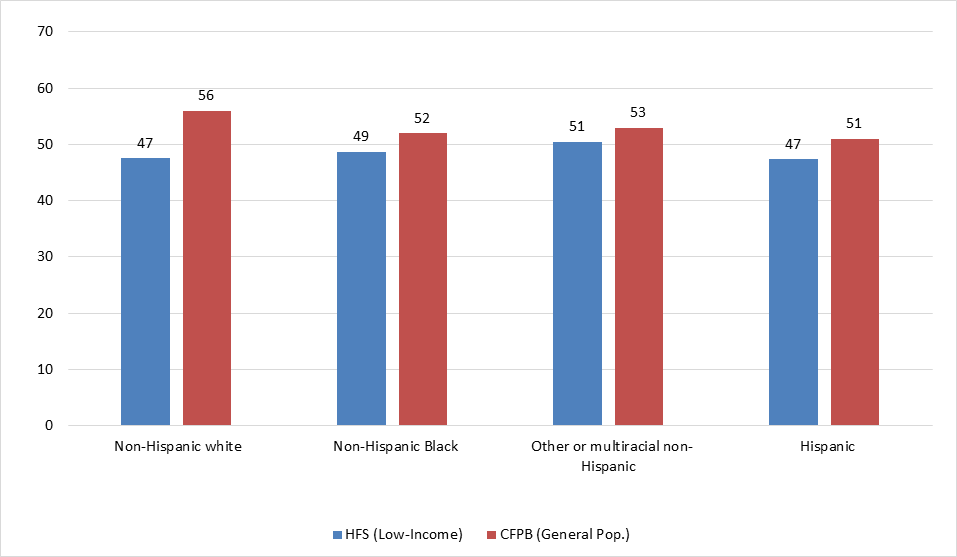

LMI non-Hispanic white households had much lower financial well-being than non-Hispanic white households in the general population sample (Figure 1c), and in a separate regression analysis (not shown here), we found that LMI non-Hispanic Black households tended to have higher levels of financial well-being than LMI non-Hispanic white households.

Financial well-being did not increase with income level in the LMI sample as it did in the general population sample. Yet, similar to the trend observed in the general population sample, financial well-being in LMI households generally rose with liquid savings levels and the perceived ability to come up with liquidity in an emergency.

Figure 1: Demographic characteristics and financial well-being

How does the financial well-being of LMI households change over the short-term?

Financial well-being appeared very stable in the short term: The weighted financial well-being score averaged 48.5 points at the time of tax filing and 49.0 points six months after that, a statistically insignificant difference. A regression analysis showed that, after controlling for the baseline level of financial well-being, most demographic and financial characteristics measured at baseline were not predictive of financial well-being in the second survey wave. There were a few notable exceptions. For example, having good health, having access to $2,000 in emergency funds, and identifying as a non-Hispanic Black household were associated with significant improvements in financial well-being over the short-term.

How do changing financial circumstances relate to financial well-being?

We used difference-in-differences estimation to compare how changes in financial well-being differed between households that experienced some financial event between the first and second survey waves and households that did not experience that same event in either survey wave. We found that the experience of financial hardships in the six months following tax filing was associated with relative reductions in financial well-being (Figure 2). The use of transaction-based alternative financial services or AFS (e.g., money orders, payroll cards) between survey waves was linked to a significant relative reduction in financial well-being by 2.8 points, while the coefficient on the use of credit-based AFS (e.g., payday loans, auto-title loans) was statistically insignificant. Finally, we observed positive relationships between financial well-being and certain household experiences, such as saving a tax refund, gaining access to emergency resources, and experiencing improvements in self-reported physical health between the survey waves (Figure 3).

Figure 2: The relationship between hardships and changes in financial well-being

Note: Relative change in financial well-being is different from 0, ***p<.001; **p<.01; *p<.05

Figure 3: Decisions and circumstances associated with improvements in financial well-being

Note: Relative change in financial well-being is different from 0, ***p<.001; **p<.01; *p<.05

Research implications

Implications for research

- The short-term stability of the CFPB’s Financial Well-Being Scale in the LMI sample corroborates its measurement validity. The instrument can be used in research to measure and assess financial well-being when evaluating programs and policies.

- The finding that non-Hispanic Black households tend to have greater short-term improvements in financial well-being compared to other households calls for further investigation of the relationship between race/ethnicity and financial well-being.

- The observed relationships between age, race/ethnicity, and financial well-being is consistent with other studies that looked at well-being more generally.

Implications for policy

- A positive relationship between the indicators of household resilience (e.g., access to emergency resources, good physical health) and financial well-being points to the importance of developing more holistic financial capability policies that—in addition to building savings—could help households improve their emergency resilience more generally.

Implications for practice

- Financial practitioners can use the scale as a client-screening tool to help clients with low financial well-being levels gain access to programs and services (e.g., affordable housing, home energy assistance) that could potentially boost their feeling of financial control.

- The U-shaped relationship between age and financial well-being speaks to the need for financial capability programs to adopt a life-course perspective for their clients, as the needs of financially insecure young clients may differ from those of older clients.

Disclaimer: Statistical compilations disclosed in this document relate directly to the bona fide research of, and public policy discussions concerning, financial security of individuals and households as it relates to the tax filing process and more generally. Compilations follow Intuit’s protocols to help ensure the privacy and confidentiality of customer tax data.

Katherine Havlovic assisted with the writing of this blog.

Commentary

Financial well-being: Measuring financial perceptions and experiences in low- and moderate-income households

December 13, 2019