Studies in this week’s Hutchins Roundup find that the very low interest rates have had a significant effect on money market funds, the ECB’s quantitative easing has had less impact on the euro area’s GDP and inflation than the Fed’s QE did in the U.S., and more.

Near-zero U.S. interest rates influence money market funds’ product offerings and pricing

Using weekly data on the U.S. prime money market funds, Marco Di Maggio of Columbia and Marcin Kacperczyk of the Imperial College Business School find that the Fed’s policy of near-zero interest rates leads some money market funds (particularly those affiliated with insurers, commercial banks or investment banks) to close and leads others (particularly funds that aren’t affiliated with a bigger firm) to make riskier investments in a reach for yield. Ultra-low rates also lead money funds, on average, to subsidize expenses charged to investors by $7.3 billion across the industry.

Euro area’s real GDP and inflation would have been even lower if not for the ECB’s quantitative easing

Using monthly data from 2012 to 2016, Tomasz Wieladek and Antonio Garcia Pascual of Barclays estimate that the euro area’s real GDP and core CPI were 1.3% and 1.0% higher, respectively, than they would have been without the European Central Bank’s first round of quantitative easing that started in March 2015. That effect is half as powerful as QE was in the U.K. and only one-third as powerful as it was in the U.S, they estimate. They also find significant cross-country variation: the GDP effects were strongest in Spain and weakest in Italy, whereas the inflation effects were strongest in Germany and weakest in Spain.

California’s need- and merit-based aid Cal Grant program raises college persistence and graduation

Eric Bettinger and Oded Gurantz of Stanford, Laura Kawano of the U.S. Treasury, and Bruce Sacerdote of Dartmouth find that eligibility for California’s means-tested Cal Grant program – one of the largest and most generous state need- and merit-based aid programs – doesn’t lead more students to go to college, but increases the likelihood that recipients earn a BA and, for some, raises the chances of going to graduate school. Specifically, the grants, which average $8,000 per student, increase BA attainment by recipients by 7 to 10 percentage points, and increase graduate school attendance by the recipients whose GPAs are just high enough to qualify for the grants by 2 percentage points. The authors say the evidence is mixed on whether Cal Grant reduces outmigration of talented workers from California.

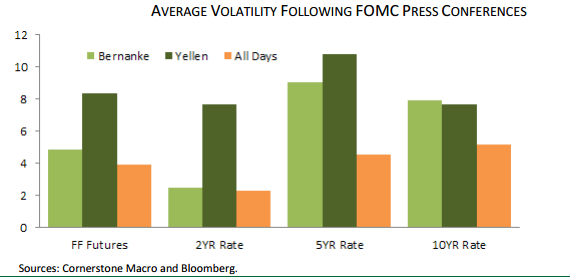

Chart of the week: Short-term interest rates move more after Yellen’s press conferences than they did after Bernanke’s

Quote of the week: “I believe we do have the legal basis to pursue negative rates but I want to emphasize it is not something that we are considering,” says Fed Chair Janet Yellen

“This is not a matter that we are actively looking at… When we’ve looked at it, or looked at that in the past, we have identified significant shortcomings of that type of approach. I don’t think we’re going to have to provide accommodation, and, if we do, that’s not something that’s on our list. But I do think we have the legal authority.”

– Federal Reserve Chair Janet Yellen in answer to a question at Senate Banking Committee, June 21.

Commentary

Hutchins Roundup: Money market funds, quantitative easing, and more

June 23, 2016