Studies in this week’s Hutchins Roundup find that an increase in the duration of unemployment benefits had little effect on the unemployment rate, changes in the structure of the economy have severed productivity trends from the business cycle, and more.

Extension of unemployment benefits has no significant effect on the unemployment rate

Gabriel Chodorow-Reich of Harvard University and Loukas Karabarbounis of the University of Chicago find that the extension of unemployment benefits from 26 to 99 weeks during the Great Recession increased the unemployment rate by at most 0.3 percentage point. In addition, they find little effect of jobless benefit extensions on state-level macroeconomic variables such as vacancies and wages. The authors conclude that concerns about large negative macroeconomic effects of unemployment insurance are not warranted.

Changes in the economy have made productivity vary less with the business cycle

John Fernald of the San Francisco Fed and J. Christina Wang of the Boston Fed find that U.S. total factor productivity has become less procyclical– rising less in booms and falling less in recessions – because the utilization of capital and labor has become less correlated with business cycles. Among the underlying mechanisms are the changing structure of the economy and increased flexibility throughout the economy.

Demographic transition accounts for a significant portion of the decline in real interest rates

Carlos Carvalho of the Pontifical Catholic University of Rio de Janeiro, Andrea Ferrero of the University of Oxford, and Fernanda Nechio of the San Francisco Fed examine the relationship between population aging and real interest rates. They find that population aging in a representative developed country accounted for a 1.5% drop in the real interest rate between 1990 and 2014, explaining about one third of the observed decline in real interest rate during that period. According to the authors, this happens because the increase in life expectancy induces retirees and workers to save more in anticipation of more years in retirement. Their model predicts that the real interest rate will continue to decline in the next 40 years, before stabilizing at about 2%.

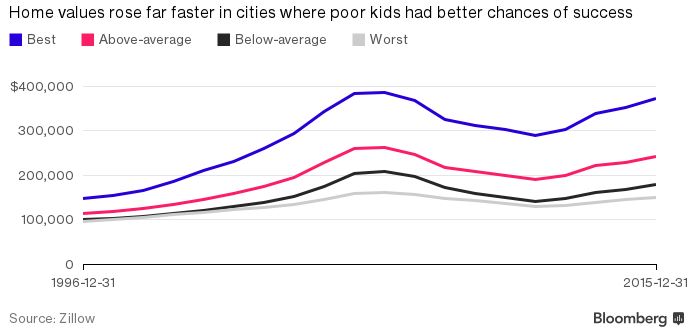

Chart of the week: The cost of social mobility has risen

Quote of the week: “The Federal Reserve exists to serve Main Street, not Wall Street. The dual mandate objectives … are clear on this point… At the same time, … without a well-functioning financial system it would be difficult, if not impossible, for the Federal Reserve to achieve those objectives,” says New York Fed President William Dudley

“… The interventions by the Federal Reserve during the crisis were designed to safeguard the economy, for the benefit of all Americans, while protecting the taxpayer…Total profits from these interventions were more than $30 billion… [T]here were no losses for any of the Fed’s programs. At the same time, I agree with those critics who argue that there was something fundamentally unfair about the disparity in treatment between the few large financial institutions that were saved versus the millions of individuals who lost their homes or their jobs. My response is not particularly satisfying… Given the Federal Reserve’s role and authority, what we knew at the time and the powers and tools that were available to us, I think we made good choices. If the large systemic banking organizations had failed, the hardships inflicted on households and small business would have been far worse. … I would caution that any further changes to the Federal Reserve System should be grounded on what we learned from the crisis and based on the needs of our evolving economy… [C]hanges based on an emotional, unreasoned response in reaction to the pain associated with the financial crisis and the Great Recession would likely be counter-productive.”

— William Dudley, president, Federal Reserve Bank of New York

Commentary

Hutchins Roundup: Unemployment benefits, total factor productivity, and more

April 14, 2016