Studies in this week’s Hutchins Roundup find that recent productivity slowdown cannot be explained away by mismeasurement, Texas Enterprise Zone has failed to enhance the financial prosperity of residents, and more.

Measurement biases cannot explain productivity slowdown after 2004

David Byrne of the Federal Reserve Board, John Fernald of the San Francisco Fed, and Marshall Reinsdorf of the IMF find little evidence that the slowdown in U.S. productivity since 2004 can be explained away by mismeasurement. Mismeasurement, they say, is significant, but not rising over time. They conclude that the fast productivity growth from 1995 to 2004 probably was an anomaly, a one-time upward shift in the level of productivity.

Texas Enterprise Zone has had little effect on residents’ financial wellbeing

Assessing the impact of the Texas Enterprise Zone—a designated geographic area in which qualified businesses get state tax breaks—on household debts, delinquencies, and credit scores, Wenhua Di and Daniel Millimet of the Dallas Fed find that the program has had little beneficial effect on residents. They find a small positive impact on the repayment of retail loans, but also an increase in the delinquency rates on auto loans and in bankruptcy filings. The authors warn, however, that their findings cannot be generalized to other Enterprise Zone programs because the Texas program has several design features distinguishing it from other Enterprise Zones.

Remittance inflows weaken major monetary policy transmission channel

Adolfo Barajas, Ralph Chami, Christian Ebeke and Anne Oeking of the IMF find that an increase in remittances from overseas workers, while welcomed by individual recipients, can have undesirable macroeconomic side effects. Specifically, remittances provide banks with a stable flow of interest-insensitive funding, which severs the link between the central bank’s policy rate and banks’ marginal costs of funds. This makes it difficult for the central bank to commit credibly to achieving an inflation target. The authors suggest that this result explains why countries with heavy flows of remittances tend to prefer fixed exchange rate regimes.

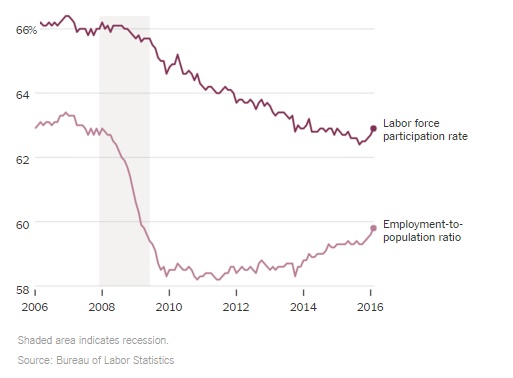

Chart of the week: More Americans are working or looking for a job

Quote of the week: “[T]here are few issues more important for the future of our economy, and those of every other country, than the rate of productivity growth,” says Fed Vice Chairman Stanley Fischer

“At this stage, we simply do not know what will happen to productivity growth… A great deal of work is taking place to evaluate the data, but so far there is little evidence that data difficulties account for a significant part of the decline in productivity growth as calculated by the Bureau of Labor Statistics.“

— Stanley Fischer, Vice Chairman, Federal Reserve Board

Commentary

Hutchins Roundup: Productivity slowdown, enterprise zones, and more

March 10, 2016