As maximum subsidized student loan amount rises, so too does tuition

David O. Lucca and Karen Shen of the New York Fed and Taylor Nadauld of Brigham Young University find that when the cap on federally subsidized student loans was raised in 2007, schools with the most students affected by the increase raised tuition disproportionately more than other schools. Specifically, the authors note that for each additional dollar of subsidized student loans received by the institutions, tuition increased by about 70 cents.

Trying to avoid bond-market volatility could be counter-productive for the Fed

Former Fed Governor Jeremy Stein and his Harvard colleague Adi Sundream argue that central banks attempting to avoid bond-market volatility by adopting a policy of gradualism—adjusting interest rates in small steps—can reduce overall welfare. If the Fed attempts to avoid bond-market volatility by raising the rate in small increments instead of one big jump, the markets will realize this, assume that any small increase is part of a series of rate hikes, and long-term rates will over-adjust. As a result, volatility is not avoided, and the Fed is further away from its long-run target than it would be if a single, larger adjustment had been made.

Emerging economies would be better off targeting headline inflation

Rahul Anand of the International Monetary Fund, Eswar Prasad of Cornell University and Brookings, and Boyang Zhang of Cornell University argue that central banks in emerging economies can improve overall welfare by targeting headline inflation rather than core inflation, which excludes things like food and energy prices. This is largely because food expenditures make up a greater share of total consumption in emerging markets and a larger share of households are credit constrained, making consumers more vulnerable to shocks in food prices. The ideal target should ignore import prices, they add.

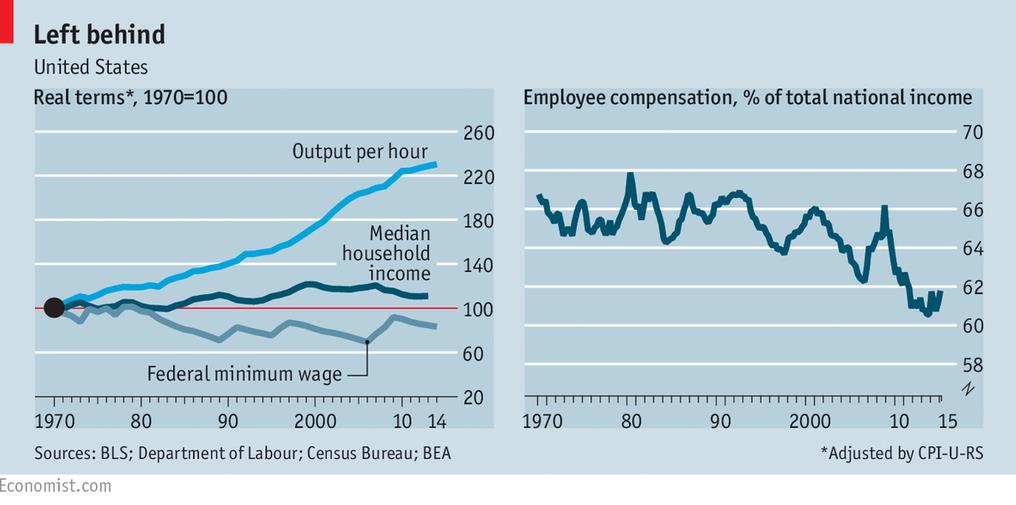

Chart of the week: Income growth continues to lag productivity growth

Quote of the week: “The post crisis world requires a major adjustment in the bank business models,” says Bank of England Deputy Governor

We should not imagine that there is some recent halcyon world of banks supporting the real economy to which we can quickly return if the regulatory straitjacket is loosened. The system was badly distorted in the long run up to the crisis. The post crisis world requires a major adjustment in bank business models. This is not some unintended consequence of overzealous regulation. It is a necessary, if painful adjustment to a new reality.

— Sir Jon Cunliffe, Deputy Governor, Financial Stability, Bank of England

Commentary

Hutchins Roundup: Subsidized student loans, Fed gradualism, and more

August 6, 2015