Macroprudential policies more effective than unexpected rate increases when fighting asset bubbles

Stefan Laseen, Andrea Pescatori, and Jarkko Turunen of the International Monetary Fund find that, in the face of a possible asset price bubble, an unexpected increase in policy rates reduces economic output and inflation without substantially reducing financial risks. Macroprudential policies, however, lead to significantly higher welfare gains when used to “lean against leverage.”

Expansionary monetary policies can increase household leverage

Christoph Ungerer of the Federal Reserve Board finds that expansionary monetary policy can increase household leverage by making lenders more likely to finance a larger share of the house price. This is because when rates are lower, more households enter the market, and the amount of time that a house remains on the market is reduced, lowering the cost of selling a foreclosed-upon house for lenders. This finding demonstrates a possible trade-off for central bankers between price stabilization and financial stability.

Relationship between higher cigarette taxes and youth smoking has diminished

Benjamin Hansen of the University of Oregon, Joseph J. Sabia of San Diego State University, and Daniel I. Rees of the University of Colorado Denver find that higher cigarette taxes were associated with lower youth smoking rates between 1991 and 2005, but that this relationship has become nearly non-existent since 2005. The authors speculate that this may be because cigarette taxes were high enough by 2005 that nearly all price-sensitive youths were deterred from smoking, or because an increasing reliance on online vendors has insulated youths from higher cigarette taxes.

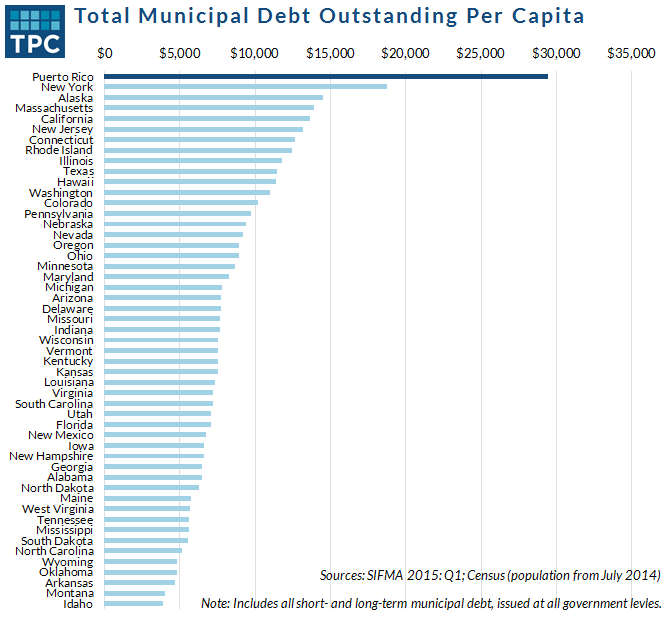

Chart of the week: With an impending default, Puerto Rican debt looms large

Quote of the week: Leaving the Eurozone would be devastating for the Greek people

… What Greece wants is to remain in the eurozone, with a lower debt burden – a position that is both economically astute and protected by treaty. Indeed, a euro exit would be remarkably costly for Greece, and would almost certainly create political and social chaos – and perhaps even hyperinflation – in the heart of Europe. The value of Greek residents’ savings would be slashed, as euros were suddenly converted into New Drachmas. The middle class would be eviscerated. And the currency conversion would not save the country one cent with regard to its external debt, which would, of course, remain denominated in euros.

— Jeffrey D. Sachs, Professor of Sustainable Development, Professor of Health Policy and Management, and Director of the Earth Institute at Columbia University

Commentary

Hutchins Roundup: Fighting asset bubbles, cigarette taxes, and more

July 9, 2015