Austerity in the Eurozone reduced GDP

Sebastian Gechert and Ansgar Rannenberg of the Macroeconomic Policy Institute and Andrew Hughes Hallett of George Mason University, arguing that fiscal multipliers are significantly higher during economic downturns, say the fiscal consolidation in the eurozone following the financial crisis reduced GDP. Specifically, they estimate that GDP was 4.3% lower in 2011, 6.4% lower in 2012, and 7.7% lower in 2013 than would have been the case with no fiscal consolidation.

No magic bullet when it comes to combating crises

Kristin J. Forbes of MIT (now at the Bank of England) and Michael W. Klein of Tufts University find that the tools traditionally used to combat crises stemming from contractions in international capital flows – sales of foreign-exchange reserves, currency depreciations, interest rate increases and new controls on capital outflows –do not lead to significant improvements in GDP growth, unemployment, and inflation, and can actually be detrimental in some cases.

Performance-based pay for teachers produces long-term benefits

Victory Lavy of the University of Warwick finds that students taught by teachers in a performance-based pay system were 4.3 percentage points more likely to attend university, 2 percentage points less likely to be eligible for unemployment benefits, and had annual earnings that were 7 percent higher than students taught by teachers not paid on the basis of performance.

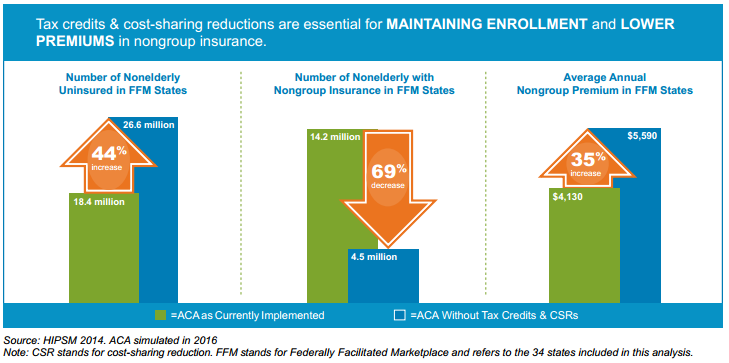

Chart of the week: Implications of King v. Burwell

Quote of the week: While not yet dangerous, near-zero interest rates cannot stay so low forever

“[N]ear-zero interest rates do not yet appear to have gone the way of Midas’ touch… But just as King Midas soon wished to end his magical touch in order to live a healthy and nourished life, the current policy of near-zero interest rates will need to end. Hopefully we will not wait until the costs are as high as when King Midas turned his daughter into gold… [G]radual increases in interest rates, if they occur in a timely fashion, should not derail the UK recovery, but instead support and strengthen it.”

– Kristin Forbes, Monetary Policy Committee, Bank of England

Commentary

Hutchins Roundup: Austerity, Performance-Based Pay, and More

March 5, 2015