IMF loans reduce the risk of banking crises

Using data on International Monetary Fund (IMF) lending programs between 1970 and 2010, Luca Papi and Alberto Zazzaro of Università Politecnica delle Marche and Andrea F. Presbitero of the IMF argue that, after controlling for financial fragility, developing countries participating in IMF loan programs are less likely to experience future banking crises, particularly those countries that meet IMF reform conditions.

Extended unemployment benefits reduce employment

Marcus Hagedorn of the University of Oslo, Iourii Manovskii of the University of Pennsylvania, and Kurt Mitman of Stockholm University find that when unemployment benefits expire, employment grows significantly because individuals then look harder for jobs. Specifically, the authors suggest that about 61 percent of U.S. employment growth in 2014 can be explained by the December 2013 cut in the duration of unemployment benefits.

Monetary “policy contagion” is more prevalent than standard theory would suggest

Using weekly data from Chile, Colombia, and Mexico between January 2000 and June 2008, Sebastian Edwards of UCLA finds that even in countries with floating exchange rates, Federal Reserve interest rate changes tend to be imported to a greater degree than theory would suggest. Over this timeframe, Chile, Colombia and Mexico imported 74%, 50%, and 33% of the Federal Reserve’s interest rate changes, respectively.

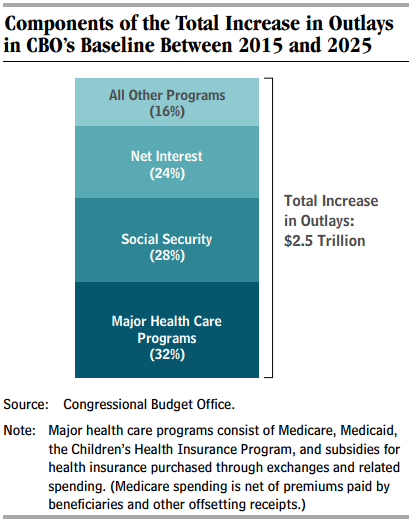

Chart of the week: Healthcare expenditures account for 1/3 of the projected growth in outlays between 2015 and 2025

Quote of the week: European debt negotiations with Greece will be a “two-way challenge”

So, the Greek people have handed a huge victory to Alexis Tsipras, who has promised them an end to austerity and social suffering. Will Greece’s €320 billion debt be waived?

“I think this is a two-way challenge. There is a dual responsibility. Europe must show that it can adapt to a change in government, even a radical one, in a Member State. This is Europe’s democratic responsibility. Equally, Mr. Tsipras must comply with the rules of the European game.

“So what does this mean for the debt? It will be discussed, but let me remind you that the €40 billion that Greece owes to France is not owed to speculators or the financial markets: it is owed to the French taxpayers. Cancelling this debt would be giving a gift of €40 billion to Greece. Any restructuring of the debt must be meaningful. It must allow Greece to overcome this situation while continuing with reforms.”

–Benoît Cœuré, Member of the Executive Board of the European Central Bank

Commentary

Hutchins Roundup: IMF Loans, Unemployment Benefits, and More

January 29, 2015