Compensation disclosures lead to wage compression and higher turnover

Using a 2010 California mandate requiring the disclosure of public sector salaries, Alexandre Mas of Princeton University finds that city managers (usually the highest paid city employees) experienced a roughly 8 percent drop in compensation following public disclosure of their pay, along with a 75 percent increase in the quit rate.

Announcements of future spending lead to U.S. dollar appreciation

Analyzing the effects of U.S. defense spending – both actual outlays and announcements of future spending, Alan Auerbach and Yuriy Gorodnichenko of the University of California, Berkeley, conclude that announcements of future spending lead to a “significant and immediate” appreciation of the U.S. dollar, in contrast to actual outlays, which have little to no effect on exchange rates.

Monetary unions may be optimal with interest rates near zero

David Cook of the Hong Kong University of Science and Technology and Michael Devereux of the University of British Columbia argue that when interest rates are near zero and policy makers lack an effective forward guidance mechanism, a monetary union like the euro-zone may be preferable to a flexible exchange rate system. When interest rates are near zero in flexible exchange systems, they reason, the exchange rate can serve to exacerbate the effect of shocks.

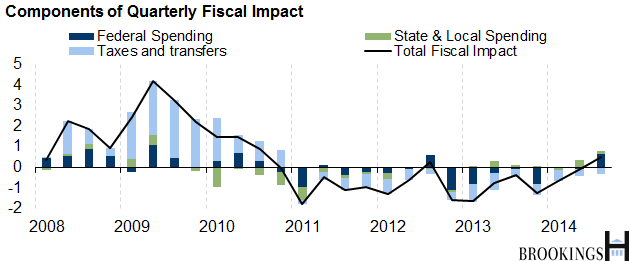

Chart of the week: The fiscal headwinds have finally subsided

Speech of the week: European banks more resilient, but must not become complacent

“European banks have become considerably more resilient as they have increased their capital stock and strengthened their governance and risk controls. While preparing for the comprehensive assessment, they have also consolidated their balance sheets by up to €200 billion in recent months, selling off assets or issuing new capital. It is therefore fair to say that enormous progress has been made. But nevertheless, there is no reason to be lenient. Like an athlete who has to train daily to keep in shape, banks – which operate in a very competitive environment – must permanently work on their business models and strategies to take into account macroeconomic conditions, such as very low interest rates.”

– Sabine Lautenschläger, Member of the Executive Board, European Central Bank

Commentary

The Hutchins Roundup: Compensation Disclosures, U.S. Dollar Appreciation, and More

November 6, 2014