Recovery Act spending had substantial spillover effects

Bill Dupor and Peter McCrory of the Federal Reserve Bank of St. Louis find that fiscal stimulus spending had substantial spillover effects. Every $1 of American Recovery and Reinvestment Act spending in one part of a labor market increased labor income by $0.79 in that community and $.59 in the neighboring community. The authors estimate that the Recovery Act created jobs at a cost of $63,700 per job-year, substantially lower than previous studies suggest.

Tighter liquidity regulation does not adversely impact bank lending

Ryan Banerjee of the Bank for International Settlements and Hitoshi Mio of the Bank of Japan conclude that tighter liquidity regulation on banks in the United Kingdom did not have a detrimental impact on either the price or quantity of lending from those banks to the non-financial sector. Furthermore, banks responded to the regulation primarily by adjusting the composition, rather than the overall size of their balance sheets. They conclude that the regulation “reduced the interconnectedness of the banking sector without affecting lending to the real economy.”

Lump sum payments are more effective at delaying Social Security claims

Surveying 2,500 adults, Raimond Maurer, Ralph Rogalla, and Tatjana Schimetschek of Goethe University and Olivia Mitchell of the University of Pennsylvania find that people offered a lump sum payment, rather than an increase in monthly benefits, are more likely to defer claiming Social Security and continue working. They estimate that people would delay collecting benefits for six months if the lump sum were paid for taking benefits after age 62, and about nine months if the lump were paid for taking them only after reaching the full retirement age (67 for those born in 1960 or later.)

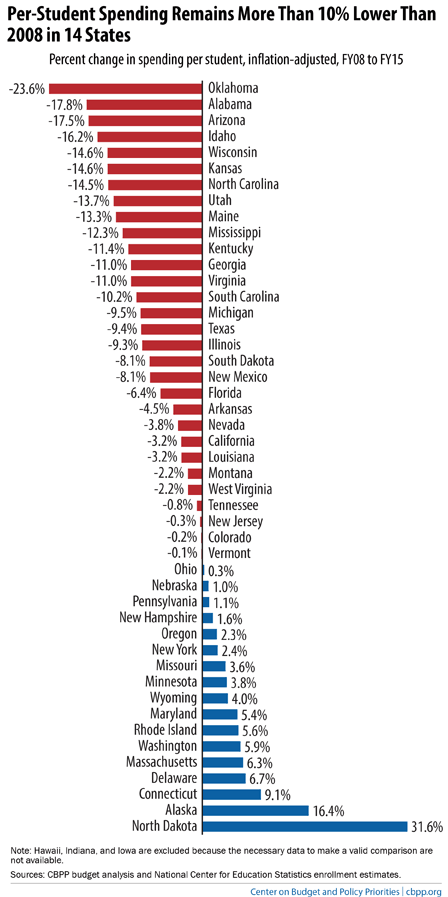

Chart of the Week: School Bucks

Speech of the Week: Threat of deflation is overstated, but ECB must remain “vigilant”

“The risk of deflation is limited. I find it difficult to accept the high probability of deflation (30%) published by the International Monetary Fund for the euro area. Our models come up with much lower figures. But we do need to be vigilant. A prolonged period of low inflation harbors the risk that an economic shock may trigger negative inflation. If you’re hovering close to zero and you experience a new shock, the risk of negative inflation is by no means negligible.” — Peter Praet, Member of the Executive Board, European Central Bank

Commentary

Hutchins Roundup: Spillover Effects of the Recovery Act, Liquidity Regulation’s Impact on Bank Lending, and More

October 30, 2014