The Dodd-Frank Wall Street Reform and Consumer Protection Act made the financial system safer, stronger and less prone to a repeat of the 2007-09 crisis, but the law could be tweaked to make it better, say Brookings’ Martin Baily and Aaron David Klein, director of the financial regulatory reform initiative at the Bipartisan Policy Center.

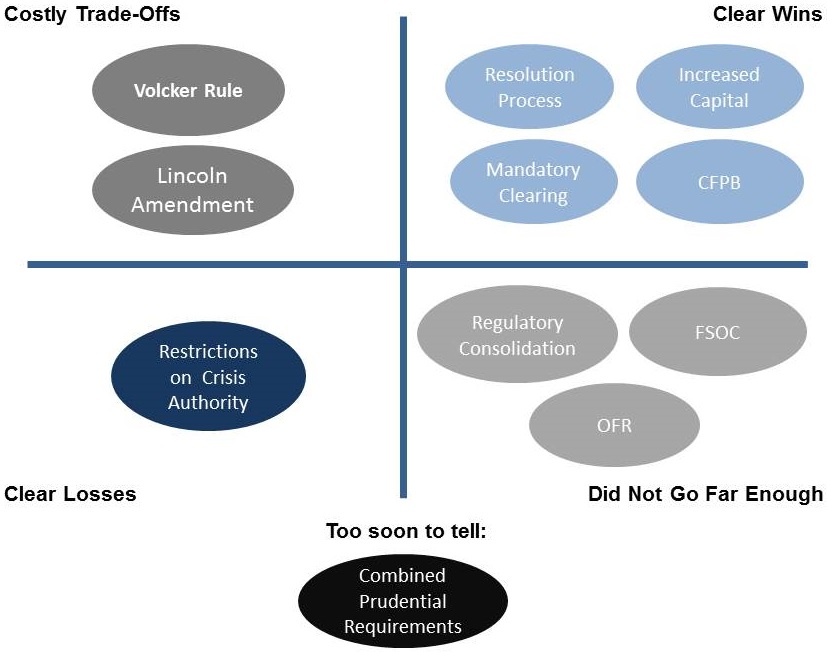

Baily and Klein, in a presentation at a University of Michigan conference, “Financial Reform: Preventing the Next Crisis,” divide Dodd-Frank’s provisions into five categories:

Clear wins: where provisions increase financial stability with little damage to economic growth

Clear losses: where provisions decrease financial stability without benefit to economic growth

Costly trade-offs: where little increase in stability is achieved at considerable cost to the economy

Didn’t go far enough: where the law failed to adequate address a threat to financial stability

Too-soon-to-tell: where only time will tell

Figure 1 below summarizes their analysis. They say, for instance, that the increase in bank capital and the new rules for the government to take off big failing financial institutions are “clear wins” while restrictions on Federal Reserve lending and on the Federal Deposit Insurance Corporation’s ability to guarantee bank liabilities in a crisis are “clear losses.”

Figure 1: Dodd-Frank Impact Across Five Categories

A more detailed version of their presentation is available here.

“Most major pieces of legislation are followed by a corrections bill,” Baily and Klein said. “But with Dodd-Frank, political gridlock has made it extraordinarily hard to get anything accomplished.”

The presentation stems from work the two did in a Bipartisan Policy Center’s Financial Reform Initiative.

Commentary

Dodd-Frank Financial Reform: Wins, Losses, Trade-Offs, Not Far Enough and Too-Soon-to-Tell

October 27, 2014