After what has been an eventful year for Latin America, and in light of the upcoming launch of the 2014 annual report “Macroeconomic Vulnerabilities in an Uncertain World: One Region, Three Latin Americas” on October 2nd in Washington D.C. (you can register for the live webcast here), we thought it would be a good time to look back at the key findings of last year’s report “Are the Golden Years for Latin America Over?” and see how events actually unfolded. We also provide a brief preview of the 2014 report.

The 2013 report highlighted two key ideas:

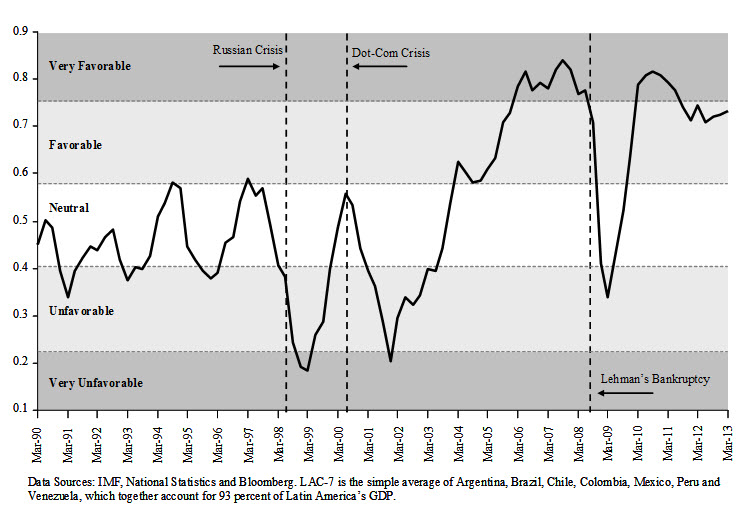

- In contrast with the 6.6 percent average growth rates prevailing between September 2003 and September 2008 – the pre-Lehman-crisis “Golden Years” for the region – LAC-7 GDP growth rates in 2012-13 decelerated significantly and reverted back to their mediocre historical average displayed over the last 20 years. The sharp cooling-off that LAC-7 experienced during 2012-13 was the natural and predictable outcome of external conditions that remained generally favorable for the region, but that had ceased to improve continuously as they did in the period 2004-2008 (see Figure 1).

Figure 1. External Conditions Index for LAC-7

- It is not the case that the region is doing relatively well in a more hostile external environment, but rather, the region’s growth rates are slowing down significantly in spite of the fact that the external environment remained overall generally favorable. In other words “unless we anticipate external conditions to improve significantly relative to 2012-13 levels, the observed slowdown in growth rates is not an oddity that will go away any time soon, but rather, the “new normal” even if external conditions remain favorable”.

Although the external environment has, generally speaking, remained relatively benign, in the year since the last report Latin America growth rates continued to decelerate even further and the region is estimated to grow at a dismal 2 percent in 2014. Brazil, the region’s largest economy, is expected to grow at close to 1 percent; Mexico’s performance has surprised markets on the downside with a growth projection for 2014 of 2.7 percent, while Argentina is technically in a recession.

Although the odds of tail-risk scenarios appear to have been greatly reduced, the external environment for Latin America is expected to become increasingly less favorable for the region, and consensus forecasts point toward continued lackluster growth rates in the foreseeable future.

Looking ahead, this year’s report attempts to answer some key questions. Are there any prospects for growth rates to recover to robust levels? How worried should policymakers be about growing social discontent linked to the lackluster economic performance of recent years? What are the pressing macroeconomic vulnerabilities the region will face in the coming years? Are Latin American banks sufficiently resilient to more adverse economic conditions? And is the diagnosis appropriate for the region as a whole, or for clusters of distinct groups of countries with very different sets of vulnerabilities and policy challenges?

This commentary was written with the invaluable collaboration of Julia Ruiz, research assistant at the Brookings Global-CERES Economic & Social Policy in Latin America Initiative (ESPLA).

Commentary

Latin America’s 2013 Macroeconomic Outlook in Retrospective: Are the Golden Years for Latin America Really Over?

September 24, 2014