In a previous blog, we showed how declining oil and gas rig counts portend more job cuts in the fracking patch. Now let’s look at the budget side of the problem, which provides more evidence that resource extraction-oriented states really do need to “remake economic development,” as our colleague Amy Liu has written.

To see why states need to rethink how they manage the fiscal side of the boom and bust cycle of resource economies (look next week for a paper we’re releasing on that), check out the ugly budget messes this spring in some of the nation’s top oil and gas fracking states, which are now contending with humongous revenue losses as oil and gas prices languish:

- Thanks to price declines, North Dakota’s total severance (extraction tax) revenue fell from more than $3.5 billion in 2014 to $2 billion in 2015, despite oil production remaining largely flat throughout 2015. Gov. Jack Dalrymple has now ordered state agencies to slash their budgets by 4 percent to close a $1 billion budget shortfall. The state has drawn down its entire $331.7 million surplus, and also plans to tap nearly $500 million from its budget stabilization fund.

- Alaska faces a whopping $3.8 billion budget deficit, or two-thirds of its budget. As a result, Gov. Bill Walker is proposing to use earnings of the Alaska Permanent Fund to help pay for government. The rest of the deficit would be overcome by implementing an income tax, cutting government spending, and raising other taxes.

- Louisiana has announced across-the-board program cuts to address an estimated $900 million gap in the current fiscal year. Next year’s shortfall is expected to be more than $2 billion. While Louisiana’s economic turmoil predates the past year’s declining oil prices, the oil price slump is adding to the pressure.

- Oklahoma is contending with a $1.3 billion budget shortfall, nearly 20 percent of last year’s spending. As a result, state agencies are faced with cuts totaling 7 percent in annual state allocations. Public schools, for instance, will have $110 million cut from their budget for the fiscal year ending June 30.

What’s surprising here is not that what went up has come down, but that so many states—with the devastating boom and bust cycle of the last decade still fresh—remain so vulnerable to a natural resources crash.

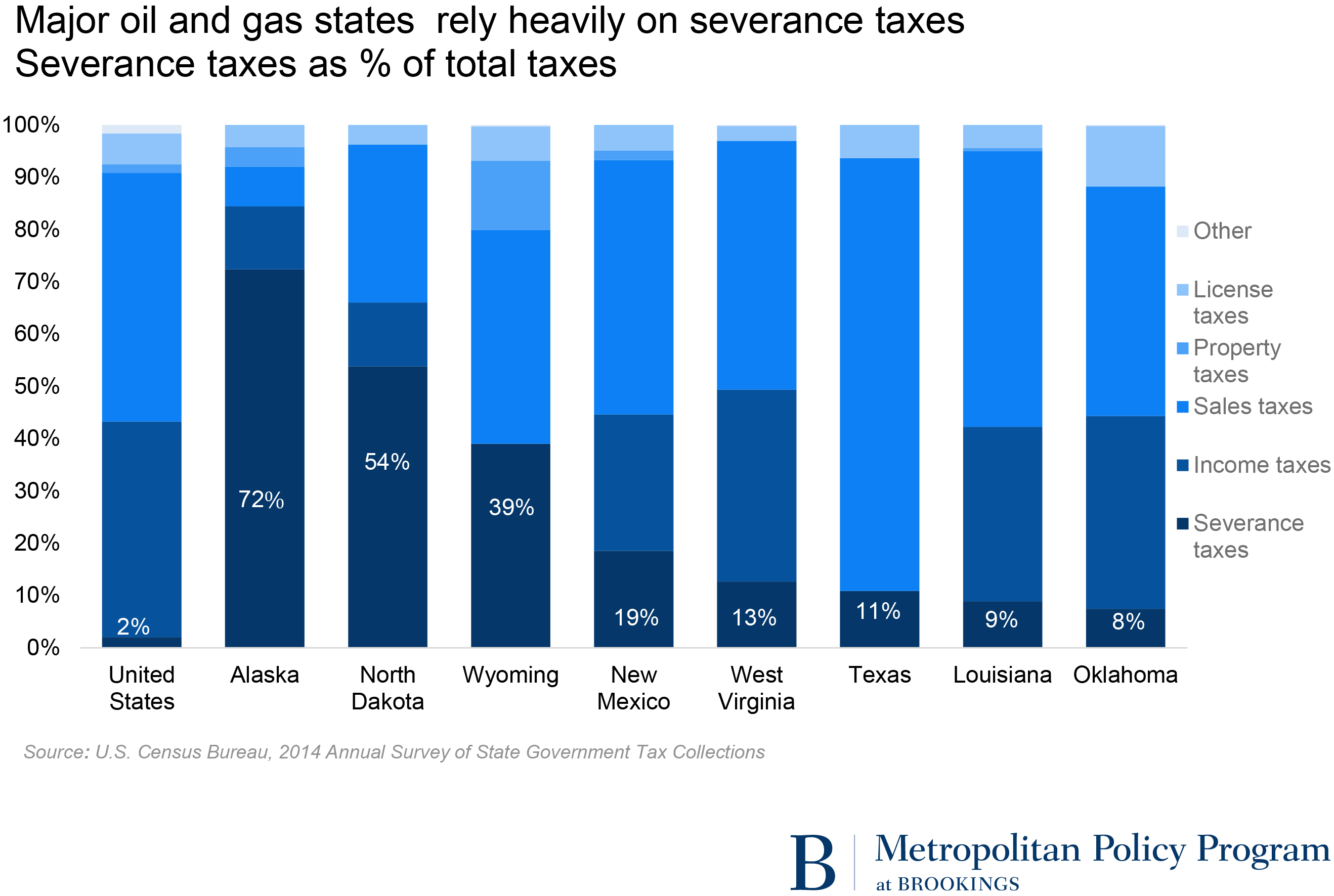

As a group, Alaska, Louisiana, New Mexico, North Dakota, Oklahoma, Texas, West Virginia, and Wyoming rely on severance taxes for 16 percent of their tax revenue, compared to only 2.1 percent for the United States on average. Such dependency makes such states’ lack of adequate counter-cyclical stabilizer programs or other structures for smoothing out fluctuating resource revenue especially hard to understand. Having hitched themselves to volatility, many of these states have left themselves to deal with its side effects chaotically.

In this regard, the recent state budget gyrations raise important questions about resource management in major oil and gas producing states. But again, we will have more to say about that next week.

Commentary

Busted: State budgets feel fracking crash

April 14, 2016