Trade and investment with the Asia Pacific region will continue to grow as a key driver of economic growth in U.S. metro areas. With the proposed Trans-Pacific Partnership still under negotiation, metro leaders from the United States and throughout the Pacific Rim are building relationships to supplement multilateral trade and investment agreements.

Earlier this month, metro leaders from Atlanta, Louisville-Lexington, Phoenix, Portland, Salt Lake, San Diego, and Seattle—all involved in the Global Cities Initiative, a joint project of JPMorgan Chase and the Brookings Institution—traveled to Brisbane, Australia for the 2015 Asia Pacific Cities Summit and Mayors’ Forum. The summit included a Global Cities track that highlighted the Brookings Metropolitan Policy Program’s Metro Export Initiative and progress in trade, investment, and innovation. Brisbane was a fitting locale for the conference, having fully embraced its global role as host to large numbers of international students and tourists and its growing trade and investment with the Asia Pacific region.

During the summit proceedings U.S. and Asia Pacific metro areas exchanged best practices in new economic development strategies to engage the globalized world economy for the benefit of metro companies, workers, and residents. I presented on the evolution of our work with Brookings that produced Greater Portland Global, our regional global trade and investment plan launched in March, and how international business connections are critical to our future.

The delegation then traveled to Sydney for meetings with the Committee for Sydney to discuss that city’s future and exchange ideas on expanding trade and investment ties. These robust discussions included a look at efforts like “We Build Green Cities,” an initiative led by the Portland Development Commission under Greater Portland Global to market the region’s clean tech and sustainability strengths to select global markets—starting with Japan.

Both Brisbane and Sydney were profiled in Brookings’ 10 Traits of Globally Fluent Metro Areas report that drew lessons from many leading metro areas in the Asia Pacific region. While U.S. metro areas have many attributes of what it takes to be globally fluent, engagement with international peer metros, as made possible by the Brisbane summit and Sydney forum, greatly aids progress.

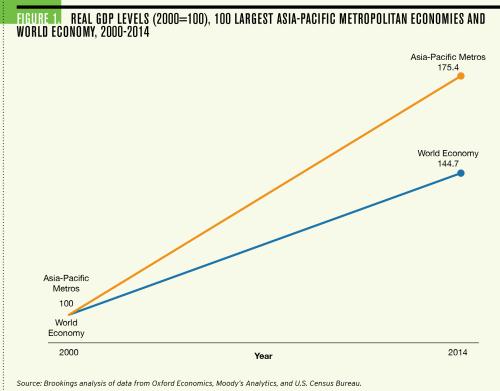

The trip coincided with the release of Brookings’ Asia-Pacific Metro Monitor 2014: Engines of Global Growth which highlighted that “In recent years, a significant share of global economic output and growth has concentrated in large cities in the Asia-Pacific region.” That report was on the heels of a recent Brookings blog which noted that the number one U.S. metropolitan port complex (Los Angeles-Long Beach-Santa Ana, CA) and four of the top 10 are West Coast port complexes, key to Asia Pacific trade. Both points reinforce the centrality of the Asia Pacific region, where the 100 largest metro economies accounted for 20 percent of global GDP in 2014, for U.S. metro areas hoping to grow through global trade and investment.

European Union metro areas will always be fundamental partners for U.S. city regions—something the proposed Transatlantic Trade and Investment Partnership under negotiation seeks to expand. However, the Asia Pacific region, where the 100 largest metro economies accounted for 29 percent of global GDP growth in 2014, is the hub for future world economic growth. U.S. metro areas need to focus on increasing Asia Pacific connections to be well placed to help build international business ties.

Derrick Olsen is vice president of regional strategy at

Greater Portland Inc

. and

the lead for the implementation of Greater Portland Global, the region’s global trade and investment plan created as part of the Global Cities Initiative.

Commentary

Asia Pacific key to future of metropolitan U.S. economic growth

July 27, 2015