Tax Day—this Wednesday—is one of give and take. While many Americans have written out checks to the IRS, others will be looking forward to a check from the government, thanks to the Earned Income Tax Credit (EITC), which turns 40 this year. It now accounts for $66 billion in spending; 26.2 million tax filers (nearly a fifth of all individual filers) received an average of $2,359 in 2012.

Rubio’s EITC reform

The EITC is a favorite target for tax reformers. Senator Marco Rubio, for instance, proposes to replace the current lump-sum EITC payment with a set of smaller installments which would arrive through workers’ paychecks. At first glance, this seems like a logical move: EITC families often struggle to make ends meet and take on debt to pay for utilities, groceries, and unexpected problems between the annual tax refunds.

In fact, EITC recipients behave in ways that wealthier observers may find counter-intuitive, and the way they interact with the existing program casts doubt on the wisdom of Senator Rubio’s proposal.

Three reasons to proceed with caution on the Rubio plan

- Stigma. A program similar to Rubio’s has been tried—the Advance Earned Income Tax Credit (AEITC). The AEITC had a participation rate below one percent. Why, if families could use the money throughout the year, did so few sign up? Some answers can be found in an insightful new book, “It’s Not Like I’m Poor, ”in which Sarah Halpern-Meekin, Kathryn Edin, Laura Tach, and Jennifer Sykes discuss findings from three in-depth interview sessions over a four-year period with 115 families that filed for the EITC in 2007.

The AEITC required workers to sign up through their employers, which may have reduced participation by explicitly distinguishing workers from their peers as recipients of government aid. Respondents in the study rankled at the thought of “welfare dependency” but did not think of the EITC as a “handout” or make a mental distinction between their tax refund (the result of over-withholding) and their tax credit.

- Savings. Low-income workers prefer the current system because it allows for “forced saving”—they can’t touch their EITC money until tax time. If the families received payments in small portions throughout the year, they would be tempted to spend it, rather than put it away for a rainy day.

- Stress.The lump sum offers a buffer against one of the respondents’ biggest fears—having a positive tax liability in April—and provides families with a mental respite from the daily burden of juggling debts and bills. Families paid off an average of 50 percent of their debts with their tax refund, and much of the refund goes towards what the authors call “mobility enhancing purchases”:

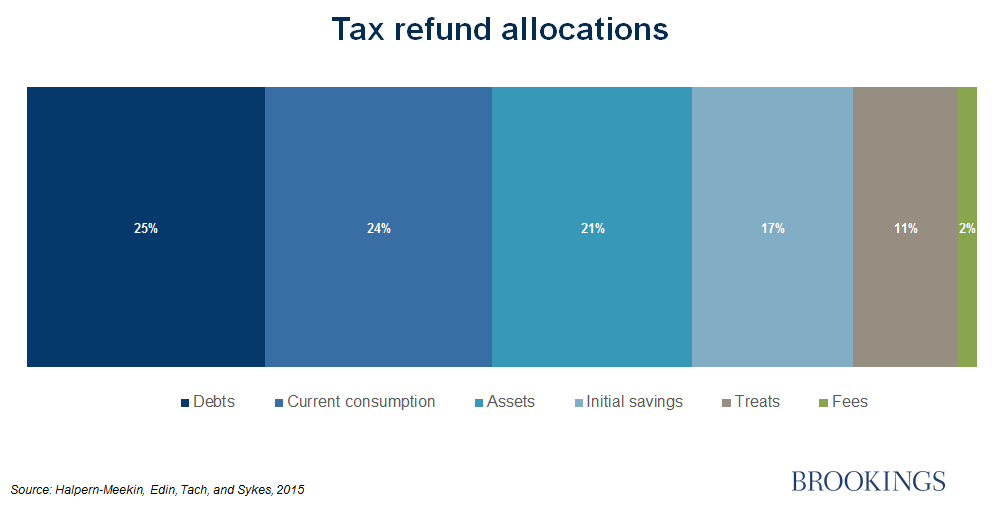

Filers used a quarter of their refund, on average, to pay down credit card debt and overdue bills; another 24 percent was used for consumption (e.g., “stocking up” on groceries, diapers, and other household necessities for lean times). Twenty-one percent went to things that could be seen as investments, such as cars to get to work or education expenses. They saved 17 percent, although only 7 percent of the total refund dollars remained in savings six months later. The remaining portions went to H&R Block and to treats, often to give the families’ children a taste of middle class life (e.g., a vacation).

Given these families’ financial constraints and the psychological stress they endure, the authors note that it’s “surprising” that more of the refund money doesn’t go to treats. Sendhil Mullainathan, whom the authors frequently cite, would say that the tax-windfall temporarily reduces the strain on mental bandwidth, allowing the families to think long-term and plan ahead.

Deferring, not advancing, EITC payments

Rather than advance the credit, as Rubio proposes, Halpern-Meekin and her co-authors suggest deferring it. In April, filers could decide to receive a portion of their credit in later installments, perhaps with a small amount of interest. This would provide the recipients with the “forced savings” mechanism and a “tax-buffer,” while also allowing them to save, plan, and smooth their consumption more easily.

Should we expand the EITC for childless workers?

Rubio and others have also proposed increasing the EITC for single childless workers and non-custodial parents. This is a good idea. But the Halpern-Meekin et al. work cautions against Rubio’s suggestion that the increase be funded by a reduction in the EITC for households with children. The average refund for these families was $4,686, equal to three months’ earnings.

We should think hard before reducing that: expenses exceed income during a typical month for families in the study and nearly 9 in 10 of the families carried some form of debt. To move into the middle class, these families need the support system provided by the current EITC to borrow less and save more. Budget neutrality is desirable, but the best way to raise money is to ask more of the affluent than of the poor.

This is the first in a series on proposed Republicans tax reforms. Later this week, Isabel Sawhill and Emily Cuddy examine the proposed Lee-Rubio tax credit and parent penalties.

Commentary

Sen. Marco Rubio’s flawed proposals for the Earned Income Tax Credit

April 14, 2015