The pandemic has revealed which governments are good at orchestrating national responses and intervening in their economies in subtle ways. Many European governments have passed the test, writes David Victor. This piece was originally published by Yale Environment 360 on June 11, 2020.

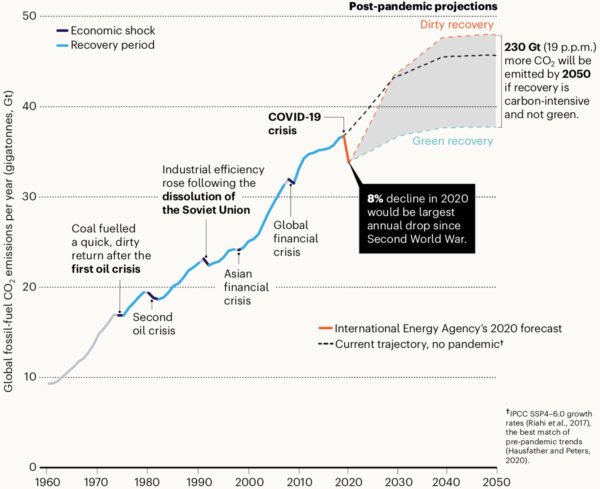

As governments spend massively to revive economies, a huge battle has emerged around whether the economic recovery should also achieve other goals, particularly cutting the emissions that cause climate change. Those advocating green spending say the $10 trillion that governments have already committed to stimulus should be just the beginning, and an even bigger pile of cash is now needed for expansive “green new deals.”

In most countries, the political forces are blowing against green recovery. Distant, abstract goals like global warming have fallen far down the list of priorities while paychecks and health loom much larger than they did six months ago. Some have actually relaxed pollution control standards and will take growth at any cost. While there are many policies that could deliver economic growth and lower emissions, most of them don’t work quickly — and thus don’t deliver what most citizens expect from government today. With global markets and societies in chaos, our ability to forecast has gone down; risks for investors in long-lived technologies, which is most of what’s needed for deep decarbonization, have gone up. Unlike the last financial crisis, when nations spent up to 15 percent of their stimulus money on clean energy, few have such forward-looking plans this time.

Europe, however, is the exception. There, the European Green Deal — a $1.1 trillion climate-focused infrastructure and decarbonization plan that had been cooked up before the pandemic — looks set to get even bigger now. Why? Because for decades the problem of climate change has gone mainstream in Europe. Outside of a few places (e.g., coal-burning Poland) and a few political stripes (e.g., populist nationalists) every major political party, left and right, has embraced climate as a core goal. As the U.S. government has waxed and waned on enthusiasm for climate policy (right now, we are in the Dark Ages), Europe has always been supportive. Now is Europe’s moment to use that leadership to change the world.

Leadership is great, but followership is what really matters for the climate.

With political support at home, spending piles of money on deep decarbonization in Europe may prove to be the easy part. Much harder will be making sure global economies build back together. A hyper-green Europe will have little impact on the climate unless the better technology and business practices nurtured at home can spread widely to the places that cause most emissions. Only 9 percent of world emissions come from Europe, a share that has dropped steadily and will decline even faster the more Europe invests in weaning its economies off of fossil fuels. Leadership is great, but followership is what really matters for the climate because it is the total emissions from all over the planet that accumulate in the atmosphere and cause global warming.

The good news is that nearly all the key elements of a successful foreign policy strategy for building back together are in place in Europe.

Markets in Europe are already open to global competition, which will help make the whole world greener. For example, Europe has a highly competitive market for building renewable power — one that is anchored in global supply chains that allow the best systems to be purchased for the lowest cost.

Open competition in these sectors of the energy system — where the technologies are known and mature — is essential because it produces bigger demand for clean energy, which means more robust international supply chains, faster global improvement in technology, and cheaper options for all countries. The European Green Deal will put that good foundation on steroids. By contrast, the U.S. government has recently issued an executive order that, interpreted expansively, could make it hard for foreign suppliers to play much of a role in producing any device hooked to the U.S. grid. Because the best in clean energy depends on globalization, economies that turn inward will probably also get dirtier.

In nations where technologies are not mature, a different strategy is needed — direct government support for demonstration projects, along with policies to assure companies that when they invest in these risky ideas they will find a market for their products. These strategies need a sector-by-sector approach — often called “industrial policy” — because each sector is different. Here, too, European policy strategies are already wired to deliver.

Just last month three big European oil and gas companies (Equinor, Shell, and Total) — along with support from the Norwegian and EU governments — made final investment decisions on a model for this approach. The project, “Northern Lights,” is a network of carbon capture and sequestration (CCS) systems that will collect carbon dioxide from industrial sites around the North Sea and then inject it safely underground. (Most studies see CCS as a critical part of a whole suite of decarbonization technologies because it makes it feasible to keep using some carbon-based fuels while pumping the pollution safely underground, rather than into the atmosphere. It surely will play a big role in China when that country gets more serious about decarbonizing its economy.) That a project like Northern Lights is moving forward when the whole industry is cutting capital budgets faster than any time in history is testimony to the stabilizing role of government support.

Still other projects with European giants like BP and Engie are building hydrogen networks — a gaseous fuel that can be made cleanly in various ways and then piped to where it is needed. Hydrogen potentially has high value because it could decarbonize applications that have proved very difficult to change, such as steel manufacturing, where hydrogen’s ability to generate high temperatures, along with its special chemical properties, make it a far-cleaner source than coal for converting molten iron ore to steel.

Europe is also poised to show the world how to achieve a “just transition” — a concept built centrally into the European Green Deal and designed to look out for those, notably workers, hurt by technological transformation. What’s most interesting about this economic crisis is that it has shocked demand along with supply chains simultaneously, making for severe economic carnage. The old technologies that will become the roadkill of deep decarbonization, which the European Green Deal will help clear, have often been big employers, and workers at those companies must find new jobs. It isn’t so easy to stop work at a coal plant one day and build wind turbines the next. The good news is that the shocks have opened running room for new technologies and systems such as electric vehicles so they can build market share and political power as they are deployed — a critical if painful process of creative destruction that happens in every technological revolution.

One element for effective European leadership is not fully in place: robust alliances with the biggest emitters, starting with China. Some nascent partnerships already exist, and many examples of technology cooperation show how EU expertise can be magnified through Chinese application. For example, Danish developments in grid management have been shared with Chinese grid operators — tiny, committed Denmark is a good place to test novel systems, but application in China yields scale that affects global emissions. The gains from trade flow both ways, for China is emerging, as well, as a leader in some clean technologies — solar cells, batteries, electric vehicles, advanced cement chemistry, and nuclear power among them. Time is of the essence, though, because there are worrying signs that if China turns inwards it will turn dirty, just as it did in the rebound after the Asian financial crisis of 1997. More new coal-fired power plants were authorized by Chinese officials in the month of March 2020 than in all of 2019 — all linked to inward-focused economic stimulus.

Europe and China are competitors, of course, but they have joint interests in openness that expands market size and the gains from innovation. The bigger the gains for China from this kind of the cooperation the more likely it is that Europe can demand that the discussion also include greening China’s own massive international investment program, the Belt and Road Initiative (BRI). Whether that initiative goes brown or green is one of the biggest wild cards for the future of the planet. The BRI, because it has laden China’s partners with debt, is in trouble; that pain, handled well, is an opening for more accountability.

The pandemic has revealed which governments are good at orchestrating national responses and intervening in their economies in subtle ways. Many European governments have passed the test.

Ironically, the United States honed the model for this kind of cooperation with China in the aftermath of the 2008-2009 financial crisis. The two countries set up joint working groups around energy topics where there were joint gains to be had, such as energy efficiency. That cooperation, in turn, lay a foundation for more ambitious joint programs, including the 2014 emission control pledges that each country made to each other and became a basis for the more global Paris Agreement a year later. What the U.S. pioneered, sadly, it can no longer deliver reliably because flip-flopping in Washington has made the rest of the world question our credibility. A new administration can breathe fresh air into global engagement, but changing the occupant in the White House doesn’t durably change U.S. policy.

Bilateral partnerships can jump-start the process of building back together. Europe should also start building multilateral foundations with a blend of the industrialized and developing countries that account for most of the world’s emissions. The G20 is exactly that grouping, and it can help. The 2021 chairman, Italy, has none of the gravitas needed to pull this off, but if the EU were the co-host, Italy could also invite China to co-host. (If there is new leadership in the U.S., it should be invited as well — but with a high bar of green investment for demonstrating seriousness. The rest of the world is skeptical of U.S. credibility.) Other countries with credible plans, such as South Korea, could sit at the top table too. The idea in this new G20 would be not just to plant the seeds for building back together, but also demonstrate the new face of global cooperation — one based around smaller groups that make credible investments and transform the world from the ground up and out.

Over the last few decades, international relations scholars like me have been building theories about how the nation-state was passé because transnationalism and action within countries — through cities, states, and civil society — were the real engines of change. With the pandemic, the nation state is back (if it ever left) because big spending means national government. Cities, states, companies, churches, and sundry other groups are a fountain of ideas, to be sure, but only national governments can spend like sailors in deficit and steer deployment at the scale needed to generate true public goods. The pandemic has revealed which governments are good at orchestrating national responses and intervening in their economies in subtle ways. Many European governments have passed the test.

Equinor, Shell, Total, and BP are general, unrestricted donors to the Brookings Institution. The findings, interpretations, and conclusions posted in this piece are solely those of the author and not influenced by any donation.

Commentary

Building back better: Why Europe must lead a global green recovery

June 11, 2020