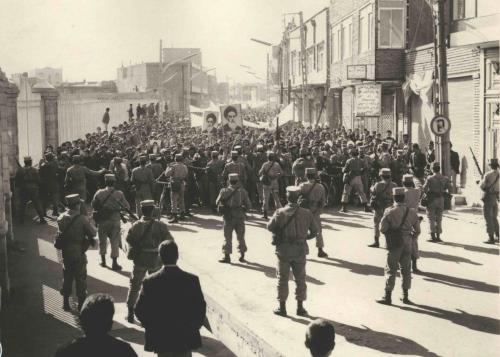

The Iranian revolution sparked the world’s second oil shock in five years. Strikes began in Iran’s oil fields in the autumn 1978 and by January 1979, crude oil production declined by 4.8 million barrels per day, or about 7 percent of world production at the time. Other producers were able to make up some of the volume, resulting in a net loss of supply of about 4 to 5 percent. Nevertheless, oil prices climbed rapidly, rising from $13 per barrel in mid-1979 to $34 per barrel in mid-1980.

The loss of production was important, but panic among crude oil buyers was an important driver of price. Buyers were concerned that the crisis would only get worse, that the combination of religious fundamentalism and nationalism would spread to other oil producing countries in the region, and that ever-growing oil demand would continually drive up the price. As a result, crude oil buyers not only bought to cover current demand, but also increased their crude oil inventories, deepening the shortage and further driving up prices. Panic buying more than doubled the actual shortage. Oil on the spot market sold for as much as $50 per barrel.

The Iranian revolution and the oil price shocks that followed catalyzed a number of important changes in petroleum markets that remain in place today.

Deregulation of American fuel market

Endless lines at gasoline stations are the overwhelming image in the minds of Americans who lived through the oil shocks. There was a genuine shortage of gasoline in the United States for a while, as refineries geared to run Iranian crude oil could not produce as much gasoline from other types. However, government policies that regulated the petroleum industry made the situation much worse.

Price controls on gasoline exacerbated shortages, by not allowing rising prices to curb demand. The controls allowed refiners to raise gasoline prices each month based on the previous month’s crude oil price. In an environment of rising prices, the price controls incentivized refiners to withhold gasoline and sell it later at higher prices, rather than selling it today. Further aggravating the shortages, the federal government had an allocation system that did not allow gasoline distribution to adjust to demand conditions around the country. Some states also established a policy that only allowed drivers to buy $5 of gasoline at a time, meaning that they had to buy more frequently, virtually assuring longer lines.

Price controls on gasoline exacerbated shortages, by not allowing rising prices to curb demand. The controls allowed refiners to raise gasoline prices each month based on the previous month’s crude oil price. In an environment of rising prices, the price controls incentivized refiners to withhold gasoline and sell it later at higher prices, rather than selling it today. Further aggravating the shortages, the federal government had an allocation system that did not allow gasoline distribution to adjust to demand conditions around the country. Some states also established a policy that only allowed drivers to buy $5 of gasoline at a time, meaning that they had to buy more frequently, virtually assuring longer lines.

Crude oil markets were regulated as well. Different prices for “old” and “new” oil were a relic of the earlier oil shock in 1973-74 that established perverse incentives, reducing domestic production and increasing imports. Additionally, in April 1979, the Department of Energy ordered large refiners to sell crude oil to smaller refineries that could not obtain affordable supply on the market. However, these smaller refineries were generally less complex, able to produce less gasoline from a given crude oil than their larger counterparts, deepening the supply shortage.

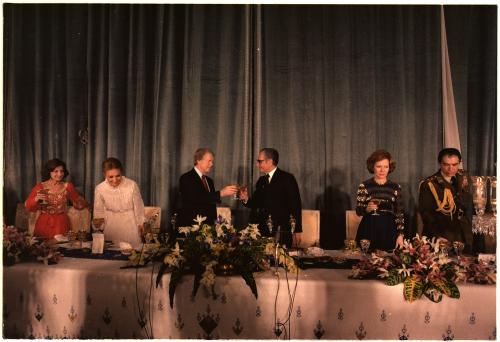

The situation drove a groundswell of anger against U.S. oil companies and public support for President Jimmy Carter dropped substantially. The crisis highlighted the inefficiencies inherent in government control of fuel markets, although the public wanted the government to do something about high prices and long lines. President Carter began to repeal price controls on crude oil in 1979, but the energy crisis, along with the Iran hostage situation, were significant factors in President Carter’s 1980 election loss. Soon after his inauguration, President Reagan removed the remaining federal controls on domestic production and distribution of crude oil and gasoline.

Rise of non-OPEC oil production

Some of the most important lingering effects of the Iranian revolution occurred afterward, as the market recovered from the price and supply shock. Oil producers around the world responded to the two crises of the 1970s by investing in exploration and production. Additionally, several large fields that had been discovered in the previous decade began substantial production.

The North Sea, Alaska, and Mexico were very large new sources of oil at this time. Oil was first discovered in the British North Sea in 1965 and in Norway in 1967. Norway began production in the giant Ekofisk field in 1971 and the British Forties field began production in 1975. In the United States, the Prudhoe Bay field in Alaska was discovered in 1968 and oil began flowing thorough the Trans-Alaska Pipeline in 1977. Approval and construction of the pipeline was rushed after the first oil crisis in 1973. In 1976, Mexico discovered the super-giant Cantarell field, named after the fisherman who noticed an oil seep in the Gulf of Mexico. At the same time, Mexico was pouring money into its oil industry, and production increased from 1.3 million barrels per day in 1978 to 2.8 million barrels per day in 1984.

In total, non-OPEC producers added 5.6 million barrels per day of crude oil production from 1979-85. In response, OPEC drastically cut production, setting a limit of 18 million barrels per day in March 1982, compared to the 31 million barrels per day it had been producing at the time of the Iranian revolution.

At the same time, the high oil prices of the previous years and a global recession in the early 1980s brought about declining oil demand. World oil demand fell by about 10 percent from 1979 to 1983. Because of growing supply and shrinking demand, oil prices crashed in the 1980s, declining 40 percent between 1981 and 1985 before collapsing another 50 percent in 1986, down to $12 per barrel.

Development of crude oil spot market

Long-term contracts were the primary means of buying and selling oil at the time of the Iranian Revolution. Therefore, the loss of Iranian oil unevenly affected buyers during the immediate crisis. Buyers with Iranian contracts scrambled to replace the missing oil, while buyers who held contracts with other producers dealt with higher prices, but not actual scarcity.

Prior to the shock, spot markets for crude oil and refined products had made up no more than 8 percent of the market, as most oil was sold under long-term contracts at set prices. Spot markets at the time were a place to buy unguaranteed oil at a discount. However, as buyers scrambled to find additional supply, they bid up prices in the spot market. In late February 1979, spot market prices reached double the official price level. The role of the spot market grew, and some producers cancelled contracts burdened with official prices to sell oil on the more lucrative spot market.

The crude oil shortage after the Iranian revolution increased the role of the spot market, but the oversupply that followed cemented the demise of long-term contracts at set prices. The surge of supply that came online in response to the second oil shock made spot prices lower than contract prices. Right after the revolution, buyers turned to the spot market willing to pay almost anything for scarce oil. However, in the early 1980s, they turned to the spot market to shop around and find the cheapest source of supply.

A New York Times article in April 1983 described the immature and chaotic spot market at the time. “The spot market mostly consists of an amorphous network of traders… working over telephone lines without the benefit of a trading floor or public disclosure of what prices are being paid elsewhere for the kind of oil they are negotiating at any given time.”

Two additional events cemented the centrality of the spot market for crude oil during the early 1980s. In 1983, the New York Mercantile Exchange (Nymex) introduced a futures contract on crude oil. Nymex had already introduced futures contracts for home heating oil and gasoline, but the crude oil contract was focused on a global commodity, rather than local ones. Futures contracts can play an important role in markets, allowing both buyers and sellers to lock in prices and reduce their exposure to volatile prices. They also allow price discovery, with supply and demand conditions on display for all to see, through trades taking place on the exchange. The Nymex contract ended the Wild West atmosphere and brought legitimacy to the oil spot market.

Second, under the production cuts that OPEC established in 1982 in response to falling prices, Saudi Arabia did not have an official quota. Instead, Saudi Arabia intended to act as the swing producer, raising and lowering its output to balance the market and maintain a reasonable price level. However, the other OPEC countries rampantly cheated on their production quotas and discounted their oil to maintain sales and revenues in the oversupplied market. Saudi oil production reached as low as 2.2 million barrels per day in 1985—merely 20 percent of the level it had been producing five years earlier. By 1985, the Saudis lost their patience with this situation and changed their pricing structure, intending to recover their market share. Instead of selling at an established contract price, they created a pricing structure known as “netback.” The price for Saudi crude was set based on the price a refiner received for the resulting products, plus a set profit for the refiner. With its profits locked in, the refiner did not need to shop around for the lowest-price crude oil. Instead, the more crude oil it processed, the more profits it made. The result of the new Saudi pricing scheme was a war for market share among oil producers, total price collapse, and a turbulent end to the era of contract oil prices.

Commentary

What Iran’s 1979 revolution meant for US and global oil markets

March 5, 2019