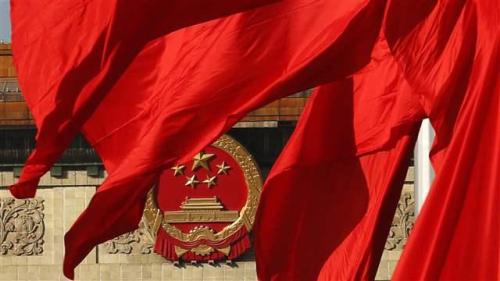

Consolidation of power under Xi Jinping may lead to accelerated reform in the short run, writes David Dollar. However, president-for-life is not a good recipe for economic policymaking in the long run. This piece originally appeared in The Hill.

China’s stock market and currency rallied Monday on news that the country would revise its constitution to abolish term limits for the president. This opens the door for Xi Jinping to continue on after his term expires in 2023.

We should not make too much out of one day’s market moves, but clearly, investors in China think that this development is positive for the economy in the short run. Xi Jinping is moving quickly to consolidate his power and to put an economic team and policies in place to address the country’s challenges, especially reducing financial risk.

The position of president has little power in the Chinese system. The most powerful person is the chairman of the communist party. The post of president was created so that the chairman could meet other heads of state.

The party constitution does not have term limits for the chairman, but there has been an age limit in place that has been respected through three transitions. Abolishing the term limit for the president suggests that Xi will try to stay on as chairman after 2022, but it does not guarantee that he will succeed.

There have been plenty of grumblings on social media that have been expunged quickly. China’s censors are deleting social media references to “serving another term in office,” “amendment to the constitution,” “ascending the throne,” and “Winnie the Pooh.” The latter is a popular nickname for President Xi. Not everyone is happy with the change.

While it is not inevitable that Xi will stay on for a third term, it is certainly more likely now. At the party congress last fall at which Xi was chosen for a second term, no obvious successor to him was identified. This left political uncertainty about what would happen in five years. That uncertainty has not been eliminated, but it has been reduced. That would explain the market moves on Monday.

In the short run, reducing uncertainty around succession is good for the economy. China faces some serious domestic challenges, notably rising financial risks, a huge urban-rural income divide and environmental degradation. Xi Jinping has enunciated these as priorities.

In each case, dealing with the issue will create winners and losers. In the financial sector, for example, the government has to apportion losses among households, local governments, banks, state enterprises and the central government.

This will be hugely political, and a firm leader with a clear vision of what needs to be done is more likely to succeed. Mishandling this issue could easily lead to a financial crisis.

Addressing the rural-urban divide requires, among other things, more permanent migration to cities in which migrants bring their families and benefit from a full range of social services. This is resisted by the existing urban population that does not want to see it privileges diluted. Environmental cleanup likewise imposes costs on polluting firms for the benefit of the larger population.

There has been some modest progress recently on environmental issues, but in general, these problems and their solutions have been known for a long time. Successive governments in China have made little headway with the needed reforms.

Consolidation of power under Xi Jinping may lead to accelerated reform in the short run. However, president-for-life is not a good recipe for economic policymaking in the long run. There are bound to be policy mistakes, and incumbent leaders are reluctant to change failing policies with which they are closely associated.

Also, in the current environment, it is likely that officials at all levels will tell Xi Jinping what he wants to hear, and the lack of honest information flow will impede good policymaking.

Commentary

Xi’s power grab gives a short-term boost with long-term ramifications

February 27, 2018