Global value chains provide opportunities for developing countries to diversify their exports and intensify their integration into the global economy. This is one of the key findings of the “Global Value Chain Development Report” recently published by the World Trade Organization (WTO), World Bank, and other partners. Developing countries traditionally exported unprocessed raw materials. The leap to exporting manufacture products was complicated because it required a full suite of complementary industries. Today, the rise of global value chains (GVCs) enables developing countries to slot themselves into a part of the production chain without having to produce a complete, final good. As a result, developing countries now mostly export manufacturing value-added. Developing countries deeply involved in GVCs have been able to leverage this involvement to achieve rapid productivity growth, gains in modern sector employment, and impressive rises in living standards and declines in poverty.

Witnessing this rise of GVCs, stakeholders in developing countries typically want to see their country more involved in value chains, and moving to higher-value-added activities within the chains over time. The report identifies some of the key factors associated with integration into GVCs.

Trade costs pose a key impediment

One of the most important impediments for developing countries is trade costs. Non-tariff trade costs in today’s world—freight, insurance, and other cross-border related fees—tend to be much larger than any remaining import tariffs as products travel through the various stages of production. Those trade costs have a monetary dimension (for example, transportation, insurance, and other fees), but also a more intangible dimension: information costs, nonmonetary barriers (regulation, licensing, and so on), and weak trade governance leading to uncertainty.

These various impediments to trade can be expressed as equivalent to an ad valorem tariff of a certain rate. Trade costs vary by country and by sector and are generally much higher than tariffs as impediments to trade. In sectors with complex value chains, such as motor vehicles, computers, and machinery, trade costs are more than four times higher than tariffs. Trade costs tend to be less of an impediment in traditional traded goods, such as agricultural products, minerals, and wood.

[A]dditional costs—such as poor transportation links, inefficient customs clearance, bureaucracy, and red tape—tend to impede trade, but their effects are most pernicious in sectors requiring that parts move back and forth across borders.

The general point is that additional costs—such as poor transportation links, inefficient customs clearance, bureaucracy, and red tape—tend to impede trade, but their effects are most pernicious in sectors requiring that parts move back and forth across borders. The costs of impediments cascade. Countries with very high trade costs will not be able to participate in GVCs, and any exports are thus likely to be traditional goods, often primary products. Developing countries try to address this problem through export processing zones (EPZs) that have superior logistics and customs clearance (as well as duty drawbacks on import tariffs that remain). The problem with this second-best approach is that it limits participation in GVCs to the small number of firms in the EPZs, while other domestic firms, especially small ones that might become parts suppliers, are left in a high-transactions cost world. It is preferable to improve trade facilitation for all the firms in the economy.

The China model

China provides some interesting lessons here. It is known for having started its economic reform with four special economic zones that fit the model of EPZs with favored infrastructure and customs clearance. What is less known is that within a short time China had expanded all the policy benefits to more than 30 cities nationwide. Competition among these cities enabled quite a few to emerge as locations with low trade costs and deep participation in GVCs. Research into the value added of trade has shown that the majority of the domestic value added in China’s exports comes from private domestic firms. Foreign firms are often the processing exporters from China, but the successful expansion of value chains to domestic firms within China has resulted in most of the value added coming from the domestic private sector.

For countries that want to get more involved in GVCs, trade facilitation and infrastructure are obvious places to start.

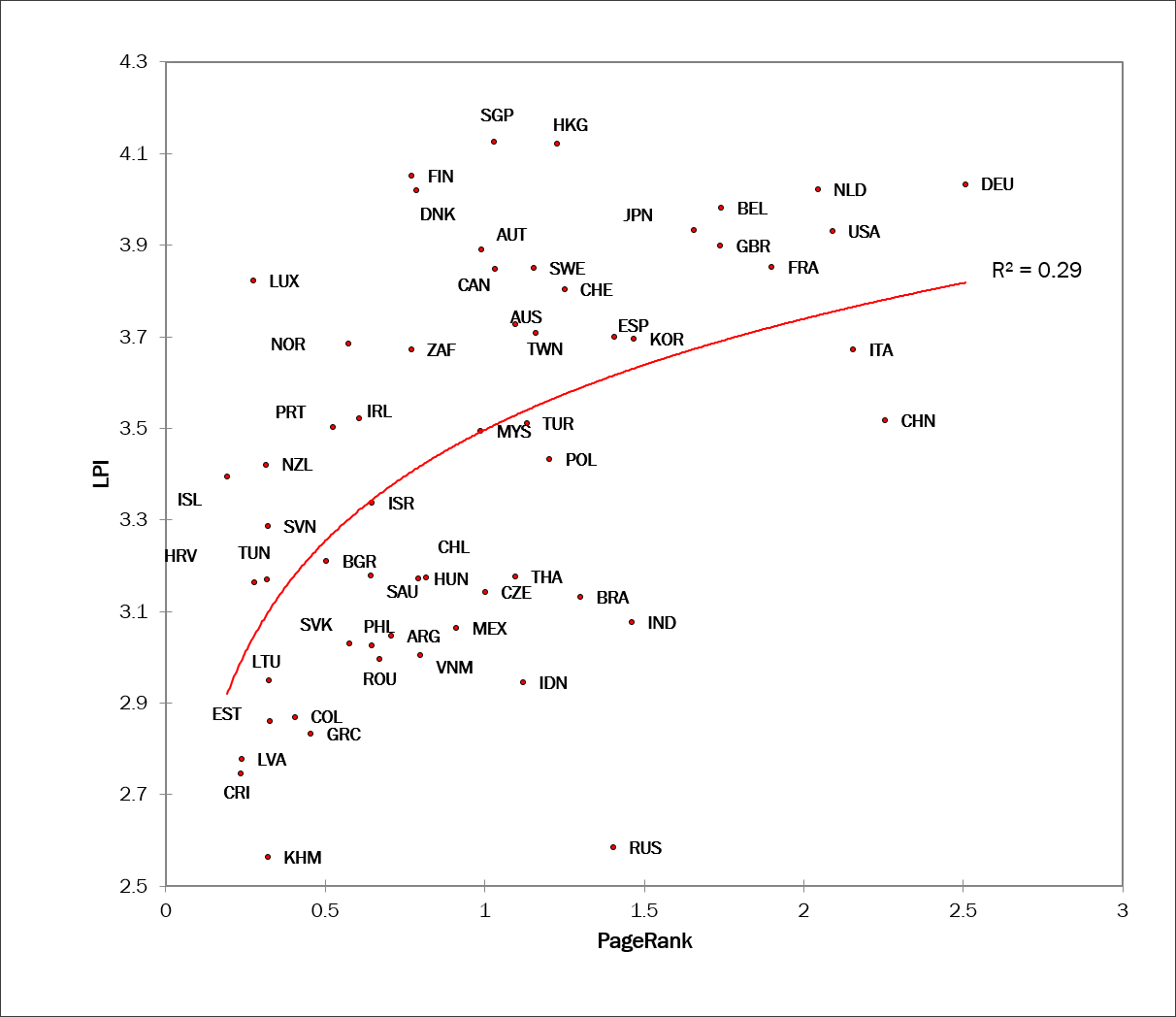

Further evidence of the importance of reducing transactions costs comes from the World Bank’s Logistics Performance Index (LPI), which captures how well infrastructure and bureaucracy work together to move goods through the production process and to consumers. A centrality indicator of each country’s role in GVCs plotted against the LPI shows a clear relationship between better logistics performance and deeper involvement in GVCs (see figure). The link is not that tight (R2 = 0.29), indicating that other factors are at work as well. But it is interesting that the lower-right quadrant has no observations at all: No countries with poor logistics performance are central to GVCs. For countries that want to get more involved in GVCs, trade facilitation and infrastructure are obvious places to start.

Another way to think about products that have complex value chains is that they are contract-intensive goods. That is, they often involve many exchanges among different firms, each facing some risk of contract nonperformance by others in the chain. GVC research shows that, other things equal, countries with better institutions such as stronger property rights and rule of law participate more in GVCs. Research for this report has found a similar result within China. Across a large number of Chinese cities, the ones with better contract enforcement, faster customs clearance, and deeper financial systems tend to participate more in GVCs.

“Deep” trade agreements

The idea of improving institutions and lowering trade costs across the board through better infrastructure, control of corruption, reduction of red tape, and zero import tariffs on imported inputs (including services) is clear. But developing country leaders naturally wonder how to pursue this agenda. It turns out that one effective route is through “deep” trade agreements. A deep trade agreement is one that goes beyond simple tariff cutting and involves legal commitments on laws and regulations. The different rounds of agreements within the framework of the WTO have primarily involved reduced import tariffs, and these have had the most effect on trade in manufactures. It has proved more difficult to go beyond tariff-cutting in agreements that involve all the members of the WTO. With the notable exception of the Trade Facilitation Agreement, progress has stalled on new multilateral agreements. Preferential trade agreements (PTAs) have proliferated and proved more congenial for deep integration. In PTAs, a group of like-minded countries make agreements on policy areas that go beyond WTO commitments. In practice, the most important areas concern services trade, investment, competition policy, and intellectual property rights protection.

Between 1958 and 2014, 279 PTAs were notified to the WTO. The GVC report rates the “depth” of each PTA based on the number and share of legally enforceable provisions in the agreement. The North American Free-Trade Agreement among Canada, Mexico, and the United States would be an example of a deep agreement, as is the Trans-Pacific Partnership (TPP), which has been negotiated but not yet ratified or implemented among 12 Asia-Pacific economies. Because deep integration often involves opening and leveling the playing fields for investment, intellectual property, and competition policy, it turns out that participation in deep PTAs is an effective way to expand involvement in GVCs. The new areas covered in these agreements facilitate the operations of complex production structures that span multiple borders. Participating in deep PTAs increases a country’s trade in parts and components, an important measure of GVC activity.

[D]eep agreements would be more effective if a group of neighboring economies all sign up for the same agreement.

While strengthening institutions and reducing trade costs, perhaps through deep PTAs, is an effective route for developing countries to become more involved in GVCs, some sobering research shows that in addition to one’s own institutions, the institutional quality of neighbors matters as well. In contract-intensive sectors (such as those with complex value chains), countries with “bad neighbors” show fewer exports, even after controlling for the country’s own institutions. This result implies that deep agreements would be more effective if a group of neighboring economies all sign up for the same agreement. In the case of the TPP, several Association of Southeast Asian Nations (ASEAN) countries (Malaysia, Singapore and Vietnam) are members, as are several Latin American countries (Chile, Mexico, and Peru). The benefits would be greater if all of ASEAN and the Pacific countries in Latin America signed on. In the wake of the U.S. election, however, it is not clear what the TPP’s fate will be. President Trump has pulled the United States out of the TPP, but the remaining 11 countries are discussing whether to proceed without the United States. The agreement will be less valuable to the developing country members without the U.S. but an agreement among the 11 is still useful and leaves open the door for America to come in at a later time.

For developing countries, the agenda of reform needed to participate more deeply in GVCs is challenging but the potential rewards are great.

Commentary

Global value chains provide new opportunities to developing countries

July 19, 2017