Companies are constantly innovating, but how do they do it? Is it savvy management, tenacious employees, or just dumb luck? The reality is companies learn the same way we all do: from others.

In a recent paper, I outlined the different methods by which firms bring outside ideas in. Here’s a summary:

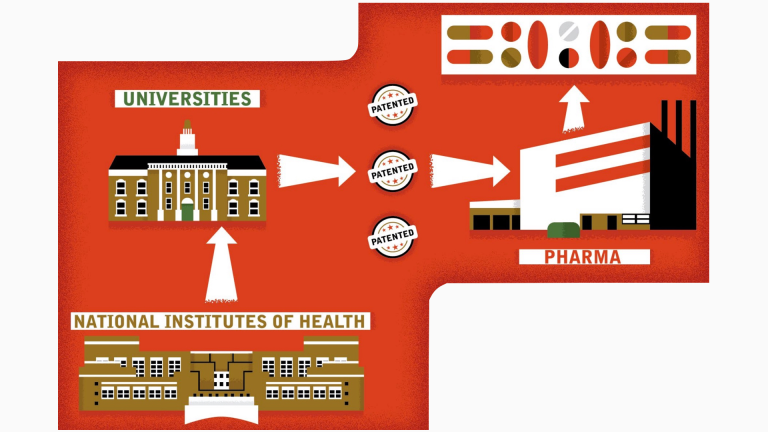

1. The classic model

Most people interested in technology development are familiar with the classic model of innovation. Here, firms put new ideas into practice in a pretty regimented way. First, scientists at national laboratories or universities are funded (often by federal science agencies) to conduct basic research and make discoveries. The institution then patents these discoveries and makes them accessible to the private sector for a fee. In the classic model there are “producers” of technology (universities and labs) and “consumers” (firms), and the transaction between the two occurs through the market (patents and licenses).

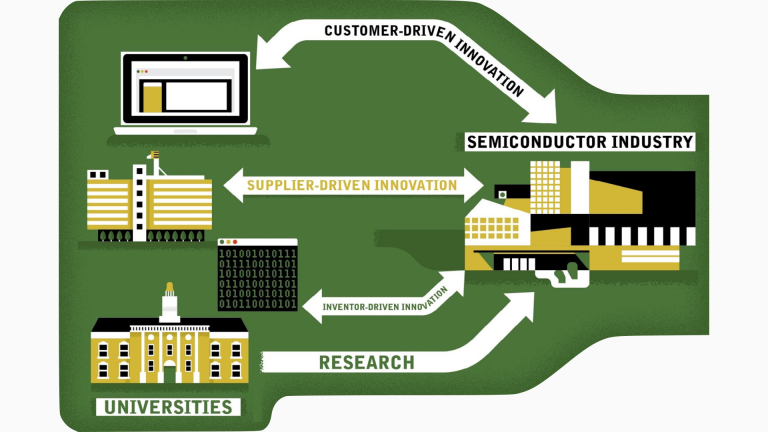

The unconventional model

The classic model applies well in some industries, but it doesn’t fit how many companies come upon new ideas. For these businesses the innovation process is messy and is based on relationships, not rules. First, unlike in the classic model, there is no clear distinction between the institutions creating technology and those consuming it. Firms, serving as customers to other companies, get the majority of their new ideas not from universities but from other peer firms and suppliers. Second, the way firms acquire technology and ideas is highly informal and not based on patents or licensing fees. Instead, they learn by watching what other companies are doing, listening to customers, pursuing joint research with others, or baking technology development into contracts with their suppliers.

The mixed model

The mixed model

Finally, there are mixed means of innovation that look a little like both models. In this category companies learn from other companies or inventors as in the unconventional model, but they tend to employ formal, market-based mechanisms to obtain technology, as in the classic model. It’s rare for firms to obtain technology from research institutions like national labs or universities through informal means. This is likely because only recently have universities begun exploring ways to engage with firms outside of the traditional patent/licensing approach.

Why your city’s model matters

Why your city’s model matters

Cities have different economic strengths and weaknesses based on their mix of industries. Some are information-technology centers like Seattle and San Francisco, while others are life science powerhouses like San Diego and Boston. Others lead in advanced manufacturing like Akron, Portland, and Pittsburgh.

Cities should consider which innovation model best fits their industries and craft urban economic policy around their particular model. Here are six strategies for doing so:

- Recognize that all industries can be innovative, not just software and medical technology startups, and identify the particular innovation pathways utilized by local firms.

- At research universities, eliminate institution-wide technology transfer practices that focus on licensing and adopt options that allow specific departments and centers to cater to different industries.

- Establish partnerships with non-research colleges and universities to support firms seeking short-term process innovation.

- Modify the traditional accelerator model to respond to the innovation needs of startups in nontraditional growth sectors.

- Link designers, engineers, and software developers in urban centers to manufacturing supply chains in the surrounding regions.

- Advance the appropriate place-based strategies to increase the density of innovative firms and support organizations.

Commentary

How do companies come up with new ideas?

May 3, 2016