Monday was Labor Day in the United States, a day set aside to celebrate the contributions of workers to the achievement of the American Dream. For many decades, the pathway was clear: education (especially higher education), leading to a formal wage-paying job, and then entry onto a corporate ladder where grit and determination (and in some lucky cases merit) would determine future opportunities and earnings.

This concept of work, jobs, earnings, and career paths seems far removed for today’s generation of new entrants into the labor force and will probably seem archaic to those born in the next few years. Labor markets everywhere are changing dramatically as a consequence of technology and globalization. Technology has allowed work to be splintered into ever smaller fragments and has permitted platforms to be created with enormous scale economies. It is becoming a driver of search and labor allocation models. Globalization is pushing these changes into an ever-larger labor market that is integrated across countries.

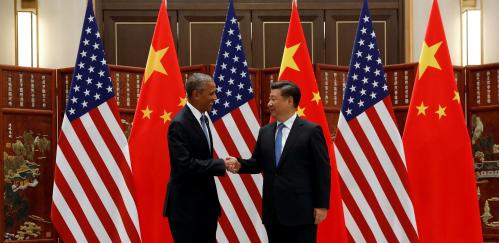

These topics were the subject of the annual Brookings-Blum Roundtable, held at the Aspen Institute. The theme of the three-day roundtable was “the future of work in the developing world.” Background documents were circulated in advance.

Here are a few takeaways:

- Where will the jobs come from? A provocative observation was that half the children born in, say, 2020, might never have a job at all. Already, half of all new jobs are being created in the gig economy in developed countries, and of course in developing countries where labor markets are more informal, the gig economy has been the de facto standard for some time. So workers in the future would increasingly be individual micro-entrepreneurs, freelancers, or small business owners. The problem is that these kind of occupations are not a good fit for everyone. At one level, job markets seem localized—disaggregated by gender, geography, skills (50,000 different skills are now listed on LinkedIn), age, culture, and other characteristics. At another level, these markets are very global in many areas and becoming increasingly integrated.

- What kind of skills will be needed and who should provide them? Obviously science, technology, engineering, and math skills drew a lot of attention, but, surprisingly for a tech crowd, there was also strong support for design, creativity, finance, business, network management, and empathy skills, with the latter being associated with liberal arts education. Private business could provide many of the most important skills, but the problems that emerged as the hardest to resolve were about what to do with students who fail—should unsuccessful students be left to their own devices or supported in some fashion and encouraged to try again. There was also considerable debate as to whether networks were good ladders to opportunity, like formal firms. Do they provide the content, structure, and credentials that can be leveraged for new opportunities? And while few believed that current education systems—in developed or developing countries—provide the right skills for the future, they also could not deny the fact that rates of return to existing education remain high, even for expensive tertiary education.

- How can labor supply be best matched to labor demand? A range of new firms have demonstrated an astonishing ability to reduce search costs in labor markets. In fact, when compared to the effort expended in matching risk-return characteristics in capital markets with investor preferences, there is relatively little sophisticated matching in labor markets. But there is a macro-micro paradox. If these new platforms are so good at improving labor matching, and some do it at considerable scale, why doesn’t it show up in labor productivity data?

- What about labor market security? Formal institutions like unemployment and disability insurance have evolved to reduce risk for workers. Risk is an appropriate lens for much of the discussion on worker security, perhaps more appropriate than a redistribution lens that has characterized a lot of the discussion so far. Lively discussion about universal basic incomes fit into this paradigm of risk versus redistribution. It meets criteria for effectively managing risk—providing cash, delinking from jobs (that cannot be easily identified in any event), and being available to citizens.

These changes have considerable implications for everyone interested in development, not least aid agencies. These have invested heavily in job training—by one count, the World Bank invested $9 billion in 93 job training programs between 2002 and 2012 with little impact to show for it—in polite-speak evaluation reports find that “results are mixed,” more so in labor abundant low-income countries.

What is frightening and exciting is the widespread nature of change that will come into societies as the labor market changes. Mortgage rules will need to be rewritten—you can’t demonstrate expected income with a paycheck in the gig economy. Part-time work, slack-time work, and income from underutilized assets will become more important. Families will develop risk-sharing practices—already common in many developing countries where remittances are a standard feature. Labor unions will need to avoid collusion when representing the interests of micro-entrepreneurs. In short, while advanced countries try and export the model of “decent” work and higher labor standards through formal labor markets to developing countries, the latter are busy exporting their experiences of managing informal labor markets to advanced countries. There is a big divide between optimists who see promise and opportunity in better functioning labor markets and pessimists who yearn for the stability of good jobs and a predictable career. Which are you?

Commentary

The future of work

September 8, 2016