Yesterday, the Federal Reserve’s Federal Open Market Committee decided to continue its monetary stimulus policy (aka “quantitative easing”), an $85 billion/month bond-buying program designed to pump money into a sluggish economy.

Senior Fellow Justin Wolfers, co-editor of the Brookings Papers on Economic Activity, said that “the Fed got it right.”

Think about it. We’re at a moment when inflation is well below the Fed’s inflation target, unemployment remains unconscionably high, Congress is threatening to either shut down the government or default, and the recovery is faltering. There is simply no sensible approach to monetary policy that would suggest that this was the moment to take your foot off the gas.

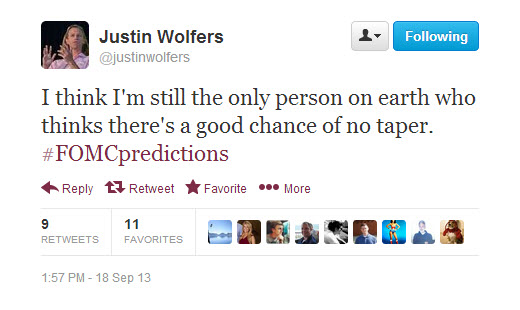

Earlier in the day, prior to the announcement, Wolfers had anticipated the decision:

He added that the taper debate—a reference to Chairman Ben Bernanke’s announcement in June that the Fed was thinking about ending the program—“is one that should never have happened. It’s the result of a failed communication strategy.”

Senior Fellow Donald Kohn wrote about the importance of a good communication strategy (pdf) to exiting “unconventional monetary policy,” such as the asset purchases in quantitative easing.

Communication about exit plans will be critical in keeping the financial markets and the economy on track, in order to achieve the central bank’s goals for output and inflation. The effectiveness of unconventional policies rests importantly on the influence of central banks over expectations in financial markets and among households and businesses. Communication is key to keeping those expectations aligned with the thinking and goals of the central bank and avoiding unnecessary volatility and counter-productive movements in financial conditions. Among other things, keeping longer-run inflation expectations anchored requires the public to have confidence that the central bank has the tools and the will to exit in a timely way.

Back to Wolfers, who highlighted such volatility stemming from the Fed’s June announcement:

Think back to the June press conference, and you’ll recall Chairman Bernanke signaled that the Fed was thinking about tapering quantitative easing. Taper-talk came to dominate the financial headlines, and a monetary meme was quickly born. The result—as I pointed out at the time—was that markets over-reacted, interpreting the Fed as being less committed to easy monetary policy in the longer run. Long-term interest rates rose, mortgage rates rose, financial conditions tightened. All of this was the result of a needless miscommunication.

To learn more about the effects of ending quantitative easing, see Doug Elliott’s presentation on “How Bad Will it Hurt?”

Commentary

Good Communication Critical When Federal Reserve Decides to Taper Stimulus

September 19, 2013