Below is a Viewpoint from Chapter 5 of the Foresight Africa 2021 report, which explores top priorities for the region in the coming year. This year’s issue focuses on strategies for Africa to confront the twin health and economic crises created by the COVID-19 pandemic and emerge stronger than ever. Read the full chapter on continental integration.

No country in Africa has been spared by the COVID-19 pandemic, and the hard-fought economic gains of recent years are under threat everywhere. In fact, in 2020, the region’s GDP could contract by as much as 3.4 percent, down by over 7 percentage points from pre-crisis estimates. Improved infrastructure has rightly been among the countermeasures proposed and should be a major component of any stimulus plan, both for responding to the pandemic and for building resilience over the long term. And it should not just be any infrastructure, but projects that stimulate economic activity, create employment, bolster supply chains, and expand access to health care, sanitation, and education. Thus, with the continent’s long-term future in mind, at Africa50, while we are still focused on traditional sectors such as transport and power generation, we are looking for opportunities in health and sanitation and redoubling our efforts in information and communications technology (ICT).

No country in Africa has been spared by the COVID-19 pandemic, and the hard-fought economic gains of recent years are under threat everywhere. In fact, in 2020, the region’s GDP could contract by as much as 3.4 percent, down by over 7 percentage points from pre-crisis estimates. Improved infrastructure has rightly been among the countermeasures proposed and should be a major component of any stimulus plan, both for responding to the pandemic and for building resilience over the long term. And it should not just be any infrastructure, but projects that stimulate economic activity, create employment, bolster supply chains, and expand access to health care, sanitation, and education. Thus, with the continent’s long-term future in mind, at Africa50, while we are still focused on traditional sectors such as transport and power generation, we are looking for opportunities in health and sanitation and redoubling our efforts in information and communications technology (ICT).

Health infrastructure has historically suffered from constrained public sector budgets and underfunding. For many years, since African residents that could afford modern care opted to go overseas and financial returns for mass provision were low, the sector did not attract many private investors. Now, with the growth of Africa’s middle classes, growing purchasing power, increased employer-provided health insurance, and rising health awareness, the sector is becoming more attractive to investors. Helped by public funding, impact investors, and blended finance, where focus is more on development impact than on financial returns, this emerging trend of increased investment in health care can also spill over into the mass market.

Although ICT has been one of Africa’s success stories, the pandemic has exposed the region’s lingering digital divide. In fact, to achieve universal broadband internet access in Africa—which could help the continent leapfrog infrastructure constraints in a number of sectors, much like cellphones did with landlines 20 years ago—an estimated $100 billion in investment is needed over the next decade, with a third of it in infrastructure.

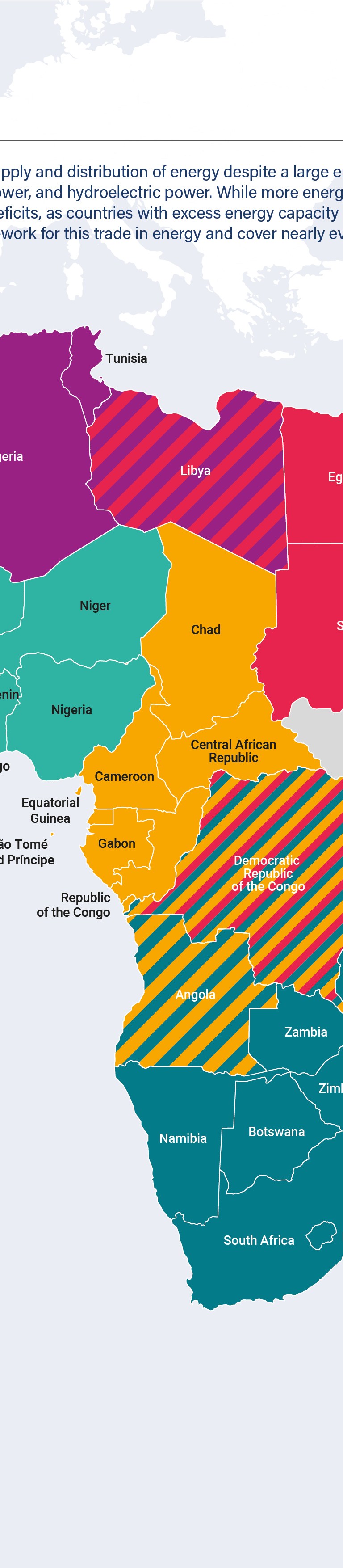

Africa also urgently needs regional infrastructure to speed up implementation of the African Continental Free Trade Area, since many of Africa’s development challenges require cross-border solutions. However, the Infrastructure Consortium for Africa found that in 2018, of a total of about $100 billion invested in African infrastructure, only 2 percent was for regional projects–simply not enough.

Unfortunately, financing becomes scarcer during crises, so what can leaders do? One strategy for securing financing is to encourage lenders to forgive or restructure public debts to give governments some fiscal space. Another is asset recycling, which enables governments to unlock the capital they invested in profitable infrastructure assets, such as toll roads, power plants, airports, and fiber optic networks, by offering them to private sector investors under a concession model. The freed-up capital can then be redeployed to fund stimulus plans and new infrastructure for the recovery phase, including in the health sector.

We must also reverse the capital flight brought on by the pandemic by better developing infrastructure projects in the early stages to make them ready to receive investments and offer attractive risk-adjusted returns. Investors want to be sure that they will be paid a fair price, can freely operate infrastructure assets and meet service level targets, and can repatriate their profits when due. Development finance institutions can help by providing risk-hedging instruments and credit enhancements, as well as supporting local currency financing to strengthen local capital markets. Through such measures we can underline that infrastructure is an investible asset class, including for international and domestic institutional investors looking for steady returns coupled with development impact.

Assets under management by African institutional investors alone are expected to rise to $1.8 trillion by 2020, so if we can tap even a fraction of this, we could substantially close the infrastructure gap.

When the crisis dies down, investors will once again be looking for opportunities, and Africa must be ready. By focusing on opportunities rather than problems and creating the enabling environment investors seek, we must dispel the myth that our continent is too risky.

Commentary

Improving infrastructure in Africa: Creating long-term resilience through investment

March 4, 2021