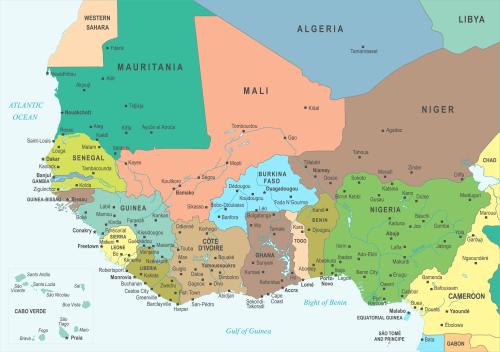

Earlier this year, the 15 heads of states and governments of the Economic Community of West African States (ECOWAS) agreed to launch a new currency, the “Eco,” in January 2020. In doing so, ostensibly, the leaders believe that business people and travelers will be freed from the hassles of exchanging currencies, intra-area trade will boom, and an integrated and prosperous region will flourish.

A monetary union with a single currency for the 15 member states would mean that governments would transfer national political authority to ECOWAS institutions. Are the member states willing to subordinate national interests to regional interests? Are there lessons from the eurozone? Will Nigeria ever give up its national currency, the naira?

These are fundamental questions. There are also lessons to be learned. In this day and age, national sovereignty is all the rage and seems to trump cross-border collaboration. Certainly, flaws of an integrating world are evident but so are those of their populist detractors.

In a recent study of Africa’s monetary unions, Debrun, Masson and Pattillo (2010) demonstrate that, in ECOWAS, net benefits from a single regional currency will accrue to Nigeria, modest benefits will accrue to Côte d’Ivoire, and the Gambia will suffer net losses. The authors further point out that strengthening domestic macroeconomic frameworks would yield similar improvements as monetary integration. This outcome reduces the relative attractiveness of the proposed Eco initiative.

Eurozone lessons. In EuroTragedy: a drama in nine acts, Ashoka Mody (2018) provides sweeping historical context to the unfolding eurozone crisis. In particular, he highlights a rich menu of lessons that the ECOWAS policymakers will do well to heed. First, leaders must be absolutely clear about the expected benefits of the single currency. Second, a fiscal pool is important for crises response and for an effective monetary union. Third, public opinion matters. The decisions by the Danes, Swedes, and Brits to retain their national currencies came largely under public pressure opposed to the euro. Even today, the U.K.’s battle around Brexit illustrates the dangers of taking public opinion for granted. It would thus be naïve for the ECOWAS leaders to march full steam ahead in their quest for a single currency on the erroneous belief that the Eco is Good for West Africa.

The bottom line here is that even with strong institutions of governance, the euro experiment continues to face serious challenges—both economic and political.

At the outset, the deutsche mark was seen as a success of hard money orthodoxy—a stable currency regime protected from manipulation for political ends. Embedded in the postwar industrial success of the then-West Germany, it won praise from capitals around Europe. The idea to export the trust that the Bundesbank had earned across Europe, to facilitate integration and also promote hard money discipline in the south, seemed to combine conservative monetarism with the progressive idea of bringing Europe together.

In hindsight, it is easy to see the appeal. The illusion was that hard money and industrious economic development would go hand-in-hand right from the start. The Greek debt crisis served as a brutal warning that a currency union was no deterrent, though. It may be tempting to conclude the opposite, but then identifying the currency union as the major culprit is challenging too. The unsustainable build-up of debt at the heart of the crisis mirrored the dynamics experienced under floating currency regimes.

What was certainly different was the reaction to the ensuing crisis. Monetary easing met resistance as it conflicted with hard money orthodoxy coded into the European Central Bank’s DNA. Eventually, the ECB had to bend to political pressure, but politics also had to bend to the ECB. At this point, if anyone has clear evidence that the outcome was tangibly worse or substantially better than under a flexible regime s/he should come forward. All we have seen is a muddle across the eurozone but the same applies to their free-floating neighbors. A credible “lender of last resort” had to first save the day while questions are still being asked about the side effects in and outside the currency union.

The ECB certainly was not as accommodating to stability at all costs but eventually gave in. Did the ECB’s often criticized slow response cause unnecessary friction, or could this accrue a long-term rent by keeping moral hazard at bay? What seems apparent though is that the benefits of trust, just like the corrosive effects of manipulation in currency arrangements, do only accrue over long periods of time. As Keynes famously noted, in the long run we are all dead. There is no instant gratification. Proceed with caution is all we can say.

Nigeria and the Eco. Nigeria’s naira is often seen as the likely anchor currency for ECOWAS, due largely to country’s sheer economic size and political importance. This role would be akin to the one played by the German deutsche mark in the period leading to the introduction of the euro.

However, for the naira to serve as an anchor currency means that the Central Bank of Nigeria (CBN) will have to give up its control of the naira to a supranational West African monetary authority. This is like asking the Brits, the Danes, and the Swedes—to finally give up their national currencies and adopt the euro. We now know the answer to that. The response of Nigerians to give up the naira will most certainly be negative.

In any case, the true value of the naira remains unknown as the CBN currently uses hard-earned foreign reserves to mechanically manipulate the exchange rates. As a consequence, Nigeria now has a multiplicity of exchange rate windows.

Under the circumstances, one may well ask what benefit a country like Nigeria or Ghana or the other members of ECOWAS derive through control over their own currencies? Or in the context of real-world complexities, maybe one should rather ask what benefit does the state and its proxies in West Africa derive, and what benefits do the people of the region derive? Inflation and currency manipulation have acted as a sovereign tax throughout history mostly for the benefit of the few. Exchange rate manipulation allows officials to serve specific interest groups but at least also in theory to hit specific economic development goals.

In the case of Nigeria, limited naira convertibility and potential volatility act as tax on foreign portfolio flows as well as direct investments. Currency manipulation can serve specific goals but will corrode trust. Constituents can therefore not be taxed forever. It is not just any other tax. The importance of foreign exchange reserves indicates when trust wears thin. Foreign merchants have little appetite for the naira.

The euro lessons show that even with robust institutions and strong political commitment, sustaining a single currency remains a challenge. These challenges are likely to be much more difficult to surmount in West Africa where the pre-conditions for success, including strong political will and robust institutions, are evidently absent. Let us also be clear that the euro was never just about monetary policy and trade. It was shaped by a vision of a united Europe. And this does not appear to be an entirely fruitless effort, especially in the eyes of Europeans coming of age in the new millennium.

Alternatives to the Eco towards solving some of ECOWAS’s problems. Are there other ways to boost intra-area investment, trade and create jobs in West Africa? Absolutely. Take, for instance, trade facilitation measures. The World Bank’s Doing Business Report 2019 shows that Mali, ranked 92, is the only ECOWAS country included in the top-100 best performing countries for “trading across borders.” Even then, exports from Mali take 48 hours to comply with the bureaucratic requirements at the border.

The comparable numbers for some of the larger ECOWAS members are as follows: Cote d’Ivoire is ranked 162 and export compliance takes 239 hours; Ghana is ranked 156 and export compliance takes 108 hours; and Nigeria is ranked 182 and export compliance takes 135.4 hours. These rankings compare unfavorably with, for example, Botswana, ranked 55, where export compliance at the border takes only 5 hours. ECOWAS countries need considerable efforts to close the evident gap and ease constraints to trading across borders.

Further, consider the proposed Pan-African Payment and Settlement System to be launched by the African Export and Import Bank. This new digital platform will enable settlement of transactions between African countries in local currencies and reduce dependence on hard foreign currencies. The new platform to be designed in support of the African Continental Free Trade Agreement is expected to boost intra-area trade by making cross-border payments easier, cheaper and safer. Under the circumstances, one wonders why ECOWAS would, in parallel, embark on the politically complex pursuit of a single currency.

Conclusion. The Eco will clearly not be the panacea for West Africa’s myriad problems, including high levels of unemployment, especially among the burgeoning population of youth and the increasing numbers of the poor. The lessons from the eurozone highlight continuing challenges among a group of highly developed countries with very strong institutions. ECOWAS will do well to heed these lessons. Second, efforts by member states to strengthen domestic macroeconomic frameworks are important. Third, concerted efforts must be made to reduce the inordinate bureaucratic delays that severely constrain exports and imports at the border. Launching the single regional currency, the “Eco,” by January 2020 is, at best, an expensive distraction that the people of West Africa can ill afford at this particular moment.

Commentary

An evaluation of the single currency agenda in the ECOWAS region

September 24, 2019