Tanzanian government takes steps to reform mining sector

On Monday, July 24, the Tanzanian government penalized Acacia Mining, the country’s leading gold miner, with a record $190 billion tax bill for allegedly underreporting the minerals contained in its concentrate exports and evading taxes—charges that Acacia disputes. Such a bill “would take [Acacia] centuries to pay,” according to Bloomberg, since it is equivalent to nearly 200 years of the company’s revenues. The amount is also notably four times the size of Tanzania’s gross domestic product. Following the news of the fine, Acacia’s share price fell by approximately 14 percent as of Tuesday morning, to its lowest level since 2013.

The Acacia tax bill is the latest decision in a series of steps made by the Tanzanian government to increase its control over the mining sector. President John Magufuli has been spearheading these efforts, and, on Tuesday, he argued that investors in the mining industry have “stolen” from the country and this must be redressed, stating, “It shouldn’t happen that we have all this wealth, sit on it, while others come and benefit from it by cheating us.” Earlier this month, Tanzania passed new mining laws that require the government to own a 16 percent or higher stake in mining projects, increase royalties taxes on gold and other minerals from 4 to 6 percent, and allow the government to renegotiate contracts for natural resources as well as remove the right to international arbitration. Furthermore, the government has suspended the issuance of new mining licenses until a Mining Commission is established to perform a thorough review of existing mining licenses and license applications. These measures aim to boost transparency and increase revenues, according to Magufuli, although businesses and the mining industry lobby have argued that the pieces of legislation lacked consultation from major stakeholders in the industry and that their strict interpretation of tax laws and higher fines are unfair to firms.

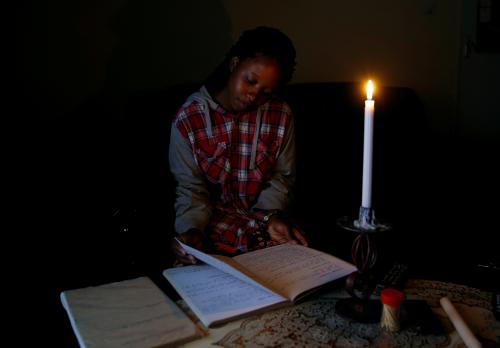

South Africa’s power utility company Eskom suspends CFO during crisis and corruption rumors, while Nigerian villages experience two straight years of uninterrupted power

On Thursday, South African power utility company Eskom suspended its chief financial officer, Anoj Singh, as the company faces increasing pressure over irregular expenditures and dubious links to the scandal-prone Gupta family. Just last week, Eskom revealed 3 billion rand ($230 million) in irregular expenditures, and critics suspect that the Gupta family used its connections with President Jacob Zuma to procure state business. Troubles seem to be widespread: Former Eskom CEO Brian Molefe resigned in November 2016 and Chairman Ben Ngubane since then under similar pressure.

Eskom has been struggling: Despite an increase in revenue of 8 percent last year, the company experienced a staggering 83 percent fall in profits at the same time. The construction of power plants costing tens of billions of dollars are years behind schedule. Costs are skyrocketing: Last year there was an increase of 13 percent in staff costs, 26 percent in other operating expenses (e.g., consultants’ fees and impairments for rising municipal debt), and 82 percent in its interest bill. These financials, as well as leadership challenges, have created nervousness in investors: The World Bank has expressed concern while the Development Bank of South Africa actually threatened to withdraw its 15 billion rand loan if Singh was not suspended.

In positive power news, two villages in Kaduna state, Nigeria, announced this week that they have experienced two years of uninterrupted electricity. The villages, Gnami and Pakau, get their power from an off-grid solar system as they are too far from the country’s power grid, and residents pay their bills via mobile money. The Gnami solar mini-grid serves 100 households, and Pakau’s solar renewable energy micro utility serves 300. Delegates from the Economic Community of West African States traveled to the area to celebrate with and congratulate the residents and the Ministry of Power, Works, and Housing.

Senegal, Rwanda, and Kenya prepare for elections

On Sunday, Senegal will hold legislative elections to designate 150 deputies to its parliament. The electoral campaign has been marked by the return of former Senegalese president, 91-year-old Abdoulaye Wade, who heads up the list of candidates for the opposition party. The election has been marred by some controversy: As of Wednesday, only 70 percent of voters were in possession of their voting cards. The Senegalese presidency has thus called on the Constitutional Council to widen the criteria for documents required to vote. In addition to the digitalized voter card, such documents could include a driver’s license, a passport, or a national identity card. Last Friday, the African Union announced that it would be deploying its election observation mission to Senegal.

Rwanda is presently gearing up to hold elections on August 4. Incumbent President Paul Kagame is running for a third term, after a December 2015 constitutional amendment allowed him to be eligible for another term. Kagame will be running against opposition leader Frank Habineza and independent candidate Phillipe Mpayimana. Both Kagame and Habineza have pulled out of the upcoming presidential debate and will be represented by their respective representatives. (Habineza had previously declared that he would only be at the debate if Kagame was present.) The Common Market for Eastern and Southern Africa (COMESA) regional bloc is set to deploy electoral observers to Rwanda during the period surrounding the elections. For more on Rwanda’s political landscape, see Nonresident Senior Fellow John Mukum Mbaku’s Foresight Africa 2017: Election spotlight on Rwanda.

On August 8, Kenya will head to the polls to pick a president out of 18 candidates. President Uhuru Kenyatta is running for his second and final term in office. His main opponent is former Prime Minister Raila Odinga, his biggest challenger in the 2013 elections and a major contender in the violence-ridden 2007 ones as well. Kenyans will also be electing governors, members of parliament, and senators. So far, there has been significant economic costs associated with the elections. Firms have scaled down production, investors have been hoarding cash, and Kenya’s neighbors have redirected cargo away from Mombasa and towards Tanzania’s Dar-es-Salam. For more on Kenya’s political landscape, see Nonresident Senior Fellow John Mukum Mbaku’s Foresight Africa 2017: Election spotlight on Kenya.

Commentary

Africa in the news: Tanzanian mining sector, Eskom management troubles, and Africa election corner

July 28, 2017