SUPPLY CHAIN

Mexico’s evolving role in global supply chains

The events of 2018-2020 have highlighted the risks of extended global supply chains, especially ones that rely on one or more key inputs produced in only one or a small number of locations. This turbulent period has included the U.S.-China trade war in which export controls were imposed on hi-tech inputs and a 25 percent tariff levied on many ordinary products traded between the U.S. and China. The COVID-19 pandemic has also been a huge shock that has disrupted supply and demand patterns all over the world. There also seem to be an increasing number of local environmental disasters tied to climate change affecting supply chains, notably, floods in Thailand, China, and Germany; wildfires across the American West; and deep freeze in Texas.

In response to the growing awareness of risks, the vast majority of firms are trying to build more resilience into their supply chains. Furthermore, the infrastructure bill should strengthen America’s role as a producer by reducing transport and power bottlenecks. The effort to improve resilience, however, does not take all firms in a similar direction. The total volume of imports into the U.S. keeps increasing, both from China and other countries, suggesting that there is no general move to reshore, though it is likely to happen to some extent in semi-conductors and other hi-tech sectors owing to U.S. government incentives. Beyond those specific products, there was a big surge in demand for consumer durables in the U.S. as a result of the pandemic, and much of this was met by imports from Asia. Resilience may come from changes such as holding more inventories or diversifying suppliers to several locations abroad, rather than shortening value chains.

The extension of the free-trade agreement of North America, now named the U.S., Mexico, Canada Agreement (USMCA) coincided with these shocks, coming into effect July 1, 2020. The agreement provides strong incentives for integrated production among these three economies, compared to no agreement, but only modestly increased incentives compared to the previous NAFTA. The main change was increasing the required share of content for autos that must come from within USMCA in order to qualify for tariff-free trade. There was also a new requirement that effectively limited Mexico’s share of automobile value added by requiring that a certain amount of value added come from high-wage locations. In that sense the agreement is a mixed blessing for encouraging Mexico’s role in manufacturing value chains. But leaving aside autos, for example in the all-important electronics sector, the incentives to involve Mexico in supply chains is modestly strengthened.

A number of commentators have noted the potential for a shift of some supply chains from China to Mexico to be a critical part of the Biden administration’s technology policy. Meltzer (2021), for example, argues that:

The importance of resilient supply chains has also been made abundantly clear in light of the impact of COVID-19, and as competition with China exposes vulnerabilities to relying on Chinese supply chains. The Biden administration has ordered a review of U.S. supply chains, with the objective of decreasing American dependence on Chinese production of critical inputs. Integrated North American supply chains could provide a viable alternative to Chinese manufacturing and allow some critical industries to move production closer to home.

Similarly, Finley et al. (2021) argue that Mexico’s proximity plus the updated trade agreement put it in a good position to strengthen its role in supply chains. At the other end of the spectrum, Schott (2021) is skeptical about Mexico’s potential, given its investment climate weaknesses: “intrusive Mexican business regulations, inadequate and irregular power supplies, and clogged road and rail networks.” The State Department’s 2021 assessment of Mexico’s investment climate likewise notes that “uncertainty about contract enforcement, insecurity, informality, and corruption continue to hinder sustained Mexican economic growth.”

The objective of this chapter is to examine some of the key factors that will determine how much Mexico advances as a manufacturing location deeply involved in supply chains and what policies would enhance this shift. The next section details the startling fact that value chains are deeply embedded in East Asia for good reasons – of scale and diversity of the economy. It will not be easy to displace China from value chains, as it produces about 30 percent of global manufacturing value added. Also, Mexico is integrated to some extent with the East Asian value chains. So, from Mexico’s point of view, its manufacturing sector is more likely to thrive if it remains connected to Asia, for example, through new trade agreements. Cutting East Asia out of supply chains is mostly unrealistic. There may be particular military items where it is important to have a closed North American supply chain, but this will be expensive and should be limited to products of clear military importance.

Simply switching purchases from MNCs in China to ones in Mexico would not really reduce dependence on Chinese production because of this dominant role of China in producing intermediate inputs.

The other main section of the chapter looks at a number of investment climate indicators for Mexico and East Asian economies. At this point China has higher manufacturing wages than Mexico, so production is not attracted there by lower labor costs. Rather, China has a number of investment climate advantages: Excellent ports and logistics, as well as outstanding human capital. Mexico compares unfavorably not just to China but to the large economies in Southeast Asia. Those economies have three times as much manufacturing value added as Mexico. Firms that are looking to diversify out of China are likely to look first to ASEAN countries. Mexico would need to address its weaknesses in logistics and human capital in order to attract more investment and deeper involvement in supply chains.

Established supply chains are incredibly complex

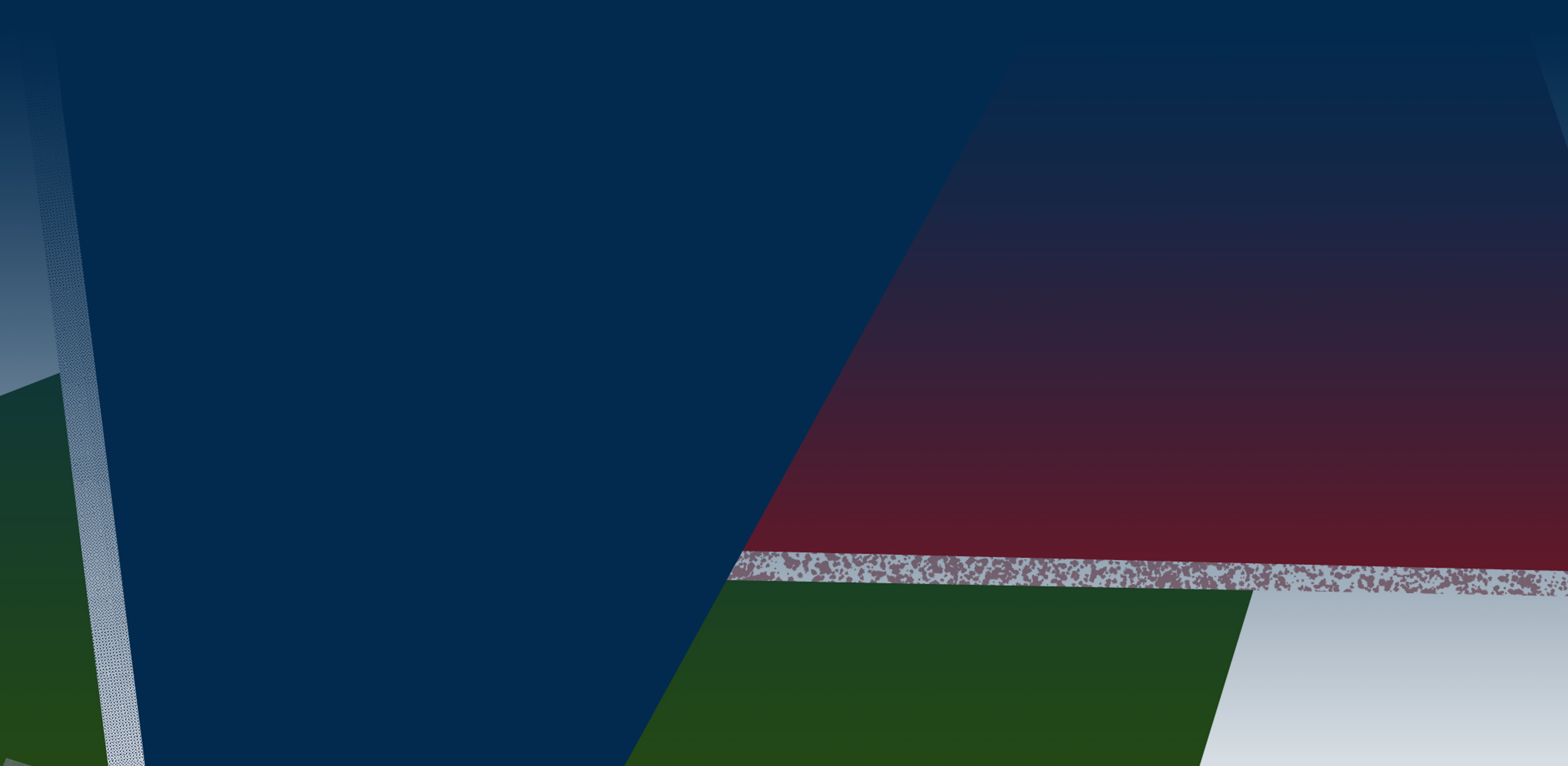

The global supply chains that have developed in the modern era of globalization are incredibly complex. In the decade from 2000 to 2010 supply chains lengthened for most products and became highly international, with two-thirds of world trade crossing at least two borders during the production process (Global Value Chain Development Report 2021). Since 2010 there has been stagnation in the length of value chains, but no observed shortening so far. Modern input-output tables enable us to trace out value chains for individual industries. Graph 12 shows the chain for China’s exports of ICT equipment coming from multinational companies (MNCs) in 2016 and illustrates several points. Each observation is a country-industry pair, for example, China’s steel production or U.S. financial services, that meets a threshold of contribution to the final product. The size of the bubble is the amount of value added contributed to the final output, while the vertical axis indicates the productivity of the country-industry pair. A second point is that many industries have this characteristic “smile curve” with high value added inputs early in the production process (design, finance, software, hi-tech inputs), then low-value-added assembly, and finally high-value inputs as products are transported and marketed.

A third observation is that there are dozens of industries making contributions to ICT production. Finally, while the number of inputs makes it hard to read all the observations, close inspection reveals that there are a large number of upstream contributions from Chinese industries such as finance, steel, glass, and others. This is an important change over the past decade. China used to be involved primarily as a low-wage assembler, but now many of the upstream inputs come from China as well. Also, many upstream inputs come from nearby Asian partners such as Japan, Korea, Malaysia, or Thailand.

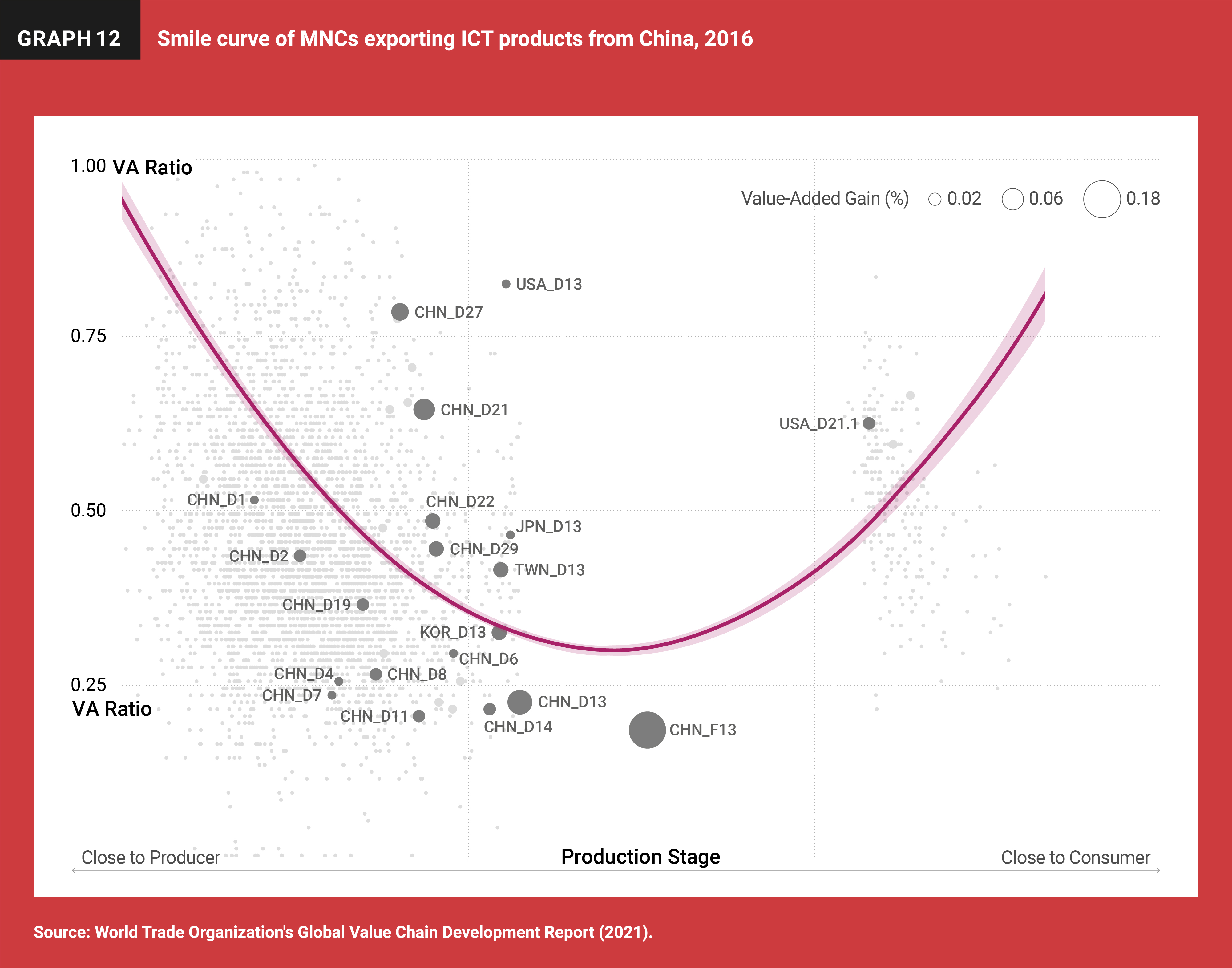

Mexico is a significant exporter of ICT equipment as well. Graph 13 shows the analogous value chain for MNC exports of ICT products from Mexico in 2016. The value-added bubble for the Mexican ICT industry is significantly smaller than the one for China, indicating that the latter is a much larger player in this sector. But otherwise the supply chain for Mexican exports is surprisingly similar to the supply chain for Chinese exports. In particular, there are a large number of different Chinese imports that contribute upstream to Mexican production. There are also contributions from the other Asian economies such as Japan, Korea, Malaysia, and Thailand. One immediate conclusion: Simply switching purchases from MNCs in China to ones in Mexico would not really reduce dependence on Chinese production because of this dominant role of China in producing intermediate inputs.

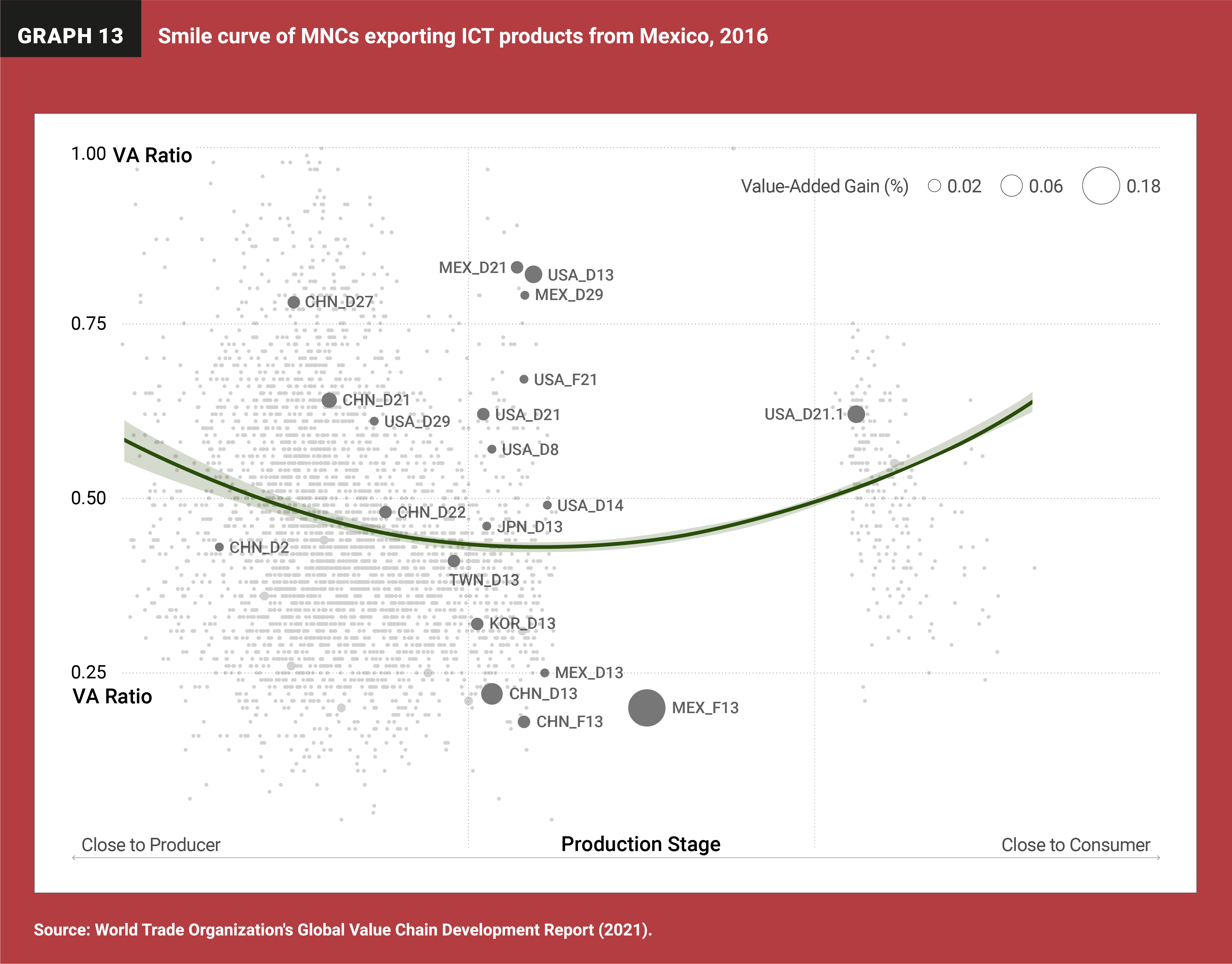

One factor to keep in mind then is the sheer scale of China’s manufacturing sector. Graph 14 shows manufacturing value added in Mexico, 2020, compared to China and other Asian economies. China’s output was 20 times larger than Mexico’s. The manufacturing value added of the six large ASEAN economies was three times Mexico’s output. Given this ecology of firms in East Asia, it would be very hard to dislodge existing supply chains. Also, keep in mind that most of the manufacturing production is consumed in Asia. China, in particular, is much less export dependent than in the past. It is the largest producer of manufactures, but also the largest consumer. Many U.S. firms refer to their strategy as “in China for China,” meaning that a large share of their production in China is sold in the domestic market. For this type of investment, relocating out of China makes no sense.

Investment climate varies across countries

The fact that so much manufacturing production ended up in East Asia, China especially, is not a coincidence. China was known initially for low wages, but wages are low throughout the developing world. Other factors turn out to be as, or more, important. Table 1 presents a number of investment climate indicators for Mexico and China, as well as Japan and Korea, and the six large economies in ASEAN (Indonesia, Malaysia, Vietnam, Thailand, Philippines, and Singapore). The countries are listed in increasing order of per capita GDP (measured at PPP) because these indicators tend to rise with development level, and it is useful to look at one’s ranking relative to peers.

The indicators are: Logistics Performance Index, which indicates how well ports and other infrastructure function to move goods in and out; Intellectual Property Rights Protection Index because the MNCs that manage value chains bring their brands and technology and need it to be protected; PISA test score for math indicates how well a country is developing basic human capital; and the tertiary school enrollment rate signals upgrading of the labor force for the future.

Mexico’s logistics performance only betters the Philippines and is well behind China or Thailand, even though the three are at similar stages of development. On the IPR index, Mexico is behind China or Malaysia. This is especially important for bringing in hi-tech value chains. China’s PISA scores for math are off the chart. An important footnote is that the Chinese testing is only done in Beijing, Shanghai, Zhejiang, and Jiangsu, but these coastal locations have several hundred million people, and they are where much of the hi-tech production takes place. Finally, China’s tertiary enrollment rate, at 58 percent, is more similar to rich countries than to other developing ones.

Conclusions and policy recommendations

The USMCA trade pact provides incentives for integrated North American production. This could be paired with industrial policy interventions to consolidate production for some specific products, which would also be smoothed by the infrastructure bill. But to promote this as a wide-ranging program aimed at dislodging supply chains from China would be expensive and would probably fail. The Regional Comprehensive Economic Partnership among ASEAN, China, Japan, Korea, Australia, and New Zealand will provide similar incentives for integrated production in the Asia-Pacific. Furthermore, that region starts as the dominant player in world manufactures and with investment climate advantages in terms of logistics, infrastructure, and human capital.

China’s application to join the Trans-Pacific Partnership is important. This is a deeper agreement than RCEP and would do even more to cement Asia-Pacific value chains. Mexico, as a member of CPTPP, would benefit from the pact’s expansion to large new partners such as China, Indonesia, and Korea. CPTPP could become the foundation for Asia-Pacific supply chains. The U.S. is the odd man out in the Asia-Pacific and it would take significant changes in attitudes towards trade by both U.S. political parties to turn that around.

From Mexico’s point of view, the potential benefits of investment climate improvements are enhanced by new trade pacts such as USMCA and TPP. Key issues are logistics, infrastructure, property rights protection, and greater investment in schooling at all levels. These are all in Mexico’s interest regardless of its trade status; they become even more important in an integrated Asia-Pacific economy. The U.S. has a similar agenda of infrastructure and human capital renewal. That agenda of renewal would be enhanced by deeper trade agreements with the Asia-Pacific.

References

Finley, F., D. Hearsch, and J. Blaeser. 2021. “Revisiting Mexico: A critical link in the supply chain.” AlixPartners. May 2021. https://www.alixpartners.com/media/17702/mexico-supply-chain-article_vf.pdf.

Meltzer, J. 2021. “The importance of USMCA for the Biden administration’s economic and foreign policy.” The Brookings Institution. Apr 28, 2021. http://www.brookings.edu/blog/up-front/2021/04/28/the-importance-of-usmca-for-the-biden-administrations-economic-and-foreign-policy/.

Schott, J. 2021. “Can Mexico help bring supply chains back to North America?” Peterson Institute for International Economics. Sep 21, 2021. https://www.piie.com/blogs/trade-and-investment-policy-watch/can-mexico-help-bring-supply-chains-back-north-america.

U.S. Department of State. 2021. 2021 Investment Climate Statements: Mexico. https://www.state.gov/reports/2021-investment-climate-statements/mexico/.

World Trade Organization. 2021. Global Value Chain Development Report 2021.

Viewpoints

John Weekes warns of fissures beneath the surface that could disrupt the U.S-Mexico-Canada Agreement.