As the federal government’s discretionary spending in the 1990s has become less lavish, so has the supply of old-fashioned lard in the U.S. budget. But if you think this means the era of big government is over, think again. Another pork barrel is burgeoning. Along with preferential micromanagement of the tax code, the bacon these days takes the form of unfunded mandates and regulatory programs and of public facilitation of private lawsuits.

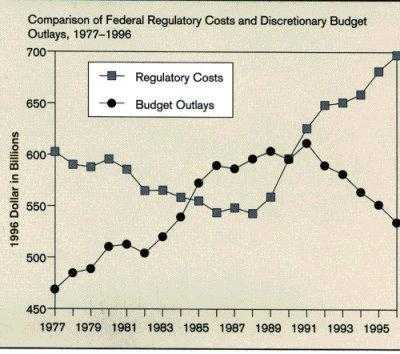

Figure 1 tells most of the story. Led by robust military budgets during the late 1970s and the 1980s, discretionary spending increased. Until 1988 the estimated costs associated with federal regulatory activities declined in constant dollars as the economy realized tens of billions in savings from deregulation of the transportation and energy industries and from the Reagan administration’s concerted efforts to curb costly new regulations. Afterwards, however, regulatory costs turned up sharply and have been on the rise ever since. A profusion of new rules and legal liabilities increasingly bore down on business decisions about products, payrolls, and personnel practices. By the mid-1990s these costs were approaching $700 billion annually – a sum greater than the entire national output of Canada.

Explanations

Whatever else explains this trend, surely it demonstrates that fiscal constraints have not limited the ingenuity of politicians and their clients. Policies that are barely visible on the budget books can still intervene massively on behalf of special interests – and can do so, conveniently, without worsening the deficit or imposing transparent tax increases.

For instance, rules that have encouraged the use of ethanol (a fuel made from corn) are a kind of pork for corn farmers, only less obvious than, say, appropriating millions for irrigation projects in Corn Belt states. Often costing billions of dollars per cancer prevented, the Superfund law to remove carcinogenic toxins from waste dumps is charging society a small fortune. But Superfund’s congressional appropriation is suitably modest, and the program is a gravy train for particular groups, like the thousands of lawyers engaged in cleanup litigation. Similarly, antidumping provisions in the trade laws, devised to regulate “unfair” foreign price competition, require small budgetary outlays to administer. At times, however, these regulations force consumers to pay markedly higher prices to protect a handful of domestic companies. The practice of crafting protections and preferences for selected groups in the name of civil rights is a relatively low-budget operation too. But this regulatory regime nonetheless reaches deep into the private sector, dispensing rewards to the regime’s extensive vested interests. There is no shortage of examples of Washington’s off-budget spoils system.

Though the regulatory pork barrel frequently serves well-organized constituencies, its scope tends to be broader than the traditional treats (a new post office here, a new road or sewer there) that members of Congress offered to their districts. In contemporary American politics, this difference is an added advantage for members of Congress who need increasingly to curry favor with national lobbies and pressure groups that provide valuable political backing. The pattern of influence and obligations is reflected in congressional campaign finance. Whereas candidates in House elections, for example, used to rely for support almost entirely on local constituents and state parties, now the winners draw almost 40 percent of their contributions from political action committees, that is, from the funding arms of national interest groups. Prosaic projects, reaching only hometown folks, do not satisfy many of these hungry organizations; they expect, instead, a diet rich in ubiquitous social mandates: more safety devices in all motor vehicles, pure water in any river, equality of athletic programs within virtually every university, prohibition of smoking from sea to shining sea, and so on.

The number and cost of such commandments also keep mounting because of the extraordinary legitimacy they are accorded. In part, this situation reflects the skill of their advocates and patrons at marshaling notions of fairness or rights. Thus, the trump card played by champions of rigid antipollution regulations is that all citizens have “an inherent right” to a pristine environment. The mandating of benefits for each new class of disadvantaged people reflexively summons the Fourteenth Amendment, rather than a plainspoken demand for government funding. The clinching argument in many product injury verdicts seems to be that buyers should bear no responsibility for the risks they run since consumers are entitled to be absolutely safe. The time-honored defense of antidumping regulations is that they uphold the economic rights of firms and workers victimized by foreign predators who employ “pauper labor.”

Because regulatory pork barreling is presented not as a system of special favors, but as a means of honoring solemn legal claims, the claimants are often given a direct hand in enforcement. Many regulatory activities, in other words, gain momentum because they deputize vigilantes. Most environmental statutes and consumer protection laws invite citizen suits to ensure compliance. Of late, the employment laws have induced a surge of job-bias class actions. Various interests are parties to these lawsuits or become beneficiaries of them. Besides awarding significant sums to nonprofit advocacy groups, settlements have ordered a bevy of purchasing contracts and franchises to designated for-profit organizations and produced a billable hours bonanza for the contingency lawyers and for a cottage industry of diversity management consultants.

Concerns

Does all this pose a problem? A prosperous, civilized country should be expected to regulate harmful types of economic fraud and abuse, to reduce socially corrosive inequities, to bar morally repugnant forms of discrimination, and to protect the health and safety of its citizens. Despite the soaring costs of the policies produced by these exertions, their net worth is sometimes impossible to measure. Even though many of them advantage certain groups while disadvantaging others, society may have decided that such uneven outcomes are virtuous and just. And the fact that politicians pull in campaign funds and votes with the decisions does not, in itself, invalidate them. Pork, courtesy of other people’s tax payments or of regulatory exactions, is a staple of politics. Without it, democratic government would lose some muscle as well as flab.

What is unsettling, however, is the seeming ease or insouciance with which current political arrangements seem to crank out expensive directives that invoke high principle to conduct, in Ambrose Bierce’s phrase, “public affairs for private advantage.” The old pork barrel, stuffed as it was with federal bricks, mortar, and macadam, at least had to be paid for with tax dollars or with deficit spending. The favoritism was explicit, concrete (often literally), and visibly priced. Even the subtler fiscal delicacy, targeted tax relief, has had reasonably obvious budgetary implications, which sooner or later would alarm deficit hawks. Wasteful as these expenditures and tax measures frequently are, at least they have borne clearly the signatures of elected officials, who occasionally might be asked to answer for the consequences of their actions.

The new system is murkier. Its contents extend far beyond earmarked appropriations or tax breaks to a stack of selective legal strictures that appear budget-neutral and “tax free,” and that are partly in the custody, so to speak, of unaccountable private attorneys general. In contrast to honest spending and tax bills, no consistent effort is made to score the economic impacts of the voluminous mandates, especially those that emanate from the executive branch. Hence, as Robert Hahn and Robert Litan recently reported, approximately half the federal government s social regulations issued between 1982 and mid-1996 generated costs plainly in excess of social benefits, yet remained unchallenged.

The rise of legal and regulatory burdens may seem of trivial consequence to America’s formidable economy, but in fact the productivity and incomes of Americans would have grown more rapidly if the nation’s cost-oblivious penchant for regulatory sanctions and suits had been brought under better control. As a conservative estimate, just ridding the Federal Register of the manifold rules since 1982 that flagrantly flunked an elementary cost-benefit test would have increased the size of the economic pie by almost $300 billion. Fixing countless other programs whose net benefits are not being maximized would “grow the economy” further. The penalty for not seizing these opportunities now while the going is good is likely to worsen substantially in the years ahead. In the next millennium, the competitive heat of the global marketplace will intensify and so will the incentives for firms to outsource across borders. Especially if encumbered by too many injudicious laws and lawsuits, more U.S. businesses will simply off-load more of their operations. In the course of this industrial upheaval, millions of American workers are likely to be sacked or, at a minimum, to see their wages stagnate.

Prudent Corrections

Not unaware of this prospect, the 104th Congress made some tentative progress toward redressing abuses of the regulatory state. Legislation was passed requiring federal agencies to weigh the costs and benefits of major new mandates and to submit their studies to Congress for review. Narrower statutes were enacted eliminating zero-tolerance standards for health risks in some consumer goods (processed foods, for example) or at least requiring regulators to publish cost justifications for safety standards (as for drinking water). In an attempt to curb the excesses of what might be called privatized social regulation – in particular, the rampant civil litigation that purports to protect consumers – Congress succeeded in setting minimal limits on the rewards to shareholders and plaintiff’ attorneys for suing companies frivolously.

To call such steps anything but a bare beginning, however, would be a delusion. The shareholder “strike” suits bill should have, but didn’t, clear the way for a broader legal reform proposal that would have restricted punitive damages in product liability cases generally. (President Clinton vetoed both bills, but only one of his vetoes was overridden.) So far, the new procedural requirements for the formulation of executive rules, in turn, have proved mostly exhortatory. In only one case, the Pipeline Safety and Partnership Act of 1995, is an executive bureau expressly enjoined from promulgating standards whose costs are unjustified by benefits. In the rest, administrators are only asked to consider and report their cost-benefit assessments and to explain any rule-making that discards them. The provisions for congressional oversight of proposed rules are constrained by tight statutory time-frames, presidential veto power over resolutions of disapproval, and too limited a role for the legislative branch’s top economic analysts. (The 1995 Unfunded Mandates Reform Act authorizes the Congressional Budget Office to “score” regulatory acts of Congress, but not those of the executive. The latter’s rules, according to the Small Business Regulatory Enforcement Fairness Act of 1996, are to be examined by the General Accounting Office, arguably under unrealistic deadlines.) Perhaps least satisfactory is the grandfathering of existing laws and rulings. With a few notable exceptions – such as the Delaney clause, which barred any level of risk in food additives – old regulations, no matter how questionable, remain on the books.

Some of these deficiencies might be partially remedied by more fine-tuning. A pending bill, the so-called Regulatory Improvement Act authored by Senators Fred Thompson (R-TN) and Carl Levin (D-MI), would try to ensure, for instance, that agencies take seriously their evaluations and risk assessments of new rules by introducing a process of independent peer review. The bill would also extend methodically a similar review process to extant regulations.

Even these corrections, however, will not suffice to sharpen the lines of political accountability for regulatory pork. A proliferation of agency analyses, peer committees, and reporting requirements is no substitute for democratic choice. Ultimately, the buck ought to stop with Congress itself, where members should have to cast transparent up or down votes on all the government’s off-budget activism, just as votes are recorded on other important taxes and expenditures. But unless these decisions are well-informed, legislators will render them meaningless, if they render them at all. One way to minimize evasion might be to expand the capacity of the Congressional Budget Office to delineate for the legislature society’s gains and losses from every major regulatory initiative, much as CBO performs this annual service with every big budgetary item. A joint report by the American Enterprise Institute and the Brookings Institution published last July suggested experimenting along these lines (see Christopher Foreman’s article on Congress and Regulatory Reform in this issue of the Review).

Beyond these institutional adjustments lie larger priorities. Sooner or later, policymakers in the United States will have to face the fact that inordinate legal contestation pervades the way this society seeks to regulate itself. Much of this punitive “adversarial legalism,” to borrow the apt description by Robert A. Kagan of the University of California, Berkeley, lines the pockets of lawyers and professional litigants while accomplishing little else. The resulting drag on American economic performance, though little noticed at the moment, may become considerably less affordable in time. Part and parcel of serious regulatory reform, therefore, has to be a reasonable contraction of federal enactments that stimulate, indeed sometimes sponsor, our seemingly insatiable appetite for litigation. This won’t be easy, for it will mean rolling back an oversupply of suits everywhere, from the workplace to the doctor’s office, as well as entertaining fewer complaints about sagging stock quotations, risky products, and many of life s hazards, misfortunes, and disappointments.

Commentary

The New Pork Barrel: What’s Wrong with Regulation Today and what reformers need to do to get it right

December 1, 1998