Editor’s Note: This paper is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between the Economic Studies Program at Brookings and the USC Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. This work was supported by Arnold Ventures.

The fundamental dilemma in prescription drug policy is often understood to be the trade-off between establishing incentives for innovation that produces new cures through high product prices and the fact that high prices can and do strain the ability of consumers and taxpayers to afford the high prices to support that innovation. This is also the trade-off posed by the Congreossional Budget Office’s (CBO) recent cost estimate of one of the leading proposals to control drug pricing, H.R.3. That bill proposes new negotiation authority be extended to the Secretary of Health and Human Services to establish drug prices and imposes limits on drug price inflation. The implementation of these policies is estimated to save the public sector almost half a trillion dollars a decade – yet at the same time declining pharmaceutical industry revenues are estimated to result in 30 fewer drugs over multiple decades. Thus, the dilemma facing policymakers is perceived to be that controlling drug prices now necessarily means fewer new drugs tomorrow.

The trade-off between prices and innovation need not be this stark and, in fact, is likely avoidable. There are ready policy options that can allow us to meet the goals of both controlling prescription drug costs and promoting investments in innovative new therapies that can make us healthier. The U.S. has successfully pursued policies in the past that improved incentives for innovation and affordability, from basic science investments to programs for financing innovative start-ups. There is significant win-win potential in legislation building on the considerable strengths of drug pricing regulation proposals.

To craft a win-win policy, it is important to recognize how the market for prescription drugs currently fails Americans. New prescription drugs are often priced at levels that limit access to lifesaving drugs among those who are underinsured or uninsured. Moreover, many new products are priced with little regard to their value, pairing high prices with few meaningful clinical advantages over existing treatments. Finally, these challenges coexist with “missing markets” for medicines to treat some diseases altogether. For example, there is an absence of new products that tackle important illnesses that threaten human health and family economic stability, including tuberculosis and anti-microbial resistance.

These shortcomings can be readily addressed using evidence-based approaches. In this paper, we review those avenues and show how they can improve affordability among drugs now and dramatically increase pharmaceutical innovation in the U.S. – improving our health and saving public and private payers money at the same time. Past evidence clearly shows that investing in public research through the National Institutes of Health (NIH), expanding access to capital for biopharma startups through existing programs such as Small Business Innovation Research (SBIR), and publicly funding targeted clinical development of drugs through existing programs such as Biomedical Advanced Research and Development Authority (BARDA) can meet significant unmet needs and can work to efficiently raise innovation.

Our central insight is that pricing and coverage mechanisms that reward product value can work in concert with other policies aimed at improving innovation incentives. Some savings from rationalizing spending on existing drugs can be used to finance new initiatives we suggest here, producing a package that both saves money on net and improves the health and well-being of us all.

Problems with the existing pharmaceutical ecosystem

The U.S. pharmaceutical sector is the world’s leader in drug innovation, delivering life-saving cures and improving innovations in a wide variety of areas, from heart disease to mental illness to cancer. It is also, by far, the system that imposes the highest cost burden on its consumers: the prices charged are driving as many as 29% of U.S. consumers to forego the benefits of those innovations. Public and private payer budgets are stressed by spending on brand-name prescription drugs forcing some states to limit access to effective treatments.

New product approvals in the past decade have been concentrated in “specialty” drug markets, intended to treat patients with complex, rare, or ‘orphan’ diseases. A little under half of all spending on branded drugs in the U.S. is now on these drugs, reflecting both their increased availability and the high prices charged for them. These products and the advent of curative gene and stem cell therapy to treat more common disorders have caused affordability and equity concerns. Improving competition, often the first instinct of policymakers in both parties, has done little to date when applied to these new specialty products and will likely do even less to address affordability and access challenges.

The U.S. spends approximately 14% of total health care expenditures on pharmaceuticals, approximately $575 billion annually. In some therapeutic areas, such as cancer and mental illness, the U.S. spends more than 30% of annual health care spending on pharmaceuticals. Existing evidence shows that the U.S. pays the highest prices in the world for patent-protected prescription drugs compared to other OECD countries. For example, a report by the House Ways and Means committee released in summer 2019 contained drug pricing data for the U.S. and several “comparable” countries in terms of country-specific wealth. After accounting for drug use, the prices Americans pay for new drugs are simply unmatched by other market economies.

New prescription drugs are often priced at levels that limit access to lifesaving drugs among those in the U.S. who are underinsured or uninsured. For example, the U.S. government initiative Ending the HIV Epidemic in the U.S. and World Health Organization (WHO) initiative Global health sector strategy on viral hepatitis, 2016-2021 call for the elimination of HIV and HCV by 2030. Life-saving pharmaceutical advancements in the past decade—direct-acting antivirals (DAAs) to cure HCV, routinized use of antiretroviral treatment (ART) for HIV management, and pre-exposure prophylaxis (PrEP) for HIV prevention—have transformed these calls into tangible goals. Yet, these drugs remain underused, especially among persons most at risk, including those with Medicaid insurance coverage and the incarcerated. In the end, too many Americans and indeed the nation lose the opportunity to experience the full benefits of scientific progress. This is especially tragic given that the development of many of these products was funded by the American public to advance the public good.

The U.S. market also fails to consistently establish prices for prescription drugs that reflect their value. That is, overall prices are at levels that impede utilization and produce supra-competitive levels of profits. In addition, drugs that offer important advantages over existing treatment do not command prices that are markedly different than those drugs that offer few if any clinical advances. This results from the combination of nearly full insurance coverage for high-cost drugs coupled with market power stemming in part from intellectual property protections which confer tremendous bargaining power on pharmaceutical manufacturers. This is very different than most other comparable countries which rely on centralized drug price negotiation and coverage policies. Drug prices are set in the U.S. through an opaque set of interactions between manufacturers, pharmacy benefit managers, and payers that can be disconnected from the health impacts of the products being purchased. Thus, even after accounting for the cost and risk of R&D, the preponderance of evidence shows the returns to new products exceed normal rates of return. Among new drugs launched in the U.S. where effectiveness was evaluated, by other country’s regulatory authorities, relative to existing treatment only in 37% of cases was there consistent agreement that the drug was better than existing products, while there was agreement that for 43% of the new drugs there were no health advantages over existing products. Likewise, drugs approved through the Food and Drugs Administration’s (FDA) Accelerated Approval pathway sell at the same high prices even when their effectiveness is either uncertain or sometimes shown to be lacking. The case of Aduhelm for Alzheimer’s disease is a salient recent example of the phenomenon given the weak clinical findings and its $56,000 yearly price tag.

Beyond its high costs, the pharmaceutical industry underachieves in its response to social needs. New products commonly fail to tackle some important illnesses that threaten human health and family economic stability. For example, there are few, if any, products in the pipeline to address anti-microbial resistance, tuberculosis, and opioid dependency despite the significant unmet need and disease burden. In contrast, many new products are new versions of existing products that offer modest changes to the incumbent drug. To provide a relative magnitude of the losses associated with the lack of treatment options for these conditions alone, consider that nearly 700,000 deaths per year worldwide are attributed to anti-microbial resistance, with a potential annual loss of up to $3.4 trillion by 2030. In a post-anti-microbial era, today’s routine medical and surgical procedures would become a game of Russian roulette. Yet, there is little private investment in addressing the problem of anti-microbial resistance. Current incentives to support new medicines to combat anti-microbial resistance are inadequate to ameliorate these challenges, despite some investment by private and public payers. As another example, current incentives to support the development of an effective HIV vaccine are also inadequate, despite promising candidates developed by some innovators and clear unmet need. There are other examples, such as no drug ever having been approved in the U.S. to prevent lung cancer and only six drugs ever approved to prevent any type of cancer, despite cancer being the leading cause of death in the U.S. currently.

Moreover, important science that would involve multiple pharmaceutical firms with the potential to advance drug discovery, human health, and economic welfare are only rarely pursued. For example, pharmaceutical firms are reluctant to engage in creating and testing products that combine best-in-class drugs that target metastatic breast cancer and lung cancer. They have also been reluctant to combine therapeutic products with diagnostics despite their promise for fear of limiting potential product market size.

The solution: A four-part approach

These shortcomings can be addressed using evidence-based approaches. Using past evidence and experience from both the U.S. and abroad as a guide here we describe a four-part strategy to do so. That strategy involves 1) creating a payment environment that rewards true innovation; 2) bolstering public investment in basic research at NIH; 3) creating a public supported pool of funds that would finance biotech entrepreneurship; and 4) establishing an agency that would strategically support human trials in diseases to de-risk areas of public health import where too few private investments have been made.

These policies should be embedded within a wider framework that aims to help set priorities for U.S. therapeutic use and development. Such a framework would help define our health priorities, our scientific possibilities, and our social needs. This would naturally be run out of the Department of Health and Human Services but in an inclusive process that includes representation from the NIH, the Office of Science Technology and Policy (OSTP), and other agencies.

Step 1: Creating an economic environment that rewards true innovation

Drug pricing reform plays a key moderating—or amplifying—the effect of potential solutions to these problems. Prices that are decoupled from social value undercut the benefits of public intervention and erode public confidence. Conversely, prices tightly tied to social value can ensure that the private sector leverages public spending to improve the health of the U.S. population and ensure innovator commercial viability. Recent U.S. legislative proposals make use of three mechanisms for value-based pricing of prescription drugs. These are: government negotiations for brand name drugs that face little or no competition, use of International Reference Prices or other measures as a benchmark for U.S. prices, and an inflation rebate.

The first two lend themselves to incorporating social value considerations into the pricing of prescription drugs. In the first case, government negotiators could operate under guidance that requires them to take account of evidence on the comparative effectiveness and cost-effectiveness of new drugs when negotiating prices. Using International Reference Pricing as the benchmark for U.S. drug price negotiations can implicitly introduce value-based pricing elements into U.S. prices because many potential comparator countries already use measures of value in making coverage and reimbursement decisions. For example, this occurs in drug pricing programs used by Germany and the United Kingdom, two countries that have been proposed to comprise the International Reference Price under recent reform proposals. In the case of applying an international price index, an adjustment to the allowable price could be made to recognize new products offering significant clinical advances over existing standards of care. Together such policies serve to increase the reward for socially valuable products relative to new products that offer few if any advantages over existing treatments. This, in turn, would serve to steer investment in the direction of higher social value products that are commercially viable.

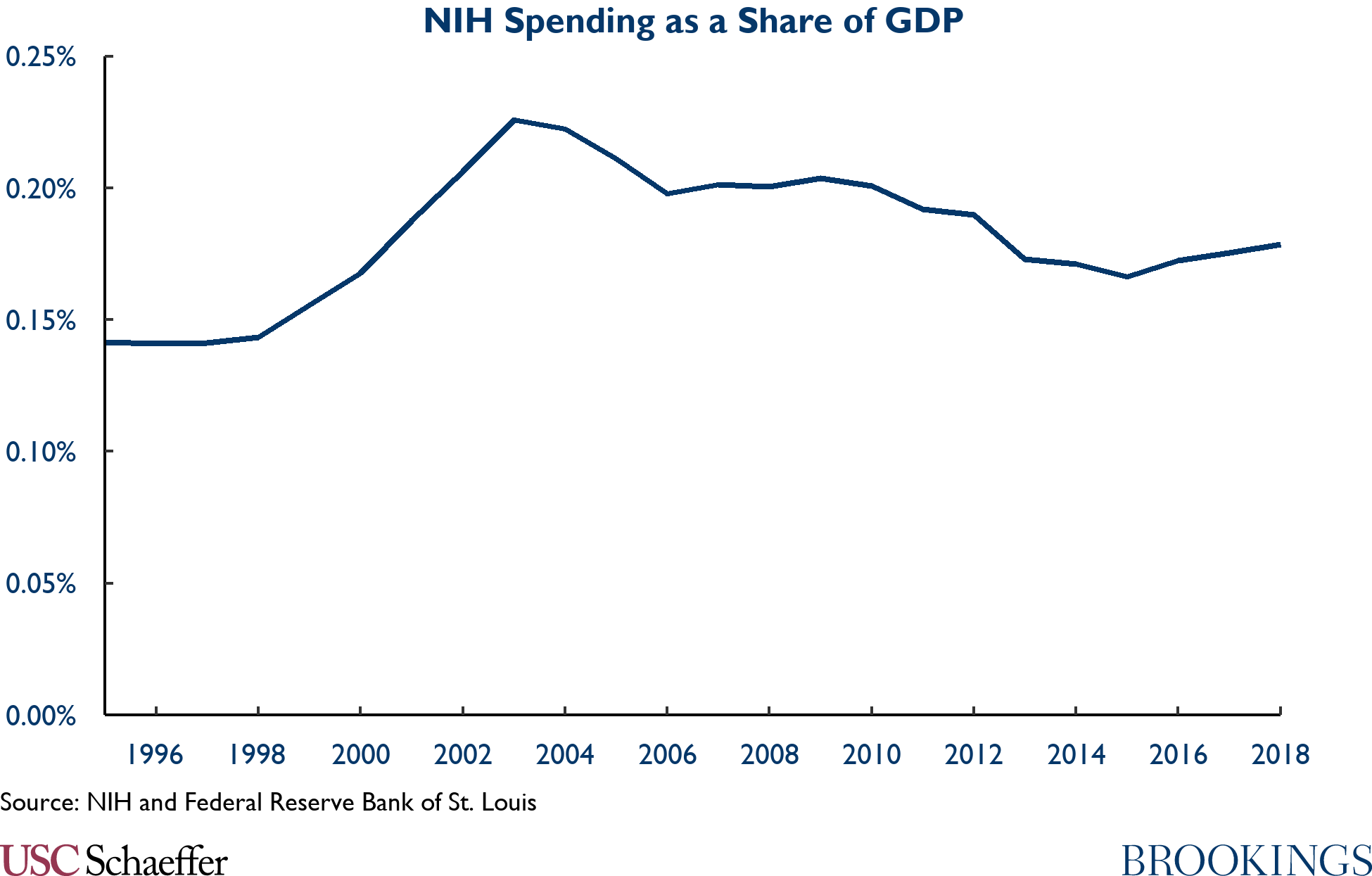

Step 2: More basic science money to NIH

The desire for significant change to our pharmaceutical R&D ecosystem should not mean ignoring the most important platform upon which U.S. pharmaceutical innovation is built, the basic science supported by the NIH. The figure below highlights the time path in NIH funding. NIH spending rose from 0.14% of GDP in 1990 to 0.23% of GDP in 2003, delivering critical contributions such as the Human Genome Project over that period. But funding has fallen as a share of the economy since and is currently 0.18% of GDP.

Almost all drugs rely on NIH-supported basic science. Some success stories are legendary, from the science behind a Hib vaccine to the discovery of JAK enzymes that are the building blocks of treatment of rheumatoid arthritis, to the Human Genome Project which was the basis for the modern field of genetic medicine.

The returns on these public investments are also very high. Researchers from MIT have found that ultimately each $125 million NIH grant leads to $375 million more in private market value, 33 more patents, and 1 new drug. Another study estimated that the rate of return on NIH investment is 43% and that each dollar in NIH funding leads to an additional $8.40 in private R&D spending.

Yet, the NIH has its critics, and in recent years it appears to be facing a challenge in continuing to stay on the cutting edge of science. One review found that NIH grants in recent years are scored much more based on “doability” than on innovation; at the time a grant proposal is submitted, it is typical for two of the three objectives to have been completed. This suggests that additional funds should come with reforms that ensure that the NIH funds will in fact generate new innovative activity.

But the bottom line is clear: NIH spending is highly productive, and we should do much, much more of it. Returning to the 2003 peak as a share of the economy would mean adding $10 billion per year, or about 25%, to the existing NIH budget. According to existing estimates, a steady state increase in NIH funding of $10 billion/year would lead to 80 new drugs – notably higher than CBO estimates of the loss in new drugs from regulating drug prices under the proposed H.R.3 legislation.

Step 3: Thickening capital markets for development of pharmaceutical innovations

Recent experience shows that pharmaceutical innovation is increasingly concentrated in smaller emerging bio-pharmaceutical companies. These firms were responsible for 73% of late-stage R&D and 42% of new drug launches in 2018, and their share of new launches is growing rapidly. Moreover, using data from public financial reports, it has been estimated that in 2018 these companies produce 4.5 new molecular entities per $1 billion of R&D spending compared to 0.7 for large pharmaceutical companies. Thus, the locus of activity in R&D has shifted towards a set of firms that are less prepared to absorb the larger financial risks and they conduct R&D more efficiently than large pharmaceutical manufacturers

But these smaller firms potentially face limited capital that is willing to finance risky and expensive new ventures. The structure of venture capital (VC) funding, with its “spray and pray” model, leads to a focus on shorter turnaround and lower capital intensity opportunities – particularly in sectors like information technology.

Correspondingly, there are multiple examples of high return investments by the public sector in thickening the pool of start-up capital for new enterprises through increased use of public entrepreneurial capital. In the U.S., the most notable example of such an effort is the Small Business Innovation Research (SBIR) program. The SBIR is currently the largest U.S. federal government program supporting private research and development. The SBIR began in 1982 and currently mandates that each federal agency spending more than $100 million annually on external research set aside 3.2% of these funds for awards to small businesses. Eleven federal agencies participated in the SBIR program, setting aside more than $3 billion each year. With a limited budget, the program is selective, with only about 22% of applicants receiving funding (24% for HHS). For many small firms, the SBIR “serves as the first place many entrepreneurs involved in technological innovation go to for funding.”

Despite its limited budget, the SBIR has been a success. The SBIR typically supports five to seven times as many early-stage tech start-ups as does private VC, and it has a vigorous and labor-intensive peer-review process that allows for revised proposals, helping early-stage technology firms develop their core mission. The SBIR also provides a key signal to the private sector of valuable potential investment in the sectors that venture funds have typically avoided; SBIR winners represent only 3 percent of VC funding recipients in information technology, but 20 percent in life sciences and 10 percent in the energy/industrial sector.

Biopharma innovation is supported by the SBIR program at the NIH, with total funding of $1.14 billion in 2019. There are numerous notable success stories that have arisen from this funding, including Amgen (founded in 1980, SBIR investment in 1986, today has 23,400 employees and valuation of $135 billion); Genzyme (founded in 1981, SBIR investment in 1983, by 2011 had more than 10,000 employees and was sold for over $20 billion); Illumina (founded in 1998, SBIR investment in 1999, today has 7,700 employees and is valued at $58 billion); and Ginkgo Bioworks, a key leader in COVID testing technology (founded in 2008, SBIR investment in 2009, today has 430 employees and is valued at $4 billion).

The success of SBIR is not just confirmed by notable examples but by academic analysis as well. One study found that firms that were awarded grants enjoyed substantially greater employment (56% increase) and sales growth (98% boost) than comparable firms that did not win SBIR funding. Another study found that winning a Phase I grant led firm patents to rise by at least 30 percent, doubled the chance of receiving VC financing and the probability of earning positive revenues within two years.

Other countries also provide additional funding to support development efforts. A recent study documents 755 programs in 66 countries with an average annual budget of $156 billion from 2010-2019—roughly equal to private VC disbursements of $153 billion over the same period. This investment has been growing rapidly, from roughly $50 billion in 1995 to more than $170 billion in 2019.

These programs rely on a wide variety of financial instruments. Most common is the use of grants, similar to SBIR, accounting for 44% of all programs; another 18% used equity financing. But other mechanisms are also used, including credit guarantees, loans, innovation vouchers, and tax credits (although loans and tax credits tended to be used by later stage and larger companies).

Unlike SBIR which expressly prohibits emerging companies that are majority owned by VCs to apply, international government financing programs tend to work in tandem with the private sector. More than one-third of the programs have private involvement on investment committees, and 45% have matching fund requirements. Perhaps as a result, a recent study finds that there is a very strong positive correlation between public entrepreneurial finance and private VC.

Several studies of these programs around the world document their success. A study of the Finish Tekes program found that small firms that received financing saw an 85% rise in employment and faster productivity growth. The public financing program in New Zealand led to employment growth in recipient firms that was 6% faster than in non-recipient firms. The SME Instrument, the first European R&D grant program targeting innovative small and medium-sized enterprises, parallels the SBIR—with comparably strong results. A recent study found that firms getting these grants had asset growth that was 46-96% higher and employment growth that was 20-45% higher than firms denied the grants. Moreover, confirming the earlier findings, winning firms experience more than a doubling in the odds and amount of private equity financing, resulting in a halving of the odds of company failure.

This track record of success in the U.S. and around the world for public entrepreneurial finance suggests high returns to expanding our investments in this area. While the U.S. was an early leader in this area, we have fallen rapidly behind. Public entrepreneurial funding has remained essentially flat in the U.S. in dollar terms since 1995, falling from more than 0.12% of GDP to less than 0.5%. Meanwhile, in the rest of the world, public entrepreneurial finance has more than quadrupled in dollar terms, remaining roughly constant as a share of GDP (0.13%).

A natural mechanism of expanding public entrepreneurial finance for biopharmaceuticals is through expanding the commitments of the SBIR. At a minimum, we should increase SBIR funding and provide flexibility for a constant “pay line,” or rate of financing. Under the current system, the pay line varies; in years where there are more good applications, then fewer applications get funded. This makes no sense—we should define the cutoff for good ideas and fund them every year. By allowing SBIR funding to be flexible over time we can hold a constant pay line and provide certainty for firms applying for funding.

Following other nations, the U.S. government could also play a role in “thickening” the venture funding for priority areas of research. A natural first step in this direction would be to allow SBIR to partner with ventures that are majority VC-owned, which is a common feature of biopharma startups, and therefore significantly limits the reach of the SBIR program. But it is possible to go further, as other nations do, by incorporating forgivable loans into the government’s portfolio at low government borrowing costs, with a long payback period to allow firms to grow. These loans would provide leverage of government funds by allowing the government to get a return on its funds when firms succeed.

An alternative structure for such investments could build on the 2016 21st Century Cares Act. The Act granted the Secretary of Health and Human Services the authority to establish public-private partnerships with venture capital firms to target investment into the development of novel medical countermeasures such as new drugs and diagnostics. To avoid conflicts of interest, the Act requires investment decisions, fund pooling with private companies, and portfolio management to be run by a not-for-profit entity. If a product invested in by the partnership succeeds in coming to market, the company goes public, or is acquired by another company, the proceeds from investments made with taxpayer funds are held by the not-for-profit and redirected to support additional investments.

To bring the U.S.’ public entrepreneurial finance back to just below the international average (and back to our 1995 level as a share of GDP) would mean spending $16 billion per year. Currently, NIH represents about 40% of total SBIR commitments. Applying that ratio would imply a commitment of $6.4 billion per year. Such a commitment, along with the rule changes described above, could finance significant innovation.

Step 4: Strategic de-risking

The last type of public investment in new product development would focus on reducing the risks for products where there are likely to be gaps between the social and commercial value of the product being considered. Clinical trials, especially later-stage clinical trials in humans, are very expensive in both time and money and carry significant risks of failure. These costs are typically borne by private companies; the public sector supports less than 3% of total trials and less than 0.5% of spending on Phase 3 trials.

But the private sector is unwilling to bear developmental costs for drugs that are worth more than developmental costs but less than likely commercial returns. Less well known than the NIH efforts discussed above, some public efforts have already recognized this market failure and have deployed public funds to support the development of transformative drugs at university labs or spin-off small companies before large manufacturers have gotten involved. These include the HIV, DAA, and PrEP products mentioned above.

Thinking more broadly, a dedicated mechanism for promoting more development of products in areas of high unmet need with potentially large social pay-offs such as anti-microbial resistance and tuberculosis would entail spending more public funds to support the testing of candidate products in clinical trials in targeted areas.

Conceptually, there are two challenges to overcome with this policy: the crowd out of private funds and the fact that the public sector may not have a good strategy to pick trials in the public’s interest. To address both concerns, we suggest taking an approach grounded in private sector success: the use of a social innovation fund that fills the holes in our pharmaceutical pipeline without displacing existing drug development and without unduly subjecting choice of projects to the whim of government.

A successful example of this type of fund is a Health and Human Services sub-agency called the Biomedical Advanced Research and Development Authority (BARDA) that is targeted to the development of products to address bioterrorism and national security threats. BARDA directly funds R&D and further supports these activities through technical assistance and the organization of clinical research. BARDA also creates manufacturing capacity by developing manufacturing networks as well as by directly contracting for supply that will be available when the need arises. There is an added national security benefit to these efforts in the form of ensuring domestic access to the knowledge entailed in making such treatments and ensuring adequate supply. BARDA’s annual budget has averaged about $1-1.5 billion.

BARDA has been successful in developing medical countermeasures against some highly visible threats to the U.S. population. BARDA’s work is exemplified by its efforts to develop therapeutic drugs against the threat of Anthrax. BARDA contributed to the development and supported the path to manufacturing for three therapeutic products: Anthim (obiltoxaximab), Raxibacumab, and Immune Globulin (which is also being tested for use in treating COVID-19). BARDA has also led in the development of vaccines and treatments for Zika and Ebola. The results have once again been very positive, resulting in the world’s first Ebola vaccine.

BARDA has also played a key role in investing in COVID-19 vaccines and therapeutics. A recently released CBO report details the diversity of these investments in vaccine efforts. The U.S. government spent more than $900 million supporting non-clinical studies and research to accelerate movement of candidate vaccines into clinical trials at companies (including Johnson and Johnson, Sanofi, Merck, and Moderna) and some of these companies (Johnson and Johnson, Moderna, Sanofi, and AstraZeneca) have received more than $2.7 billion from the federal government to cover expenses related to human trials. BARDA has played a major role in every single vaccine used in developing countries today, with additional government funds through BARDA and other government agencies including Operation Warp Speed and the Department of Defense to support manufacturing at scale and the continued purchase of virtually every vaccine candidate for use by the U.S. population among other countries.

We suggest building on this success to promote greater private sector investments in socially valuable but privately marginal late-stage R&D by incorporating elements from several models of risk sharing used in the U.S. and abroad. The key elements of a proposed social innovation fund are: 1) housing the effort in a federal agency that can combine lending authority, understanding of health care markets, and scientific and manufacturing expertise; 2) a focus on investing in projects where the gap between social and commercial value is large, yet where the government can partner with private sector-based biopharmaceutical companies; 3) reliance on forgivable loans as the principal financial instrument in combination with greater opportunities to cost share by both government funds and private industry finance; and 4) direct underwriting of late-stage clinical trials and manufacturing efforts which might involve contracts with Clinical Research Organizations (CROs), academic medical centers and contract manufacturing organizations.

The program needs to be housed in an agency that has the authority and expertise to make and oversee forgivable loans and direct investments in promising biopharmaceutical projects that meet social objectives. Because of the emphasis on emerging biopharmaceutical companies, the program would require capabilities to assess the market for prescription drugs, gaps in development of high social value products, and the science required to judge the prospects for successful project development. This, in turn, requires specific expertise in targeted therapeutic areas and manufacturing and regulatory experience in what it would take to successfully bring such products to market. Such multi-disciplinary expertise does exist in the federal government but is currently split across the private sector and diverse government agencies including the Small Business Administration (SBA), the NIH, FDA, among others.

Just like BARDA, having the right expertise to be successful would require either the founding of a new hybrid agency (preferred) or through changes in the structure of SBA (less preferred). Critically this new entity would operate alongside of, and not displace, BARDA. BARDA’s mission would continue to be focused specifically on medical countermeasures, while this agency would focus on diseases exhibiting significant unmet need and limited currently available therapeutics. The criteria for projects to be supported would be based on an assessment of the social value of a project based in part on cost-effectiveness criteria, the likelihood of success, and the scientific and experimental capability of the offer and their CRO/academic partners.

The proposed financial strategy for the social investment program would build on existing successes of BARDA, and some more limited non-governmental programs. The key is that the funds can be deployed at risk—in other words, before the product has been approved or authorized and is available for purchase. Therefore, financial participation would have two components: forgivable loans and cost sharing requirements. Loans would be forgivable if the funded project failed to attain a defined commercial (revenue) threshold. Repayment terms would include an interest rate that was below the lowest expected return project adopted in the private market. Market analysis would be required to determine the proper cost-sharing rates, or we could adopt an EU-like partnership model that amounts to a form of cost sharing. Together, these provisions would eliminate a substantial portion of the downside financial risk of the largest cash outlay in the R&D process. Efforts should also be made to reduce perceived conflicts of interest.

These initiatives would require cooperation and regulatory adjustments by the FDA. In the development of new cancer therapeutics and medical countermeasures, NIH’s and BARDA’s support for targeted clinical trials has been complemented by FDA’s novel efforts to lower the barriers to product launch and improve the availability of therapeutics. These efforts include the revision of trial endpoints for product provisional review and approval and the acceptance of alternative trial design, including basket trails, challenge trail, and Bayesian adaptive design trials as well as other efforts to confirm safety and efficacy. These efforts could be expanded to address targeted areas of unmet need.

Disclosures: The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

Jonathan Gruber has received financial support from Sarepta Pharmaceuticals. The authors did not receive financial support from any firm or person for this article or, other than the aforementioned, from any firm or person with a financial or political interest in this article. They are currently not an officer, director, or board member of any organization with an interest in this article.

Acknowledgments: We thank Matthew Fiedler for helpful comments on a draft of this piece.