Spain’s once-substantial rental market is now one of the smallest in Europe

Editor’s note: In case you missed it, watch an event held on April 21 discussing lessons from around the world related to policies to support stable, affordable rental housing.

Fewer than one in four of Spain’s 18.6 million households rents their home, reflecting strong policy bias toward homeownership. Renters are young, have lower incomes, and are more likely to be immigrants. The rental market is composed mostly of nonprofessional landlords, although recently, international companies have started to develop and manage rental housing. Public policies have been traditionally designed to promote homeownership and have failed to provide enough rental housing, especially public rental housing.

Overview of rental households and rental housing

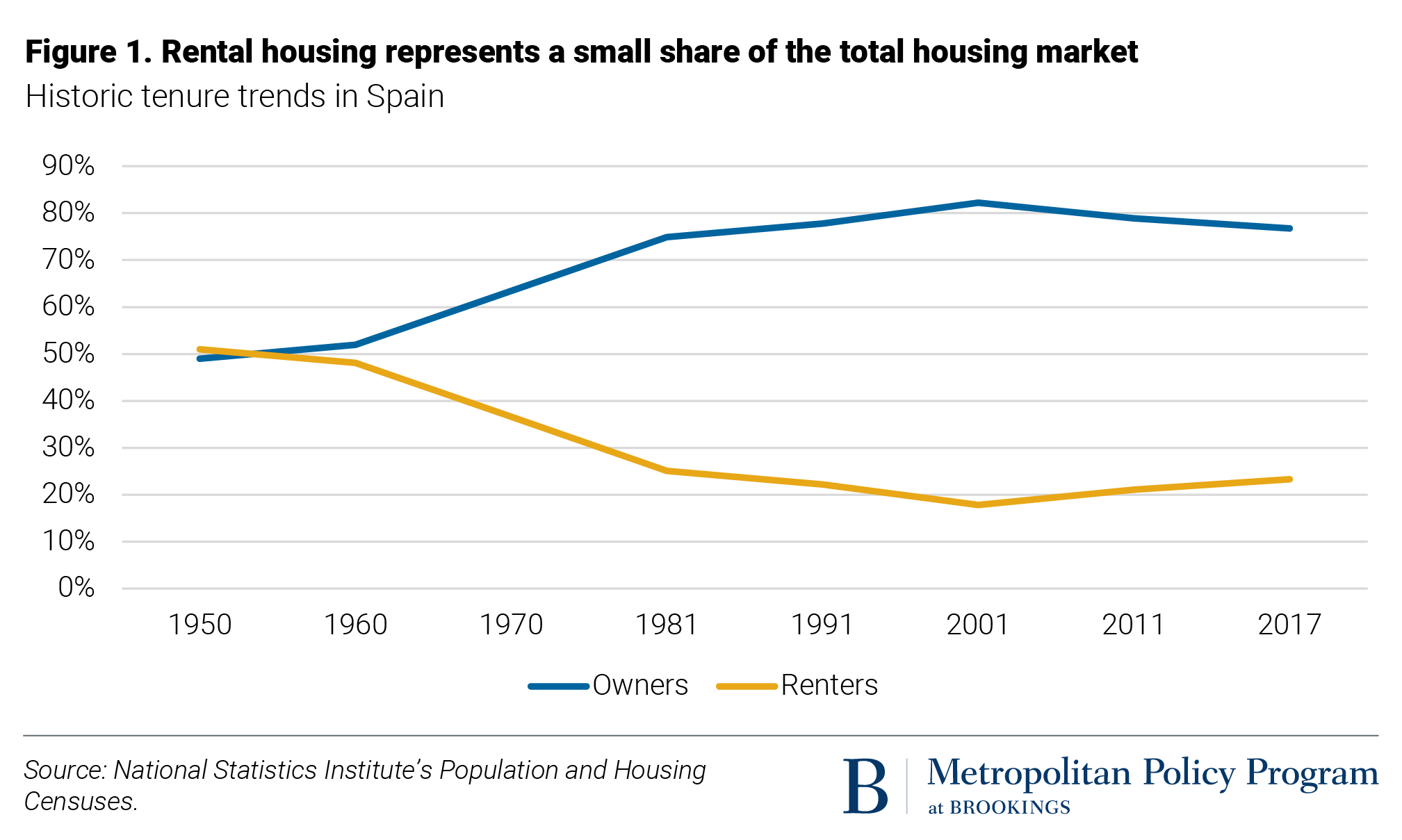

Spain has one of the lowest rentership rates among European countries, with just 23% of households renting their homes. As Figure 1 illustrates, this was not always the case. In 1950, the percentage of owners and renters was equal. But starting in the 1960s, rising incomes and homeownership subsidies led to higher homeownership rates, reaching a peak in 2001 at 82%. During the last 20 years, the rental market has been gradually growing due to two reasons: 1) job insecurity and low salaries pushed housing prices out of reach for younger people, and 2) banks are much more cautious about granting mortgages than in previous years.

Rentership rates are higher in larger provinces (a geographical unit similar to metro areas in the U.S.). In the two largest urban areas, Barcelona and Madrid, the percentage of renters is 26% and 24%, respectively. In smaller urban areas, this percentage is less than 15%.

There is also a lot of geographical variation in rents per square meter. In 2018, the average monthly rent was 675€ per month (8.1€ per square meter) for an average size unit of about 96 square meters (1,033 square feet). Barcelona and Madrid have higher rental prices and smaller dwellings. In Barcelona, the monthly rent for an average rental unit of 90 square meters (969 square feet) is 930€ (12.5€ per square meter). The problem of housing affordability is more intense in those cities, even though wages and incomes are higher.

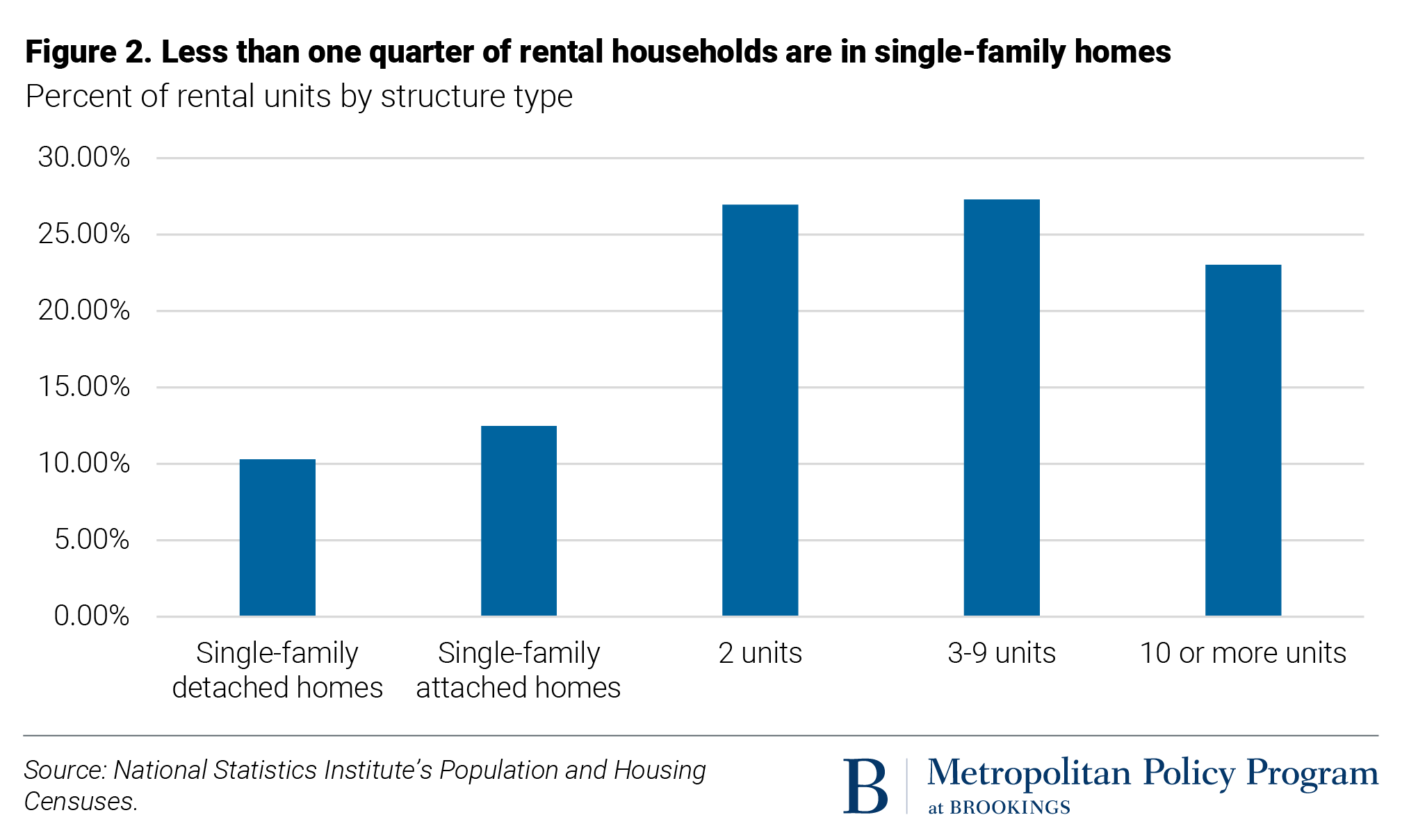

Most rental homes are in multifamily buildings (Figure 2). The percentage of housing for rent exceeds 25% in buildings with two or more dwellings, while 88% of single-family structures are owned-occupied. Around half of renter homes were built before 1980, similar to the age of the homeowner-occupied stock.

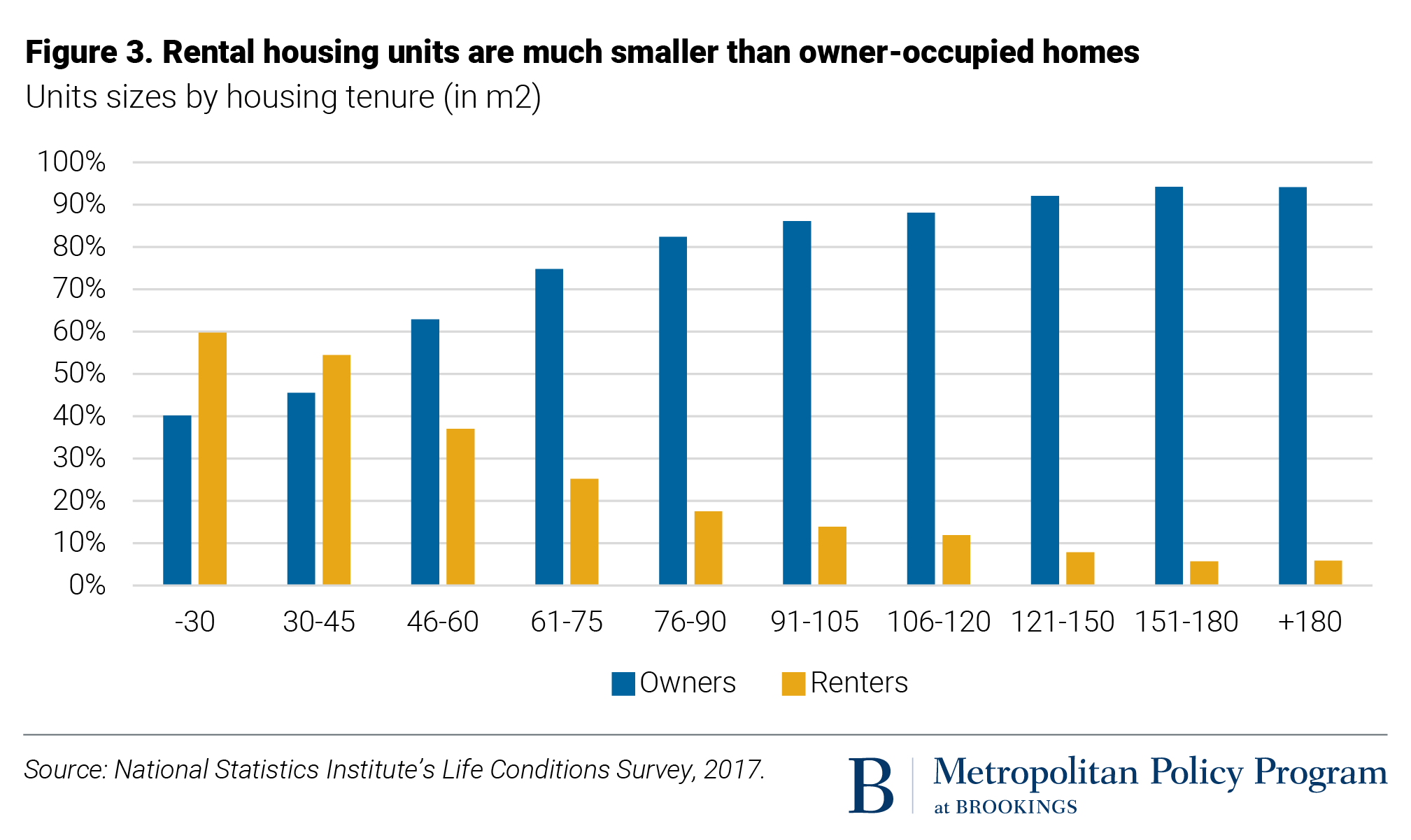

Rental homes tend to be much smaller than owner-occupied homes (Figure 3), with most rental units having a surface area of less than 45 square meters. About 85% of owner-occupied homes have more than 105 square meters.

Although the majority of all household types own their homes, renting is relatively more common among single-person households and single-parent households. Younger people are also more likely to rent, with nearly 70% of people ages 16 to 29 renting their homes.

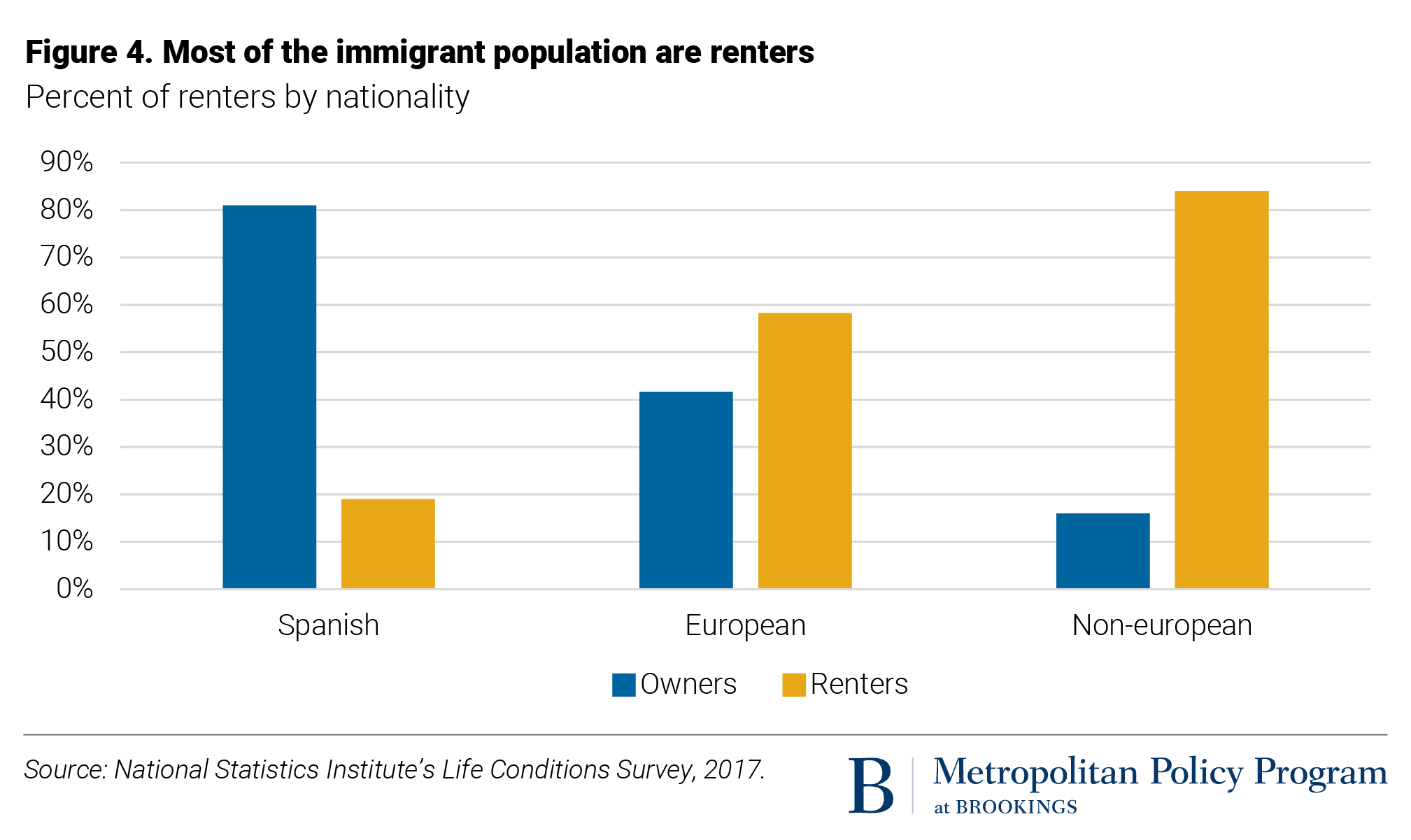

Figure 4 illustrates the tenure system based on the nationality of the household head. Renting has increased among Spanish-headed households, rising from 16% in 2007 to 20% in 2018. For households led by citizens of other European Union countries, the percentage of renters has also increased, although somewhat more moderately—from 54% to nearly 60%. Rentership is highest for households headed by non-EU citizens.

Private sector firms play a small role in developing and managing rental housing

Rental housing has traditionally been owned by individuals; only recently have more professional landlords entered the market, including foreign capital firms similar to real estate investment trusts (REITs). The increased profitability of the rental sector and recent fiscal incentives (such as a high tax credit on corporate and transaction taxes) coincided with the entry of new international operators. Private firms devoted to the rental housing business represented around 10% of the national rental market in 2018. These firms have a larger presence in big cities, making up 25% of rental housing in Barcelona. Some of these new rental units have been added to the short-term rental market (e.g., Airbnb rentals), so they have not increased the amount of long-term rental housing.

Institutional and policy environment of rental housing

Three levels of government are responsible for housing policies, with land use regulation primarily done at the local level

In Spain, housing policies are designed and implemented by three levels of government: the central government, the regional governments (17 Autonomous Communities), and local governments (more than 8,000 municipalities, although most are quite small). However, the private sector plays a key role in land ownership, urban development activity, and residential development.

The design of land use policies illustrates this relationship. Although an individual might own the land, the government is empowered to control and implement all processes of urban development. Landowners are not permitted to develop their land without the prior agreement of the local administration. It is not simply that they need a building license (which is granted automatically in most cases). Before reaching this step, the government must declare the land “developable” and define precisely the conditions for such development. The main tool that the government uses to do this is its Urban Plan. Urban planning in Spain is essentially a local responsibility, but as there are more than 8,000 municipalities nationwide, the system is highly fragmented.

Housing policies have disproportionally promoted homeownership

Article 47 of the Spanish Constitution acknowledges the right of all citizens to have decent and adequate housing. It also establishes that the government must ensure that this right is made effective for all the people. However, there was no institutional framework (such as public housing) that provided high-quality affordable housing to all citizens. Rather, most citizens relied on the private market to provide owner-occupied homes.

But as shown in Figure 1, 70 years ago, rental housing made up half of the market. The high economic growth of the 1960s—together with the perception that homeownership was a better investment than renting—can partially explain this change. But this structural change also reflects many years of public policies designed to promote homeownership and limited efforts to promote private and public rental housing.

Housing subsidies in Spain can be divided into two groups. First, the so-called “stone subsidies” are intended to increase the availability of affordable housing for rent and for sale. Second, the government provides direct financial subsidies to people to help them pay rent or purchase a house. Since the mid-20th century, housing policy has been based on protecting for-sale housing by subsidizing construction and purchases through tax relief or mortgage interest rates.

Recent policies have shifted to promoting rental housing

Interestingly, the last central government House Plan (2018 to 2021) removed the subsidies to promote homeownership and direct household subsidies. Instead, it established new subsidies to assist people under age 35 either rent or purchase a home in smaller municipalities (fewer than 5,000 residents). It also created subsidies for low-income older adults, both for rent and to pay maintenance costs. It is still too soon to evaluate the impact of these new policies.

Past regulations have failed to increase the supply of rental housing

In the 1960s, the central government adopted strict rent regulation and strong tenant protections. The law required landlords to extend the lease for the entire life of the tenant, and upon the tenant’s death, the surviving spouse and children could assume the lease. In addition, the landlord could only terminate the contract for causes strictly established in the law and could only raise rent according to the national rate of inflation. While these strong tenant protections were attractive to renters, they reduced the profitability for landlords to invest in rental housing. Because landlords had to compensate tenants if they wanted to terminate the lease, they often increased the initial rent levels for new leases.

The 1985 Boyer Law removed the mandatory lease extension in an attempt to increase rental housing supply and reduce rents. From then on, lease contracts would last for the duration agreed upon by the tenant and landlord. This legal reform did not produce the expected effects, and the supply of rentals hardly increased. Some years later, two new reforms (in 1994 and 2013) removed the mandatory extension and set the minimum duration of leases to three years (extendable for one more). But the results remain the same. The most recent reform, adopted in 2019 during tight rental supply and high rents, was designed to reinstate stronger tenant protections. One of the most controversial aspects that was left out (but is still on the government agenda) was rent control.

One aspect that the successive new regulations have tried to solve is the legal uncertainty over the eviction process. Although the eviction process has always existed, since 2018, the procedures have been streamlined. The current regulation allows the delinquent renter to be evicted in less than six months, depending on the particular circumstances of each case. Other measures were introduced to protect tenants (and, in some cases, squatters) from abusive evictions. The law also allows regional governments to create a tax on vacant homes. For the moment, only the region of Catalonia has approved this tax.

In 2020, Catalonia became the first region in Spain to establish a rent control program, which applies to large municipalities that are defined as having “tight housing market” conditions. In January 2021, the Constitutional Court proposed to declare rent control unconstitutional.

Tenants’ unions are a recent phenomenon in Spain. Currently, the largest unions are in Barcelona, and legislation does not allow collective bargaining of contracts. However, there have been some cases of collective agreements between tenants and large landlords.

The public rental market has not met the demand forsocial housing

Since the 2009 economic crisis, the number of households in Spain in need of housing subsidies has grown exponentially. It is impossible to know the exact volume of this demand, since the available statistical information is limited. However, based on existing data, estimations indicate that at least 1.5 million affordable rental homes are needed for low-income households.

Publicly owned rental housing is a much smaller share of Spain’s housing market than other European countries. Spain currently has around 290,000 public rental homes that house just 1.6% of households—substantially lower than the EU average of 9.3%. Regional governments own 62% of public rental housing while local governments own the remainder.

Support for social housing has been limited over the last four decades. Since the mid-1980s, the social housing stock has decreased, and today is at historic lows. The regions of Madrid and Barcelona have been increasing investment in social housing, but the available stock is small compared with the need for affordable housing. The central government has recently launched the “20,000 Plan” to build 20,000 social housing rentals during two terms of office. Meanwhile, the government of the region of Madrid adopted the “Plan Vive” that will build 25,000 new units to alleviate the severe shortage of public rental housing.

Regarding the housing subsidies for renters, there are programs in all regions for people with very low incomes (8,000€ per year), who can receive a subsidy of up to 50% of the maximum monthly housing rent. These subsidies are designed for people in critical financial situations and are supposed to be available to all eligible households. But only 2.5 out of every 1,000 people receive this subsidy. More recently, as rents have risen, regions have designed some additional rental subsidies for people under age 35 or over age 65.

Challenges facing rental housing markets

Housing affordability and the lack of rental housing are two of the most serious problems that the housing market in Spain is facing. Construction and mortgage levels did not recover even as the market started to recover after the financial crisis. The number of new houses constructed dropped from 850,000 in 2006 to 100,000 in 2018, and the number of new mortgages originated fell from 1.9 million to 482,000 in the same period. This gap has triggered a shift toward the rental market, but with limited supply, rents have increased. This problem is even more intense in urban areas, where rents are at all-time highs. Approximately four out of 10 Spaniards allocate more than 40% of their salary to pay the rent, in contrast to 25% of Europeans.

The young population is the most affected demographic group. Their job insecurity and low wages have resulted in a big drop in home purchases. Before the crisis, almost 60% of young people between 16 and 29 years old who had formed a household lived in an owner-occupied flat. Without the option to buy a house, this group’s pressure on the rental housing market has not stopped growing. As a consequence, more young people are staying longer in their parents’ home.

There are clear impacts of the COVID-19 pandemic on the rental housing market

The COVID-19 pandemic is also disproportionately affecting younger people and immigrants—two groups who mostly rent. Millennials and Gen Z households have seen their incomes drop by 45%, leaving them unable to save, buy homes, or establish independent households. Immigrant households are also more affected by income losses in the pandemic.

As a result of the crisis, the supply of rental homes in Spain increased 52% between September 2019 and September 2020. One factor is the transfer of tourist and short-term rental properties to the long-term rental market, as well as the change from sale to rent for owners who cannot reach their price expectations. Despite the increase in available rental homes, rent levels for the average apartment rose by almost 2% by the end of 2020.

As in other countries, in addition to the direct government assistance to households, other COVID-19 policies have been designed specifically for housing: mortgage payment moratoriums, rental assistance, and the suspension of evictions for vulnerable families. Another important decision was the automatic extension of rental contracts to avoid any abusive increase in prices during the crisis.