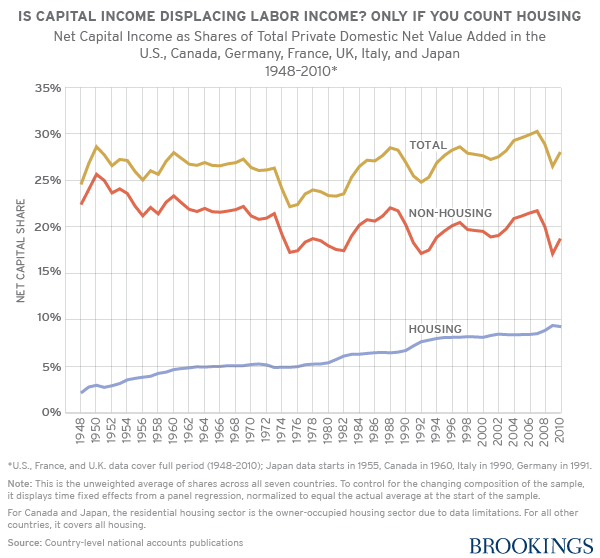

Thomas Piketty’s Capital, widely considered one of the most influential economics books of the century, paints a sobering picture of the future of global inequality. According to Picketty, after initially falling during the Depression and the two world wars, the accumulation of capital amongst the wealthy in the form of property, stocks and other assets is set to reach levels unseen since the 19th and early 20th centuries. Picketty argues that as the economy slows, wealth will continue to accumulate amongst the rich, as they earn high returns on and invest in more capital, which will in turn lead to less labor income – and growing inequality.

But according to 26-year-old graduate student Matthew Rognlie, that might not actually be the case: As part of the Brookings Papers on Economic Activity (BPEA), Rognile argues that it’s unlikely we’ll continue to see returns on capital for the duration and to the extent that Picketty predicted, other than in the housing sector. As he put it:

“Beyond housing, the results in this paper suggest that concern about inequality should be shifted away from the split between capital and labor, and toward other aspects of distribution, such as the within-labor distribution of income. Although the net capital share has at times seen dramatic shifts both up and down, away from housing its long-term movement has been quite small, and there is not strong reason to suspect that this pattern will change going forward.”

Read Rognlie’s full BPEA paper, Deciphering the fall and rise in the net capital share »

Commentary

Inequality may not grow in the way Piketty predicts

March 20, 2015